"The Global Packaging Automation Market was valued at $ 77.66 billion in 2025 and is projected to reach $ 156.53 billion by 2034, growing at a CAGR of 8.1%."

The packaging automation market is experiencing robust growth as manufacturers across industries seek to streamline operations, reduce costs, and improve efficiency. Packaging automation refers to the use of various automated technologies and machinery to perform packaging processes without human intervention, including filling, labeling, sealing, palletizing, and inspection. The growing emphasis on reducing human error, improving packaging consistency, and increasing production speed has significantly boosted demand for automation solutions. Key industries such as food and beverage, pharmaceuticals, cosmetics, and consumer goods are increasingly adopting packaging automation to meet higher output requirements and stringent safety standards. The integration of robotics, vision systems, and AI into packaging lines is further enhancing capabilities, enabling companies to adapt to customized packaging and smaller batch sizes. Rising labor costs, supply chain disruptions, and the global push toward digital transformation are also contributing to the market’s acceleration.

The packaging automation market is poised for continued expansion as companies invest in smart manufacturing technologies and industry 4.0 initiatives. With growing demand for eco-friendly packaging, automation solutions are helping firms minimize material waste and adopt sustainable practices. Moreover, the rise of e-commerce and direct-to-consumer channels has led to a surge in demand for flexible and scalable packaging systems capable of handling diverse product types and volumes. Technological innovations such as sensor-based control systems, cloud-based monitoring, and predictive maintenance are creating new opportunities for solution providers. Meanwhile, small and medium enterprises are increasingly gaining access to modular and cost-effective automation systems tailored to their production needs. As global competition intensifies, businesses are leveraging packaging automation not only to optimize operational performance but also to enhance product quality, traceability, and customer satisfaction across the value chain.

Key Market Insights

- The packaging automation market is being propelled by the increasing demand for faster, error-free, and cost-efficient production processes. Companies are adopting automated systems to minimize reliance on manual labor, reduce operational bottlenecks, and meet rising production targets in a highly competitive environment.

- Robotics and AI integration are revolutionizing packaging automation by enabling real-time decision-making, adaptive packaging, and quality control. These technologies are particularly beneficial in industries that require high levels of customization, such as cosmetics and personalized consumer goods.

- E-commerce growth has significantly influenced packaging automation trends, with businesses seeking systems that can handle high order volumes and diverse packaging formats. Automation helps meet rapid fulfillment demands, reduce order errors, and improve overall supply chain responsiveness.

- The food and beverage sector remains one of the largest adopters of packaging automation, driven by the need for hygiene, speed, and consistency. Automated packaging systems ensure compliance with safety standards and extend shelf life through precise sealing and contamination-free environments.

- Packaging automation is also seeing strong uptake in the pharmaceutical industry, where precision, traceability, and regulatory compliance are critical. Automated solutions support serialization, tamper-evidence, and controlled environments necessary for sensitive products.

- Modular and scalable automation systems are enabling small and medium enterprises to enter the automated packaging space. These solutions are designed to be cost-effective and adaptable, helping smaller firms remain agile and competitive without heavy upfront investments.

- Environmental sustainability is becoming a major driver in packaging automation, as companies look to reduce waste and optimize material usage. Automation helps achieve these goals by minimizing over-packaging and integrating recyclable and biodegradable materials more efficiently.

- Industry 4.0 initiatives are accelerating the shift toward smart packaging systems equipped with IoT sensors and cloud connectivity. These systems enable remote monitoring, predictive maintenance, and real-time analytics, allowing companies to optimize performance and reduce downtime.

- Labor shortages and increasing wage pressures in key markets are pushing manufacturers to adopt packaging automation as a long-term strategic solution. Automated systems not only lower dependence on manual labor but also improve consistency and uptime across production lines.

- Technological advancements in vision systems and machine learning are enhancing the accuracy of defect detection and quality control during packaging. These innovations are reducing product recalls and customer complaints, thereby improving brand trust and operational efficiency.

