The Palm Oil Market is estimated at USD 95.6 Million MT in 2024. Further, the market is expected to grow from USD 98.7 Million MT in 2025 to USD 134.7 Million MT in 2032 at a CAGR of 4.5%.

The palm oil market is one of the most strategically important segments of the global edible oils and fats industry, underpinned by high-yield oil palm plantations concentrated in tropical regions and extensive downstream refining capacity. Crude and refined palm oil, along with palm kernel oil and their fractions, are used across a wide spectrum of applications including edible oils for household and foodservice use, bakery and confectionery fats, instant noodles, snacks, dairy substitutes, margarines, and specialty fats for coatings and fillings. Beyond food, palm-based oleochemicals feed into soaps, detergents, personal care products, lubricants, and a growing portfolio of industrial applications, while palm oil and its derivatives are also used as feedstocks for biofuels and biomass energy in certain markets.

Recent trends reflect a dual focus on sustainability and functionality: there is strong momentum behind certified sustainable palm oil, traceable supply chains, and deforestation-free commitments, alongside continued innovation in fractionation and blending to meet trans-fat regulations and performance demands in processed foods. Market growth is driven by population and income expansion in emerging economies, ongoing substitution away from partially hydrogenated oils, and the cost-competitiveness and versatility of palm oil relative to other vegetable oils. The competitive landscape is dominated by vertically integrated plantation and refining groups, large agribusiness traders, and regional refiners that supply branded food companies, retailers, and industrial end-users. As governments, NGOs, and consumers scrutinize environmental and social impacts, producers are investing in certification, smallholder engagement, yield improvement, and value-added downstream products, positioning the palm oil market for a gradual transition toward more sustainable and differentiated growth.

Key Insights

-

Palm oil’s dominant industry position is rooted in its exceptionally high yield per hectare compared with other oil crops, which has historically made it the most cost-efficient large-scale source of vegetable oil. This yield advantage supports competitive pricing in both food and non-food applications, reinforcing palm oil’s role as a staple ingredient in global supply chains.

- The market is heavily geographically concentrated, with a few tropical countries accounting for most plantation area and exports, while consumption is globally dispersed. This creates a structurally trade-dependent market where logistics, export policies, and weather patterns in key producing regions have outsized influence on global availability and pricing dynamics.

- Food applications remain the core demand driver, especially in cooking oils, bakery fats, confectionery, instant foods, and dairy substitutes. Technological advances in fractionation and enzymatic interesterification allow manufacturers to tailor melting profiles and textures, enabling palm-based fats to meet performance requirements that once depended on partially hydrogenated oils.

- Non-food uses, particularly oleochemicals and biofuels, provide important additional demand outlets and influence overall market balance. Surfactants, soaps, detergents, personal care products, and industrial lubricants rely on palm-based derivatives, while biodiesel policy decisions in key regions can quickly alter the share of palm oil directed to energy versus food and industrial applications.

- Sustainability concerns are a defining force in the market, with deforestation, peatland conversion, greenhouse gas emissions, and labour conditions under constant scrutiny. Industry responses include certification schemes, traceability programs, supplier monitoring, and landscape-level initiatives aimed at reconciling production growth with environmental and social safeguards.

- Regulatory changes around nutrition and labelling, especially the removal of trans fats and constraints on certain saturated fat claims, have reshaped how palm oil is used in formulated foods. Manufacturers are increasingly deploying palm fractions and blends to optimize nutritional profiles and consumer perceptions while preserving functionality and shelf life.

- Smallholders play a significant role in many producing regions, making inclusive business models and yield-improvement programs critical to long-term supply security and rural livelihoods. Extension services, replanting support, access to finance, and certification readiness are key levers for integrating smallholders into more sustainable and resilient value chains.

- Volatility in global vegetable oil markets, currency movements, and energy prices affects palm oil competitiveness against soybean, sunflower, and rapeseed oils. Traders and refiners manage these risks through hedging, flexible refining configurations, and portfolio diversification, while downstream users balance cost, functionality, and sustainability positioning in their sourcing strategies.

- Technological innovation, including precision agriculture, remote sensing, improved planting material, and mill-efficiency upgrades, is increasingly important for raising yields on existing land and reducing environmental pressure. Over the long term, productivity gains are expected to be a key pathway to meeting demand without proportional expansion of plantation area.

- Looking ahead, the palm oil market is likely to be shaped by the interplay of rising demand from emerging economies, stricter sustainability expectations from regulators and brands, and shifts in energy and climate policies. Companies that can combine efficient production and refining with credible environmental and social performance, product innovation, and transparent communication are best positioned to capture future growth opportunities.

