"The Global Paper and Paperboard Packaging Market was valued at USD 376.81 billion in 2025 and is projected to reach USD 604.59 billion by 2034, growing at a CAGR of 5.39%."

The paper and paperboard packaging market has witnessed significant growth in recent years, driven by increasing consumer demand for sustainable and eco-friendly packaging solutions. As concerns over plastic pollution rise, paper and paperboard materials are being increasingly preferred due to their recyclability and biodegradability. These packaging materials are commonly used in various industries, including food and beverages, pharmaceuticals, consumer goods, and electronics. Paper and paperboard packaging offer a versatile, cost-effective, and environmentally friendly alternative to traditional plastic packaging, which has led to the material’s increasing adoption. The rising awareness of environmental issues and the growing demand for sustainable packaging solutions are further boosting the market. Additionally, the expanding e-commerce sector, which requires secure and sustainable packaging options, has contributed to the growing use of paper and paperboard packaging across the globe.

The market is further supported by continuous innovations in packaging design, with manufacturers focusing on developing lightweight, durable, and functional packaging solutions. The food and beverage industry, in particular, is a key driver, as paper and paperboard packaging materials provide an excellent way to preserve products while reducing environmental impact. The increasing shift towards recyclable and renewable resources has also spurred the growth of the market, with manufacturers adopting more sustainable production processes. In regions like North America and Europe, strict regulations on plastic waste management have led to heightened demand for paper-based alternatives. In addition, emerging economies in Asia-Pacific are expected to drive future market growth, as industrialization and changing consumer preferences foster the adoption of paper and paperboard packaging solutions.

Key Market Insights

- The paper and paperboard packaging market is experiencing significant growth driven by increasing consumer demand for sustainable and eco-friendly packaging solutions. With growing environmental concerns surrounding plastic, paper and paperboard have emerged as preferred alternatives due to their recyclability and biodegradability, making them a viable solution for reducing environmental impact.

- The rise in consumer awareness of environmental issues and the need for waste reduction has spurred the shift towards paper and paperboard packaging. Industries such as food and beverages, pharmaceuticals, and electronics are increasingly adopting these materials to meet consumer preferences for eco-friendly packaging options.

- The growth of the e-commerce sector has contributed significantly to the demand for paper and paperboard packaging. As more products are sold online, there is a heightened need for secure, durable, and sustainable packaging solutions to ensure the safe transportation of goods, further driving the adoption of paper-based packaging materials.

- The food and beverage industry remains a key driver of the paper and paperboard packaging market. Packaging materials like cartons, trays, and wrappers offer advantages such as product protection, extended shelf life, and the ability to preserve food products while adhering to sustainability goals, especially in organic and fresh food packaging.

- Technological advancements in packaging design have led to the development of lighter, more durable, and functional paper and paperboard packaging solutions. Innovations such as moisture-resistant coatings, tamper-evident seals, and improved barrier properties have enhanced the performance of paper-based packaging materials, further expanding their applications across various industries.

- Regulatory pressures, especially in regions like Europe and North America, have accelerated the transition from plastic to paper-based packaging. Stringent regulations on plastic waste management, along with extended producer responsibility (EPR) programs, are encouraging businesses to adopt paper and paperboard solutions to comply with sustainability targets.

- Asia-Pacific is expected to become the fastest-growing market for paper and paperboard packaging due to rapid industrialization, growing consumer demand for packaged goods, and increasing awareness of environmental sustainability. As these markets shift towards sustainable packaging, the region will play a crucial role in the future growth of the industry.

- The market for paper and paperboard packaging continues to evolve with increasing consumer demand for customization and brand differentiation. Manufacturers are now focusing on incorporating advanced printing technologies, like digital and flexographic printing, to offer more personalized and attractive packaging options that appeal to consumers seeking unique product experiences.

- Recycling and the use of renewable resources are central to the growth of the paper and paperboard packaging market. Many manufacturers are investing in circular economy models that emphasize reusing materials and reducing waste through sustainable production practices. This focus on sustainability is expected to drive further innovation and market expansion in the coming years.

