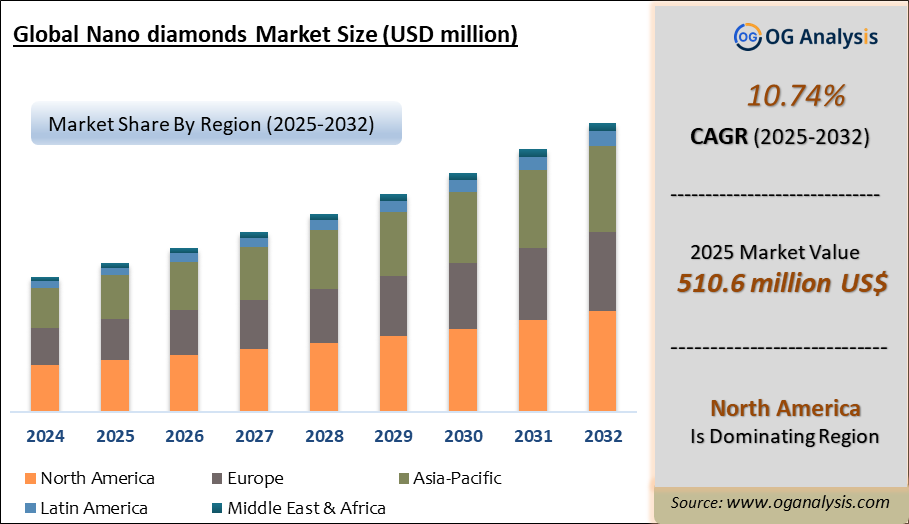

The Nanodiamonds Market is estimated to be USD 416.1 million in 2024. Furthermore, the market is expected to grow to USD 849.8 million by 2031, with a Compound Annual Growth Rate (CAGR) of 10.74%.

The nanodiamonds market is witnessing robust growth driven by their unique mechanical, optical, and chemical properties, which enable diverse applications across industries. Nanodiamonds are carbon-based nanoparticles with diameters below 10 nm, produced mainly through detonation, high-pressure high-temperature synthesis, and chemical vapor deposition techniques. Their excellent hardness, thermal conductivity, biocompatibility, and ability to disperse in various matrices make them suitable for use in polishing, lubricants, drug delivery systems, bioimaging, quantum computing, and composite reinforcement. The growing demand for advanced polishing agents in the semiconductor and optics industries, coupled with rising adoption in medical and pharmaceutical research for targeted drug delivery and diagnostics, is accelerating market expansion globally.

Regionally, Asia Pacific dominates the nanodiamonds market due to large-scale manufacturing facilities, high adoption in electronics and precision polishing sectors, and emerging biomedical research investments in China, Japan, and South Korea. North America and Europe follow, driven by advanced research in quantum sensing, nanomedicine, and aerospace materials. However, challenges such as high production costs, scalability limitations for consistent purity and particle size, and environmental concerns regarding detonation synthesis remain key restraints. Leading companies and research institutions are focusing on optimizing cost-effective, sustainable production technologies and developing surface-functionalized nanodiamonds to enhance application compatibility. Strategic partnerships, patent developments, and commercial pilot programs for quantum and medical-grade nanodiamonds are expected to define market competitiveness, positioning nanodiamonds as critical materials in next-generation electronics, photonics, medical, and energy storage technologies worldwide.

Industrial grade is the largest segment by type in the nanodiamonds market. This is due to their extensive use in polishing, electroplating, coatings, and composite reinforcement applications, where their hardness, thermal conductivity, and cost-effectiveness provide performance benefits for semiconductor, optics, and manufacturing industries compared to medical-grade nanodiamonds.

Polishing is the largest application segment in the nanodiamonds market. Its dominance is driven by widespread use in precision polishing of semiconductors, optical lenses, and metal surfaces, where nanodiamonds deliver uniform surface finishing, minimal material removal rates, and superior product quality, supporting their high-volume adoption globally.