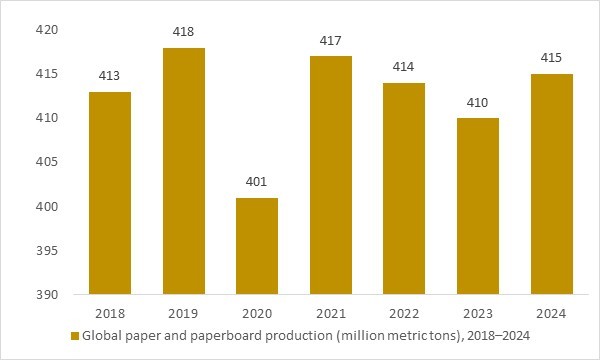

Global paper and paperboard production (million metric tons), 2018–2024

Figure: Global paper and paperboard production remained above 400 million tonnes between 2018 and 2024, with only a short-lived dip during the pandemic. This large and relatively stable raw material base for packaging grades underpins sustained investment in automated filling, cartoning, case packing, and palletizing systems, supporting long-term growth in the packaging automation market.Global paper and paperboard production (million tonnes), 2018–2024

- Global paper and paperboard production remained above 400 million tonnes from 2018 to 2024, underscoring the strong and resilient substrate base used in cartons, corrugated cases and other packaging formats. This consistent demand for packaging materials continues to drive investment in automated filling, packing, palletizing and labeling solutions, reinforcing long-term growth in the packaging automation market.

Regional Insights

North America Packaging Automation Market

North America leads the packaging automation market, powered by advanced manufacturing infrastructure, robust automation adoption, and strong e-commerce growth. Companies across industries such as food & beverage, healthcare, and consumer goods are increasingly deploying automated solutions to enhance productivity and quality. The shift towards Industry 4.0 is fostering greater integration of robotics, AI, and IoT-enabled packaging systems, enabling real-time monitoring, predictive maintenance, and seamless data-driven operations. This region continues to see investment in scalable and modular automation systems, creating lucrative opportunities for technology providers and integrators.

Asia Pacific Packaging Automation Market

Asia Pacific is emerging as the fastest-growing region for packaging automation, driven by rapid industrialization, expanding e-commerce networks, and government-backed modernization initiatives. Countries like China and India are investing heavily in smart manufacturing technologies to tackle labor shortages and meet rising consumer demand. The need for fast, adaptable packaging lines in high-volume sectors like food, pharmaceuticals, and logistics is propelling automation uptake, with solutions incorporating robotics, AI-based sorting, and sustainable packaging practices gaining traction.

Europe Packaging Automation Market

Europe maintains significant momentum in packaging automation as companies focus on sustainability, precision, and regulatory compliance. The market is influenced by strong environmental standards leading to automated systems that minimize waste, integrate recyclable materials, and enhance energy efficiency. Innovations like smart packaging with AI-enhanced quality control and seamless integration across production lines are advancing. The growth of food & beverage, pharmaceuticals, and luxury goods sectors, combined with rising digitalization, are creating high-value opportunities for suppliers offering flexible, eco-conscious automation solutions.

Report Scope

| Parameter | Packaging Automation Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Packaging Automation Market Segments Covered In The Report

By Offering

- Solution

- Services

By Automation Type

- Robotic Pick And Place Automation

- Secondary Packaging Automation

- Tertiary And Palletizing Automation

By Industry Vertical

- Healthcare And Pharmaceuticals

- E-Commerce And Logistics

- Food And Beverage

- Automotive

- Chemical And Refinery

- Aerospace And Defense

- Other Industry Verticals

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

- Siemens AG

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Honeywell International Inc.

- Jabil Inc.

- ABB Ltd.

- Toshiba Corporation

- Emerson Electric Co.

- Rockwell Automation Inc.

- Bosch Rexroth AG

- Omron Corporation

- Krones AG

- Daifuku Co. Ltd.

- Dematic Corporation

- KUKA AG

- YASKAWA Electric Corporation

- ATS Corporation

- BEUMER Group GmbH & Co. KG

- ProMach Inc.

- Kollmorgen Corporation

- ACTEGA GmbH

- Essel Propack Ltd.