- The increasing use of sustainable raw materials in paper production, such as recycled fibers and alternative pulp sources, is helping reduce the environmental footprint of paper and paperboard packaging. This shift is in line with the growing demand for packaging solutions that contribute to a more sustainable supply chain and lower carbon emissions.

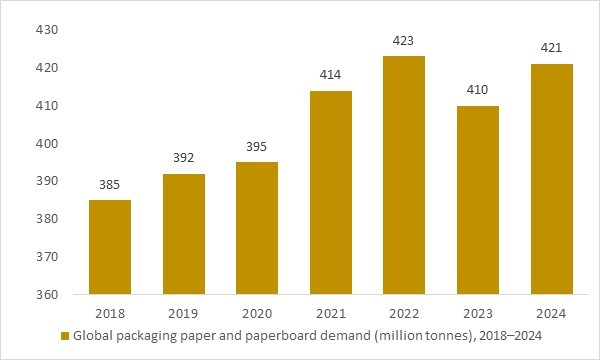

Global packaging paper and paperboard demand (million tonnes), 2018–2024

Figure: Global packaging paper and paperboard demand increased from around 385 million tonnes in 2018 to over 420 million tonnes in 2024. As brand owners and retailers replace plastics with fiber-based formats and e-commerce volumes rise, this expanding paper and paperboard demand directly underpins growth in corrugated boxes, folding cartons and other paper-based packaging. OG Analysis estimates, supported by international pulp and paper statistics, highlight how the long-term shift toward sustainable fiber packaging strengthens the outlook for the paper and paperboard packaging market. Global packaging paper and paperboard demand (million tonnes), 2018–2024

- Global packaging paper and paperboard demand increased from around 385 million tonnes in 2018 to over 420 million tonnes in 2024. As brands shift from plastics to sustainable fiber-based formats and e-commerce boosts corrugated box consumption, this rising raw material base directly drives growth in the paper and paperboard packaging market. OG Analysis estimates reflect how sustainability mandates and consumer preferences continue to propel long-term demand for fiber packaging solutions.

Regional Insights

North America Paper and Paperboard Packaging Market

The North American paper and paperboard packaging market is experiencing robust growth, driven by increasing consumer demand for sustainable and eco-friendly packaging solutions. The region's high disposable income, coupled with a strong inclination towards wellness and self-care, has led to a surge in the adoption of at-home beauty devices. Key players in the market are focusing on innovation, introducing smart devices equipped with AI and IoT capabilities to offer personalized skincare experiences. The popularity of LED therapy masks, microcurrent devices, and facial cleansing brushes is on the rise, with consumers seeking effective alternatives to professional treatments. Moreover, the influence of social media and endorsements from beauty influencers have significantly boosted the visibility and acceptance of these devices among a broader audience. The market is expected to continue its upward trajectory, with projections indicating substantial growth in the coming years.

Asia Pacific Paper and Paperboard Packaging Market

The Asia Pacific region stands out as the fastest-growing market for paper and paperboard packaging, fueled by a deep-rooted skincare culture and increasing consumer awareness about personal grooming. Countries like South Korea, Japan, and China are at the forefront, with consumers actively seeking advanced beauty technologies to enhance their skincare routines. The rise of K-beauty and C-beauty trends has further accelerated the demand for innovative facial devices such as LED masks, ultrasonic cleansers, and microcurrent stimulators. Additionally, the proliferation of e-commerce platforms has made these devices more accessible to a wider audience, contributing to market expansion. The integration of AI and augmented reality in skincare devices is gaining traction, offering users customized solutions based on real-time skin analysis. As the middle-class population grows and disposable incomes rise, the adoption of facial beauty devices is anticipated to increase, presenting lucrative opportunities for companies operating in the region.