Trade Intelligence for nanodiamonds market

|

Global Dust and powder of diamonds, incl. synthetic diamonds Trade, Imports, USD million, 2020-24 |

|||||

|

|

2020 |

2021 |

2022 |

2023 |

2024 |

|

World |

348 |

484 |

416 |

330 |

327 |

|

United States of America |

37.1 |

48.3 |

57.4 |

42.8 |

46.0 |

|

Korea, Republic of |

28.2 |

43.4 |

40.0 |

30.0 |

39.2 |

|

Japan |

31.8 |

37.7 |

40.5 |

37.0 |

33.3 |

|

India |

23.5 |

37.6 |

37.6 |

29.6 |

28.9 |

|

Ireland |

21.4 |

34.8 |

35.9 |

23.0 |

27.9 |

|

Source: OGAnalysis, International Trade Centre (ITC) |

|||||

- United States of America, Korea, Republic of, Japan, India and Ireland are the top five countries importing 53.6% of global Dust and powder of diamonds, incl. synthetic diamonds in 2024

- Global Dust and powder of diamonds, incl. synthetic diamonds Imports decreased by 6.1% between 2020 and 2024

- United States of America accounts for 14.1% of global Dust and powder of diamonds, incl. synthetic diamonds trade in 2024

- Korea, Republic of accounts for 12% of global Dust and powder of diamonds, incl. synthetic diamonds trade in 2024

- Japan accounts for 10.2% of global Dust and powder of diamonds, incl. synthetic diamonds trade in 2024

|

Global Dust and powder of diamonds, incl. synthetic diamonds Export Prices, USD/Ton, 2020-24 |

|

|

|

Source: OGAnalysis |

Key Insights

- The nanodiamonds market is driven by growing demand in the polishing industry, where their ultra-hardness and uniform nanoscale size enable superior surface finishing for semiconductors, optics, and precision instruments, ensuring high-quality outputs with minimal abrasion damage.

- Biomedical applications are expanding, as nanodiamonds are increasingly used for targeted drug delivery, gene therapy, and bioimaging. Their excellent biocompatibility and ability to attach therapeutic agents enable efficient and safe delivery systems for cancer treatments and advanced diagnostics.

- Asia Pacific leads the market due to strong manufacturing infrastructure in China, Japan, and South Korea, high adoption in electronics polishing, and growing investments in biomedical nanotechnology research across regional academic and industrial ecosystems.

- North America and Europe are witnessing steady growth driven by quantum computing and quantum sensing research, leveraging nitrogen-vacancy nanodiamonds for applications in secure communications, quantum memory, and nanoscale magnetic field detection technologies.

- Detonation synthesis remains the most widely used nanodiamond production technique due to its scalability and cost-effectiveness; however, it presents environmental concerns and requires advanced purification processes to achieve application-grade purity levels.

- Surface functionalization is gaining traction, enhancing nanodiamond dispersion in polymers, resins, and biological systems. This improves compatibility for composite materials, coatings, and drug delivery carriers, expanding market applications across diverse industries.

- Nanodiamond-based lubricants are emerging, reducing friction and wear in automotive engines and industrial machinery. Their nano-scale polishing effect enhances component durability, fuel efficiency, and operational performance in demanding mechanical environments.

- High production costs and challenges in ensuring consistent particle size and purity continue to limit widespread market adoption. Companies are investing in process optimization, advanced purification methods, and alternative synthesis routes to address these barriers effectively.

- Strategic collaborations between nanodiamond producers, research institutions, and end-user industries are increasing to accelerate the development of application-specific products, performance validation, and commercial deployment in high-value sectors.

- The competitive landscape is characterized by patent-driven differentiation, with companies focusing on developing quantum-grade and medical-grade nanodiamonds to secure leadership positions in emerging markets such as quantum computing, advanced bioimaging, and targeted therapeutics.

