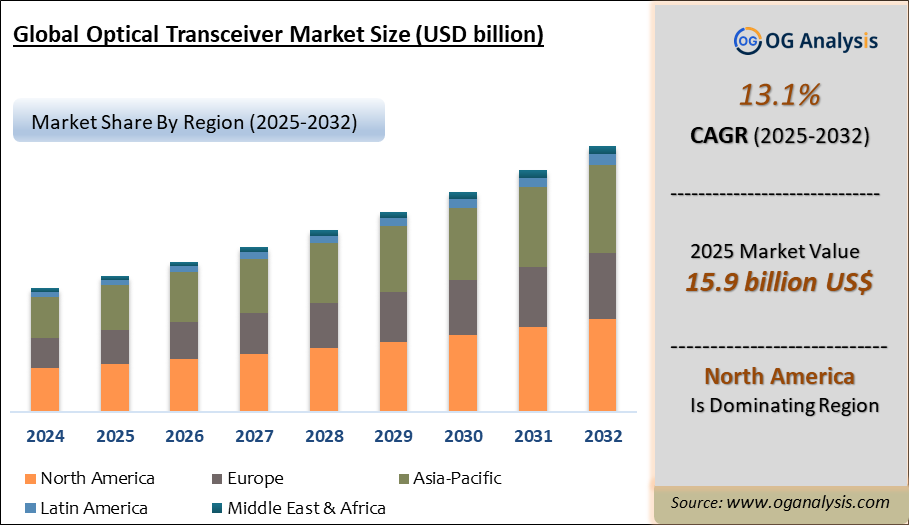

"The Global Optical Transceiver Market is valued at USD 14.3 billion in 2024 and is projected to reach USD 15.9 billion in 2025. Worldwide sales of Optical Transceiver are expected to grow at a significant CAGR of 13.1%, reaching USD 49.5 billion by the end of the forecast period in 2034."

"5G, IoT, and Data Center Expansion Fuel the Growth of the Optical Transceiver Market: A Look at Key Trends and Opportunities"

The Optical Transceiver Market is gaining significant momentum, driven by the increasing demand for high-speed internet connectivity, data center expansion, and the widespread adoption of 5G technology. Optical transceivers, which convert electrical signals into optical signals and vice versa, are a crucial component of modern communication networks, enabling efficient data transmission over fiber-optic cables. In 2024, the market has witnessed substantial growth, with telecom operators, cloud service providers, and enterprises upgrading their network infrastructure to support the rising demand for data-heavy applications such as video streaming, online gaming, and virtual collaboration tools.

Looking ahead, the Optical Transceiver Market is expected to continue its upward trajectory in 2025, with advancements in technology and the proliferation of the Internet of Things (IoT) driving further demand. As 5G networks become more prevalent, the need for high-speed, low-latency optical transceivers is expected to surge, particularly in regions experiencing rapid digital transformation. Additionally, the growing shift towards cloud computing and the increasing deployment of hyperscale data centers are expected to contribute to the robust growth of the market. These trends position optical transceivers as a critical component of the global digital infrastructure in the years to come.

Latest Trends

One of the key trends shaping the Optical Transceiver Market is the ongoing shift towards higher data transmission rates. With the rise of bandwidth-intensive applications and the rapid expansion of data centers, there is an increasing demand for transceivers capable of supporting 400G, 800G, and even 1.6T transmission speeds. In 2024, we„¢ve seen a rise in the adoption of coherent optical transceivers, particularly in long-haul and metro networks, as they offer better performance in terms of speed and distance compared to traditional direct-detect technology. The growing need for faster, more reliable connections is pushing manufacturers to innovate and deliver cutting-edge transceiver solutions.

Another important trend is the miniaturization and integration of optical transceivers. As data centers grow in size and complexity, operators are seeking more compact and power-efficient components to optimize their infrastructure. This has led to the development of pluggable transceivers, such as QSFP-DD and OSFP modules, which offer high performance in a smaller form factor. Additionally, silicon photonics technology is gaining traction as it enables the integration of optical and electronic components on a single chip, reducing the cost and complexity of manufacturing high-speed transceivers. These advancements are playing a critical role in shaping the future of the optical transceiver market.