Europe Paper and Paperboard Packaging Market

Europe's paper and paperboard packaging market is characterized by a strong emphasis on sustainability, innovation, and regulatory compliance. Consumers are increasingly inclined towards eco-friendly products, prompting manufacturers to develop devices using recyclable materials and energy-efficient technologies. The market is witnessing a shift towards multifunctional devices that combine various skincare treatments, such as cleansing, anti-aging, and skin rejuvenation, into a single device. The integration of smart technologies, including AI and IoT, is enabling personalized skincare experiences, allowing users to tailor treatments to their specific skin needs. Regulatory standards in the region ensure product safety and efficacy, fostering consumer trust and encouraging market growth. The presence of established beauty brands and a growing trend towards self-care and wellness are driving the demand for facial beauty devices. As consumers become more educated about skincare, the market is poised for continued expansion, with companies focusing on innovation and sustainability to meet evolving consumer preferences.

Report Scope

| Parameter | Paper and Paperboard Packaging Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Paper and Paperboard Packaging Market Segments Covered In The Report

By Product Type

- Folding Cartons

- Corrugated Boxes

- Other Product Types

By Grade

- Solid Bleached Sulfate

- Coated Unbleached Kraft Paperboard

- Folding Boxboard

- White Lined Chipboard

- Glassine And Greaseproof Paper

- Label Paper

- Other Grades

By End Users

- Food

- Beverage

- Healthcare

- Personal Care

- Electrical

- Other End Users

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

WestRock Company, International Paper Company, Amcor Ltd., Tetra Pak, UPM-Kymmene Corporation, Smurfit Kappa Group Plc, Stora enso Oyj, Oji Holdings Corporation, Graphic Packaging International, DS Smith Plc, Packaging Corporation of America, India Tobacco Company Limited, Metsa Group, South Africa Pulp and Paper Industries Ltd, Valmet Oyj, Domtar Corporation, Cascades Inc., Nippon Paper Industries Co. Ltd, Infor Inc., Shandong Bohui Paper Company Ltd, Visy Industries Australia Pty Ltd, BillerudKorsnäs AB, Svenska Cellulosa Aktiebolaget SCA, Mondi Group, Weyerhaeuser, Sonoco Products Company

Recent Industry Developments

- June 2025 – IIT Madras researchers developed a biodegradable packaging material using agricultural waste and mycelium, offering a sustainable alternative to traditional plastic foams. This innovation addresses both plastic pollution and agricultural waste management by converting residues into compostable packaging solutions.

- June 2025 – ITC Ltd significantly increased its production of sustainable plastic alternatives by 2.4 times over the past three years, highlighting its strategic focus on organic development and long-term innovation in eco-conscious packaging solutions.

- June 2025 – Green Bay Packaging announced the acquisition of SMC Packaging, a provider of packaging materials and corrugated boxes, aiming to broaden its product lineup and fortify its market presence in the paper and paperboard packaging sector.

- June 2025 – International Paper secured EU approval for its $7.2 billion acquisition of UK-based DS Smith, with the condition of divesting five plants in Europe to mitigate competition concerns, aiming to strengthen its European market presence in the paper and packaging industry.

- June 2025 – Australian start-up Earthodic secured $6 million in funding to advance its recyclable protective coating for paper and cardboard packaging, providing an eco-friendly alternative to non-recyclable coatings and aiming to reduce landfill waste.

- June 2025 – Novolex completed the $6.7 billion acquisition of Pactiv Evergreen, enhancing its portfolio in food packaging and foodservice products, and expanding its reach across North America.

- May 2025 – International Paper announced plans to shut down five UK sites and reduce operations at others, putting approximately 300 jobs at risk, following its acquisition of DS Smith, citing difficult trading conditions and high UK energy costs.

- May 2025 – The UK government announced the implementation of a "grocery tax" under the extended producer responsibility scheme, imposing fees on packaging types, including paper and board, to offset council recycling costs, potentially increasing household food bills.

- May 2025 – The traditional printing industry in India is undergoing a transformation due to the rise of e-commerce and increasing branding needs, with packaging now being a significant contributor to the printing sector's growth.