Report Scope

|

Parameter |

Nanodiamonds Market scope Detail |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Market Size-Units |

USD billion |

|

Market Splits Covered |

By Type, By Application |

|

Countries Covered |

North America (USA, Canada, Mexico) |

|

Analysis Covered |

Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

|

Customization |

10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

|

Post-Sale Support |

4 analyst hours, available up to 4 weeks |

|

Delivery Format |

The Latest Updated PDF and Excel Data file |

Market Segmentation

By Type

- Medical Grade

- Industrial Grade

By Application

- Polishing

- Electroplating and Coatings

- Composites

- Lubricants

- Medical Diagnosis

- Other

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Malaysia, Vietnam, Rest of APAC)

- The Middle East and Africa (Saudi Arabia, South Africa, UAE, Iran, Egypt, Rest of MEA)

- South and Central America (Brazil, Argentina, Chile, Rest of SCA)

Nanodiamonds Market

-

CARBODEON LTD. OY

-

Kerridge Commercial Systems Limited

-

Ray Techniques Ltd

-

Daicel Corporation

-

SINO-CRYSTAL MICRO-DIAMOND

-

FND BIOTECH

-

Adámas Nanotechnologies

-

SINTA

-

TONG LI TECH CO LTD.

-

Columbus NanoWorks In

What You Receive

• Global Nanodiamonds market size and growth projections (CAGR), 2024- 2034

• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Nanodiamonds.

• Nanodiamonds market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Nanodiamonds market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Nanodiamonds market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Nanodiamonds market, Nanodiamonds supply chain analysis.

• Nanodiamonds trade analysis, Nanodiamonds market price analysis, Nanodiamonds Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Nanodiamonds market news and developments.

The Nanodiamonds Market international scenario is well established in the report with separate chapters on North America Nanodiamonds Market, Europe Nanodiamonds Market, Asia-Pacific Nanodiamonds Market, Middle East and Africa Nanodiamonds Market, and South and Central America Nanodiamonds Markets. These sections further fragment the regional Nanodiamonds market by type, application, end-user, and country.

Recent Developments

- Oct 2025: Hebrew University & Humboldt U. researchers demonstrate a method to collect up to 80 % of photons from nitrogen-vacancy centers in nanodiamonds at room temperature via engineered nanoantennas.

- Sep 2025: A new low-temperature, catalyst-free synthesis produces defect-free nanodiamonds from hydrocarbon crystals via electron irradiation in vacuum.

- Sep 2025: Nano Dimension initiates a strategic review and changes executive leadership, signaling potential repositioning in their technology portfolio.

- Mar 2025: Researchers embed nanodiamonds in flowing microdroplets to significantly boost quantum sensing precision for trace chemical detection.

- Apr 2025: Scientists report high-yield assembly of plasmon-coupled nanodiamonds (via DNA origami) to modulate NV photoluminescence for quantum devices.