- CFT S.p.A

- JLS Automation LLP

- Automated Packaging Systems Inc

Recent Industry Developments

- August 2025 – Gerresheimer announced its strategic decision to divest its molded glass division to sharpen its focus on high-growth areas such as pharmaceutical and biotech packaging automation, aligning with its long-term innovation roadmap.

- June 2025 – Honeywell disclosed internal restructuring plans involving its warehouse automation segment, with an emphasis on optimizing business operations to support its future strategic separation into standalone business units.

- May 2025 – Ranpak unveiled the PadPak Multi‑Station, an automated packaging system designed to deliver cushioning pads to multiple packing lines, enhancing operational efficiency while promoting environmentally friendly packaging.

- February 2025 – Ranpak entered into a strategic equity agreement with Amazon, enabling deeper collaboration on sustainable packaging automation and reinforcing its leadership in e-commerce fulfillment technologies.

- February 2025 – Ranpak partnered with AI company Rabot to integrate intelligent automation in packaging operations. The collaboration focuses on enhancing real-time performance, reducing waste, and improving throughput using machine learning models.

- February 2025 – Viking Masek expanded its North American operations to scale its packaging automation portfolio, responding to increased demand for integrated secondary packaging and end-of-line solutions across various industries.

- September 2024 – Premier Tech launched a collaborative robotic packaging system under its TOMA product line, targeting small and medium manufacturers seeking scalable automation with intuitive interfaces and compact design.

- August 2024 – Sidel Group introduced an upgraded version of its robotic palletizing system to improve speed, flexibility, and floor space efficiency in automated packaging lines, catering to food and beverage manufacturers.

- June 2024 – ProMach acquired a regional automation integrator to enhance its capabilities in providing turnkey packaging automation systems, especially for pharmaceutical and personal care product lines.

- May 2024 – Schneider Packaging Equipment announced a software update for its robotic case packers to support predictive maintenance and cloud connectivity, allowing clients to monitor packaging performance remotely and optimize uptime.

What You Receive

• Global Packaging Automation market size and growth projections (CAGR), 2024- 2034

• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Packaging Automation.

• Packaging Automation market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Packaging Automation market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Packaging Automation market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Packaging Automation market, Packaging Automation supply chain analysis.

• Packaging Automation trade analysis, Packaging Automation market price analysis, Packaging Automation Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Packaging Automation market news and developments.

The Packaging Automation Market international scenario is well established in the report with separate chapters on North America Packaging Automation Market, Europe Packaging Automation Market, Asia-Pacific Packaging Automation Market, Middle East and Africa Packaging Automation Market, and South and Central America Packaging Automation Markets. These sections further fragment the regional Packaging Automation market by type, application, end-user, and country.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Packaging Automation Market Latest Trends, Drivers and Challenges, 2024 - 2034

2.1 Packaging Automation Market Overview

2.2 Market Strategies of Leading Packaging Automation Companies

2.3 Packaging Automation Market Insights, 2024 - 2034

2.3.1 Leading Packaging Automation Types, 2024 - 2034

2.3.2 Leading Packaging Automation End-User industries, 2024 - 2034

2.3.3 Fast-Growing countries for Packaging Automation sales, 2024 - 2034

2.4 Packaging Automation Market Drivers and Restraints

2.4.1 Packaging Automation Demand Drivers to 2034

2.4.2 Packaging Automation Challenges to 2034

2.5 Packaging Automation Market- Five Forces Analysis

2.5.1 Packaging Automation Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Packaging Automation Market Value, Market Share, and Forecast to 2034

3.1 Global Packaging Automation Market Overview, 2024

3.2 Global Packaging Automation Market Revenue and Forecast, 2024 - 2034 (US$ billion)

3.3 Global Packaging Automation Market Size and Share Outlook By Offering, 2024 - 2034

3.4 Global Packaging Automation Market Size and Share Outlook By Automation Type, 2024 - 2034

3.5 Global Packaging Automation Market Size and Share Outlook By Industry Vertical, 2024 – 2034

3.6 Global Packaging Automation Market Size and Share Outlook By Segment4, 2024 - 2034

3.7 Global Packaging Automation Market Size and Share Outlook by Region, 2024 - 2034

4. Asia Pacific Packaging Automation Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Packaging Automation Market Overview, 2024