Future Market Drivers

The growing adoption of 5G networks is one of the major drivers of the Optical Transceiver Market. As telecom operators continue to roll out 5G infrastructure, the demand for optical transceivers capable of supporting high-speed, low-latency communication is expected to increase. These transceivers are essential for enabling 5G„¢s massive machine-type communication (mMTC) and enhanced mobile broadband (eMBB) use cases, which require faster and more reliable data transmission. Additionally, the rise of IoT applications, such as smart cities, autonomous vehicles, and industrial automation, will further boost the demand for optical transceivers as these technologies rely on high-speed connectivity.

Another important driver is the growing shift towards cloud computing and the expansion of hyperscale data centers. As organizations increasingly migrate their operations to the cloud, the need for high-performance, scalable network infrastructure is rising. Optical transceivers play a crucial role in enabling data center interconnect (DCI) solutions, which allow data centers to communicate with each other and manage the massive amounts of data generated by cloud services. The expansion of data centers in regions such as North America, Europe, and Asia-Pacific is expected to be a key factor driving market growth in the coming years.

Market Challenges

Despite the strong growth prospects, the Optical Transceiver Market faces several challenges that could impede its progress. One of the primary challenges is the high cost associated with the development and deployment of advanced optical transceivers. As data rates increase, the complexity of manufacturing optical components also rises, leading to higher production costs. This is particularly true for coherent optical transceivers, which require more sophisticated technology and higher precision in their design and fabrication. As a result, the cost of these transceivers may limit their adoption, especially among smaller data center operators and telecom providers with budget constraints.

Another challenge is the issue of power consumption. As data centers scale up and network speeds increase, the energy consumption of optical transceivers becomes a significant concern. Operators are looking for more energy-efficient solutions to reduce their operational costs and meet sustainability goals. However, achieving higher performance while minimizing power consumption is a difficult balancing act for manufacturers. Addressing these challenges will require ongoing innovation in materials, design, and manufacturing processes to meet the market„¢s evolving needs.

Competitive Landscape and Key Strategies

The competitive landscape of the Optical Transceiver Market is characterized by the presence of several leading players, each striving to capture a larger share of the growing market. Companies are focusing on innovation, with substantial investments in research and development to create faster, more efficient, and cost-effective transceivers. Key strategies include expanding product portfolios to include 400G, 800G, and 1.6T transceivers, catering to the evolving needs of data centers and telecom networks. In addition, partnerships and collaborations with network equipment manufacturers and telecom operators are common, allowing companies to integrate their products into broader network solutions.

Sustainability is also a key focus for many companies, with efforts to develop energy-efficient optical transceivers that help reduce power consumption in data centers. Furthermore, leading players are leveraging mergers and acquisitions to strengthen their market position and expand their technological capabilities. By adopting these strategies, top companies are positioning themselves to capitalize on the opportunities presented by the growing demand for high-speed connectivity and data-driven applications.

Market Players

Key companies operating in the Optical Transceiver Market include:

1. Broadcom Inc.

2. Cisco Systems, Inc.

3. II-VI Incorporated

4. Lumentum Holdings Inc.

5. Infinera Corporation

6. Fujitsu Optical Components Ltd.

7. Sumitomo Electric Industries, Ltd.

8. Finisar Corporation (part of II-VI Inc.)

9. Accelink Technologies Co., Ltd.

10. Ciena Corporation

11. Mellanox Technologies (NVIDIA)

12. NeoPhotonics Corporation

13. Arista Networks, Inc.

14. Source Photonics, Inc.

15. Applied Optoelectronics, Inc.

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Form factor By Data Rate, By fiber, By Application, By Distance |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analysed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Form factor

- SFF and SFP

- SFP+ and SFP28

- QSFP-DD, QSFP+, QSFP AND QSFP28

- CFP, CFP2, AND CFP4

- XFP

- CXP

By Data Rate

- LESS THAN 10 GBPS

- 10 GBPS TO 40 GBPS

- 41 GBPS TO 100 GBPS

- MORE THAN 100 GBPS

By Fiber Type

- Single mode fiber (smf)

- Multimode fiber (mmf)

By Application

- Data Center

- Telecom

- Enterprise

By Distance

- 0 to 2KM

- 2 TO 10 KM

- 11 TO 100 KM

- MORE THAN 100 KM

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Optical Transceiver Market is estimated to generate USD 14.3 billion in revenue in 2024.

The Global Optical Transceiver Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 13.1% during the forecast period from 2025 to 2032.

The Optical Transceiver Market is estimated to reach USD 38.3 billion by 2032.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!