TABLE OF CONTENTS

1. TABLE OF CONTENTS

1.1. LIST of TABLES

1.2. LIST of FIGURES

2. GLOBAL NANODIAMONDS MARKET REVIEW, 2023

2.1. Nanodiamonds Market Industry Overview

2.2. Research Methodology

2.2.1. Market Scope and Definition

2.2.2. Study Assumptions

3. NANODIAMONDS MARKET INSIGHTS

3.1. Key Types of Nanodiamonds Market to 2031

3.2. Leading Metal of Nanodiamonds Market to 2031

3.3. High Prospect Geography for Nanodiamonds Market to 2031

4. NANODIAMONDS MARKET TRENDS, DRIVERS, AND RESTRAINTS

4.1. Latest Trends and Recent Developments in Nanodiamonds Market

4.1.1. Technological Advancements

4.1.2. Recent Developments of Nanodiamonds In Coating Applications

4.1.3. Rising Demand from Emerging Economies

4.2. Key Factors Driving the Nanodiamonds Market Growth

4.2.1. Expanding Application Scope of Nanodiamonds

4.2.2. Rising Demand for Nanodiamonds Applications in Automotive Industry

4.3. Major Challenges to the Nanodiamonds Market Industry, 2023-2031

4.4. Five Forces Analysis for Global Nanodiamonds Market

5. GLOBAL NANODIAMONDS MARKET DATA - INDUSTRY SIZE, SHARE, AND OUTLOOK

5.1. Nanodiamonds Market Annual Sales Outlook, 2023-2031 ($Million)

5.2. Global Nanodiamonds Market Annual Sales Outlook by Type, 2023-2031 ($Million)

5.2.1. Medical Grade Nanodiamond Market Outlook, 2023-2031

5.2.2. Industrial Grade Market Outlook, 2023-2031

5.3. Global Nanodiamonds Market Annual Sales Outlook by Application, 2023-2031 ($Million)

5.3.1. Polishing Market Outlook, 2023-2031

5.3.2. Electroplating and Coatings Market Outlook, 2023-2031

5.3.3. Composites Market Outlook, 2023-2031

5.3.4. Lubricants Market Outlook, 2023-2031

5.3.5. Medical Diagnosis Market Outlook, 2023-2031

5.3.6. Other Market Outlook, 2023-2031

5.4. Global Nanodiamonds Market Annual Sales Outlook by Geography, 2023-2031 ($Million)

6. ASIA PACIFIC NANODIAMONDS MARKET INDUSTRY STATISTICS - MARKET SIZE, SHARE, COMPETITION AND OUTLOOK

6.1. Asia Pacific Market Insights, 2023

6.2. Asia Pacific Nanodiamonds Market Revenue Forecast by Type, 2023-2031 (USD Million)

6.3. Asia Pacific Nanodiamonds Market Revenue Forecast by Application, 2023-2031 (USD Million)

6.4. Asia Pacific Nanodiamonds Market Revenue Forecast by Country, 2023-2031 (USD Million)

6.4.1. China

6.4.2. Japan

6.4.3. India

6.4.4. Rest of Asia Pacific

7. EUROPE OUTLOOK AND GROWTH OPPORTUNITIES

7.1. Europe Market Insights, 2023

7.2. Europe Nanodiamonds Market Revenue Forecast by Type, 2023-2031 (USD Million)

7.3. Europe Nanodiamonds Market Revenue Forecast by Application, 2023-2031 (USD Million)

7.4. Europe Nanodiamonds Market Revenue Forecast by Country, 2023-2031 (USD Million)

7.4.1. Germany

7.4.2. United Kingdom

7.4.3. France

7.4.4. Italy

7.4.5. Spain

7.4.6. Rest of Europe

8. NORTH AMERICA OUTLOOK AND GROWTH OPPORTUNITIES

8.1. North America Market Insights, 2023

8.2. North America Nanodiamonds Market Revenue Forecast by Type, 2023-2031 (USD Million)

8.3. North America Nanodiamonds Market Revenue Forecast by Application, 2023-2031 (USD Million)

8.4. North America Nanodiamonds Market Revenue Forecast by Country, 2023-2031 (USD Million)

8.4.1. United States

8.4.2. Canada

8.4.3. Mexico

9. SOUTH AND CENTRAL AMERICA OUTLOOK AND GROWTH OPPORTUNITIES

9.1. South and Central America Market Insights, 2023

9.2. South and Central America Nanodiamonds Market Revenue Forecast by Type, 2023-2031 (USD Million)

9.3. South and Central America Nanodiamonds Market Revenue Forecast by Application, 2023-2031 (USD Million)

9.4. South and Central America Nanodiamonds Market Revenue Forecast by Country, 2023-2031 (USD Million)

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Rest of South and Central America

10. MIDDLE EAST AFRICA OUTLOOK AND GROWTH OPPORTUNITIES

10.1. Middle East Africa Market Insights, 2023

10.2. Middle East Africa Nanodiamonds Market Revenue Forecast by Type, 2023-2031 (USD Million)

10.3. Middle East Africa Nanodiamonds Market Revenue Forecast by Application, 2023-2031 (USD Million)

10.4. Middle East Africa Nanodiamonds Market Revenue Forecast by Country, 2023-2031 (USD Million)

10.4.1. Middle East

10.4.2. Africa

11. NANODIAMONDS MARKET STRUCTURE AND COMPETITIVE LANDSCAPE

11.1. ADAMAS NANOTECHNOLOGIES, INC.

11.2. CYMARIS LABS

11.3. FND BIOTECH, INC.

11.4. DAICEL CORPORATION

11.5. PLASMACHEM GMBH

12. APPENDIX

12.1. Nanodiamonds Relevant Trade

12.2. About Us

12.3. Sources

12.4. Research Methodology

12.5. Research Process

12.6. Research Execution

12.7. Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Nanodiamonds Market is estimated to generate USD 416.1 million in revenue in 2024.

The Global Nanodiamonds Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 10.74% during the forecast period from 2025 to 2032.

The Nanodiamonds Market is estimated to reach USD 941.1 million by 2032.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!