4.2 Asia Pacific Packaging Automation Market Revenue and Forecast, 2024 - 2034 (US$ billion)

4.3 Asia Pacific Packaging Automation Market Size and Share Outlook By Offering, 2024 - 2034

4.4 Asia Pacific Packaging Automation Market Size and Share Outlook By Automation Type, 2024 - 2034

4.5 Asia Pacific Packaging Automation Market Size and Share Outlook By Industry Vertical, 2024 – 2034

4.6 Asia Pacific Packaging Automation Market Size and Share Outlook By Segment4, 2024 - 2034

4.7 Asia Pacific Packaging Automation Market Size and Share Outlook by Country, 2024 - 2034

5. Europe Packaging Automation Market Value, Market Share, and Forecast to 2034

5.1 Europe Packaging Automation Market Overview, 2024

5.2 Europe Packaging Automation Market Revenue and Forecast, 2024 - 2034 (US$ billion)

5.3 Europe Packaging Automation Market Size and Share Outlook By Offering, 2024 - 2034

5.4 Europe Packaging Automation Market Size and Share Outlook By Automation Type, 2024 - 2034

5.5 Europe Packaging Automation Market Size and Share Outlook By Industry Vertical, 2024 – 2034

5.6 Europe Packaging Automation Market Size and Share Outlook By Segment4, 2024 - 2034

5.7 Europe Packaging Automation Market Size and Share Outlook by Country, 2024 - 2034

6. North America Packaging Automation Market Value, Market Share and Forecast to 2034

6.1 North America Packaging Automation Market Overview, 2024

6.2 North America Packaging Automation Market Revenue and Forecast, 2024 - 2034 (US$ billion)

6.3 North America Packaging Automation Market Size and Share Outlook By Offering, 2024 - 2034

6.4 North America Packaging Automation Market Size and Share Outlook By Automation Type, 2024 - 2034

6.5 North America Packaging Automation Market Size and Share Outlook By Industry Vertical, 2024 – 2034

6.6 North America Packaging Automation Market Size and Share Outlook By Segment4, 2024 - 2034

6.7 North America Packaging Automation Market Size and Share Outlook by Country, 2024 - 2034

7. South and Central America Packaging Automation Market Value, Market Share and Forecast to 2034

7.1 South and Central America Packaging Automation Market Overview, 2024

7.2 South and Central America Packaging Automation Market Revenue and Forecast, 2024 - 2034 (US$ billion)

7.3 South and Central America Packaging Automation Market Size and Share Outlook By Offering, 2024 - 2034

7.4 South and Central America Packaging Automation Market Size and Share Outlook By Automation Type, 2024 - 2034

7.5 South and Central America Packaging Automation Market Size and Share Outlook By Industry Vertical, 2024 – 2034

7.6 South and Central America Packaging Automation Market Size and Share Outlook By Segment4, 2024 - 2034

7.7 South and Central America Packaging Automation Market Size and Share Outlook by Country, 2024 - 2034

8. Middle East Africa Packaging Automation Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Packaging Automation Market Overview, 2024

8.2 Middle East and Africa Packaging Automation Market Revenue and Forecast, 2024 - 2034 (US$ billion)

8.3 Middle East Africa Packaging Automation Market Size and Share Outlook By Offering, 2024 - 2034

8.4 Middle East Africa Packaging Automation Market Size and Share Outlook By Automation Type, 2024 - 2034

8.5 Middle East Africa Packaging Automation Market Size and Share Outlook By Industry Vertical, 2024 – 2034

8.6 Middle East Africa Packaging Automation Market Size and Share Outlook By Segment4, 2024 - 2034

8.7 Middle East Africa Packaging Automation Market Size and Share Outlook by Country, 2024 - 2034

9. Packaging Automation Market Structure

9.1 Key Players

9.2 Packaging Automation Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Packaging Automation Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Packaging Automation Market is estimated to generate USD 77.66 billion in revenue in 2025.

The Global Packaging Automation Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% during the forecast period from 2025 to 2034.

The Packaging Automation Market is estimated to reach USD 156.53 billion by 2034.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!