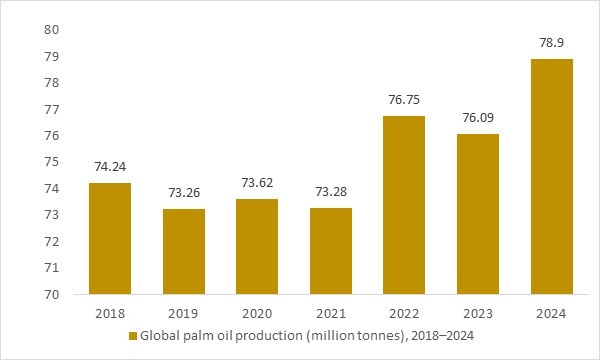

Global palm oil production (million tonnes), 2018–2024

Figure: Global palm oil production (million tonnes), 2018–2024. The sustained and rising output base underpins downstream demand for food, oleochemicals, and biofuel applications across the global palm oil market.

- Global palm oil production has maintained a high and gradually rising trajectory from 2018 to 2024, reflecting a robust and resilient raw material base for the palm oil value chain. This expanding supply underpins steady growth in food manufacturing, oleochemicals, personal care formulations, and biofuel blending, reinforcing palm oil’s role as a critical feedstock for both mature and emerging markets worldwide.

Regional Insights

North America Palm oil market

In North America, the palm oil market is almost entirely import-dependent, with volumes flowing mainly from Indonesia and Malaysia into the United States, Canada, and Mexico. Palm oil is used across packaged foods, bakery fats, confectionery coatings, instant foods, and personal care and cleaning products, often in highly processed or blended forms. Brand owners and retailers face ongoing scrutiny from NGOs and investors, pushing them toward certified sustainable and traceable supply, with many large multinationals committing to RSPO-aligned sourcing and deforestation-free supply chains. Regulatory developments in Europe and global ESG expectations are indirectly influencing North American sourcing policies as companies harmonize standards across portfolios. At the same time, growth in renewable diesel and biofuel programs keeps palm derivatives under discussion, but local feedstocks and policy risks constrain large-scale fuel use relative to food and oleochemical applications.

Europe Palm oil market

Europe is a major importing and refining hub for palm oil but also the region with the toughest sustainability and deforestation-related regulations. Food, personal care, and industrial users increasingly rely on certified sustainable palm oil and advanced traceability systems to comply with retailer demands and new EU rules on deforestation-free supply chains. The European Union’s deforestation regulation, which restricts imports linked to forest loss, has been delayed by one year but remains a powerful driver of supply-chain transformation and digital traceability. Refiners and traders are investing in data platforms, geolocation, and satellite monitoring to demonstrate compliance, while consumer-facing brands continue reformulation and labelling efforts to manage health and sustainability perceptions. Overall, Europe is shifting from volume-driven demand to a more selective, high-compliance market for palm oil and derivatives.

Asia-Pacific Palm oil market

Asia-Pacific is the core engine of the palm oil market, encompassing the world’s largest producers, refiners, and consumers. Indonesia and Malaysia dominate global production and exports, with vertically integrated groups managing plantations, milling, refining, and downstream manufacturing. Domestic policies in Indonesia, including biodiesel blending mandates such as B40, are structurally increasing local palm oil use and influencing global trade flows. At the same time, political and land-governance shifts, including large-scale state-led seizures of plantations in Indonesia, are creating uncertainty around future investment, yields, and export capacity. On the demand side, India and China are among the largest importers, using palm oil extensively in edible oil blends, processed foods, and foodservice. Regional initiatives to promote sustainable palm oil, particularly in China and key ASEAN markets, are growing, but implementation is uneven across producers and buyers.

Market Scope

|

Parameter |

palm oil Market scope Detail |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Market Size-Units |

USD billion |

|

Market Splits Covered |

By Product, By Application, By End User and By Technology |

|

Countries Covered |

North America (USA, Canada, Mexico) |

|

Analysis Covered |

Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

|

Customization |

10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

|

Post-Sale Support |

4 analyst hours, available up to 4 weeks |

|

Delivery Format |

The Latest Updated PDF and Excel Data file |

Market Segmentation

By Product

- CPO

- Palm Kernel Oil

By End-Use

- Food & Beverage

- Personal Care & Cosmetics

- Biofuel & Energy

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Companies Covered

Wilmar International Ltd., Sime Darby Plantation Berhad, IOI Corporation Berhad, Kuala Lumpur Kepong Berhad, Musim Mas Group, Golden Agri-Resources Ltd., FGV Holdings Berhad, Genting Plantations Berhad, Asian Agri, Cargill Incorporated, Archer Daniels Midland Company, Olam International, Agropalma, Oleopalma, Presco PLC, United Plantations Berhad, PT Sampoerna Agro Tbk, Univanich Palm Oil Public Company Ltd., PT Bakrie Sumatera Plantations Tbk, AEN Palm Oil

TABLE OF CONTENTS

1. GLOBAL PALM OIL INDUSTRY

1.1. Market Scope and Definition

1.2. Study Assumptions

2. PALM OIL MARKET LATEST TRENDS, DRIVERS AND CHALLENGES, 2023-2031

2.1. Palm Oil Market Latest Trends

2.1.1. The Surge in Consumption of Snacks and Canned Foods

2.1.2. Government initiatives to boost biofuel production

2.1.3. European Mandate to Procure Sustainable Palm Oil

2.1.4. Resurging COVID in China

2.1.5. Sunflower Oil Shortage with the impact of the Russia-Ukraine war

2.2. Palm Oil Market Insights, 2023-2031

2.2.1. Leading Palm Oil, by Product, 2023-2031

2.2.2. Dominant Palm Oil End-Use, 2023-2031

2.2.3. Fast-Growing Geographies for Palm Oil, 2023-2031

2.3. Palm Oil Market Drivers to 2031

2.3.1. Higher demand from the Food sector

2.3.2. Escalating Crude Oil Prices

2.3.3. Palm Oil Producers’ Measures Towards Sustainability

2.4. Palm Oil Market Restraints to 2031

2.4.1. Environmental Concerns for Palm Oil-

2.4.2. Pests and Diseases Affecting Crop Growth -

2.4.3. Growing Concerns About Food & Environmental Security

2.4.4. Impact of Climate Change

2.5. Palm Oil Market-Five Forces Analysis

3. GLOBAL PALM OIL MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

3.1. Global Palm Oil Market Overview, 2023

3.2. Global Palm Oil Market Size and Share Outlook, By Product, 2023-2031

3.2.1. CPO

3.2.2. Palm Kernel Oil

3.3. Global Palm Oil Market Size and Share Outlook, By End-Use, 2023-2031

3.3.1. Food & Beverage

3.3.2. Personal Care & Cosmetics

3.3.3. Biofuel & Energy

3.3.4. Others

3.4. Global Palm Oil Market Size and Share Outlook by Region, 2023-2031

4. NORTH AMERICA PALM OIL MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

4.1. North America Palm Oil Market Overview, 2023

4.2. North America Palm Oil Market Size and Share Outlook, By Product, 2023-2031

4.3. North America Palm Oil Market Size and Share Outlook, By End-Use, 2023-2031

4.4. North America Palm Oil Market Size and Share Outlook by Country, 2023-2031

4.4.1. United States

4.4.2. Canada

4.4.3. Mexico

5. EUROPE PALM OIL MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

5.1. Europe Palm Oil Market Overview, 2023

5.2. Europe Palm Oil Market Size and Share Outlook, By Product, 2023-2031

5.3. Europe Palm Oil Market Size and Share Outlook, By End-Use, 2023-2031

5.4. Europe Palm Oil Market Size and Share Outlook by Country, 2023-2031

5.4.1. Germany

5.4.2. Italy

5.4.3. Spain

5.4.4. Rest of Europe

6. ASIA PACIFIC PALM OIL MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

6.1. Asia Pacific Palm Oil Market Overview, 2023

6.2. Asia Pacific Palm Oil Market Size and Share Outlook, By Product, 2023-2031

6.3. Asia Pacific Palm Oil Market Size and Share Outlook, By End-Use, 2023-2031

6.4. Asia Pacific Palm Oil Market Size and Share Outlook by Country, 2023-2031

6.4.1. Indonesia

6.4.2. China

6.4.3. India

6.4.4. Malaysia

6.4.5. Pakistan

6.4.6. Thailand

6.4.7. Rest of Asia Pacific

7. SOUTH AND CENTRAL AMERICA PALM OIL MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

7.1. South and Central America Palm Oil Market Overview, 2023

7.2. South and Central America Palm Oil Market Size and Share Outlook, By Product, 2023-2031

7.3. South and Central America Palm Oil Market Size and Share Outlook, By End-Use, 2023-2031

7.4. South and Central America Palm Oil Market Size and Share Outlook by Country, 2023-2031

7.4.1. Brazil

7.4.2. Colombia

7.4.3. Rest of South and Central America

8. MIDDLE EAST AFRICA PALM OIL MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

8.1. Middle East Africa Palm Oil Market Overview, 2023

8.2. Middle East Africa Palm Oil Market Size and Share Outlook, By Product, 2023-2031

8.3. Middle East Africa Palm Oil Market Size and Share Outlook, By End-Use, 2023-2031

8.4. Middle East Africa Palm Oil Market Size and Share Outlook by Country, 2023-2031

8.4.1. Middle East

8.4.2. Africa

9. PALM OIL MARKET STRUCTURE

9.1. Wilmar International Limited

9.2. Sime Darby Plantation Berhad

9.3. IOI Corporation Berhad

9.4. Golden Agri-Resources Ltd

9.5. Musim Mas Group

10. CRUDE PALM OIL SUPPLY-DEMAND AND PRICES

10.1. Crude Palm Oil _Price Forecast

10.2. Crude Palm Oil _Supply Forecast

10.3. Crude Palm Oil _Demand Forecast

10.4. Crude Palm Oil _Supply, Key Countries

10.5. Crude Palm Oil _Demand, Key Countries

11. APPENDIX

11.1. About Us

11.2. Sources

11.3. Research Methodology

11.4. Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!