- May 2025 – International Paper's CEO, Andy Silvernail, is leading a comprehensive transformation of the company from a traditional paper business to a modern packaging enterprise focused on corrugated cardboard, aiming to enhance efficiency and service for customers amid challenging market conditions.

What You Receive

• Global Paper and Paperboard Packaging market size and growth projections (CAGR), 2024- 2034

• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Paper and Paperboard Packaging.

• Paper and Paperboard Packaging market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Paper and Paperboard Packaging market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Paper and Paperboard Packaging market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Paper and Paperboard Packaging market, Paper and Paperboard Packaging supply chain analysis.

• Paper and Paperboard Packaging trade analysis, Paper and Paperboard Packaging market price analysis, Paper and Paperboard Packaging Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Paper and Paperboard Packaging market news and developments.

The Paper and Paperboard Packaging Market international scenario is well established in the report with separate chapters on North America Paper and Paperboard Packaging Market, Europe Paper and Paperboard Packaging Market, Asia-Pacific Paper and Paperboard Packaging Market, Middle East and Africa Paper and Paperboard Packaging Market, and South and Central America Paper and Paperboard Packaging Markets. These sections further fragment the regional Paper and Paperboard Packaging market by type, application, end-user, and country.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Paper and Paperboard Packaging Market Latest Trends, Drivers and Challenges, 2024 - 2034

2.1 Paper and Paperboard Packaging Market Overview

2.2 Market Strategies of Leading Paper and Paperboard Packaging Companies

2.3 Paper and Paperboard Packaging Market Insights, 2024 - 2034

2.3.1 Leading Paper and Paperboard Packaging Types, 2024 - 2034

2.3.2 Leading Paper and Paperboard Packaging End-User industries, 2024 - 2034

2.3.3 Fast-Growing countries for Paper and Paperboard Packaging sales, 2024 - 2034

2.4 Paper and Paperboard Packaging Market Drivers and Restraints

2.4.1 Paper and Paperboard Packaging Demand Drivers to 2034

2.4.2 Paper and Paperboard Packaging Challenges to 2034

2.5 Paper and Paperboard Packaging Market- Five Forces Analysis

2.5.1 Paper and Paperboard Packaging Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Paper and Paperboard Packaging Market Value, Market Share, and Forecast to 2034

3.1 Global Paper and Paperboard Packaging Market Overview, 2024

3.2 Global Paper and Paperboard Packaging Market Revenue and Forecast, 2024 - 2034 (US$ billion)

3.3 Global Paper and Paperboard Packaging Market Size and Share Outlook By Product Type, 2024 - 2034

3.4 Global Paper and Paperboard Packaging Market Size and Share Outlook By Grade, 2024 - 2034

3.5 Global Paper and Paperboard Packaging Market Size and Share Outlook By End Users, 2024 – 2034

3.6 Global Paper and Paperboard Packaging Market Size and Share Outlook By Segment4, 2024 - 2034

3.7 Global Paper and Paperboard Packaging Market Size and Share Outlook by Region, 2024 - 2034

4. Asia Pacific Paper and Paperboard Packaging Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Paper and Paperboard Packaging Market Overview, 2024

4.2 Asia Pacific Paper and Paperboard Packaging Market Revenue and Forecast, 2024 - 2034 (US$ billion)

4.3 Asia Pacific Paper and Paperboard Packaging Market Size and Share Outlook By Product Type, 2024 - 2034

4.4 Asia Pacific Paper and Paperboard Packaging Market Size and Share Outlook By Grade, 2024 - 2034

4.5 Asia Pacific Paper and Paperboard Packaging Market Size and Share Outlook By End Users, 2024 – 2034

4.6 Asia Pacific Paper and Paperboard Packaging Market Size and Share Outlook By Segment4, 2024 - 2034

4.7 Asia Pacific Paper and Paperboard Packaging Market Size and Share Outlook by Country, 2024 - 2034

5. Europe Paper and Paperboard Packaging Market Value, Market Share, and Forecast to 2034

5.1 Europe Paper and Paperboard Packaging Market Overview, 2024

5.2 Europe Paper and Paperboard Packaging Market Revenue and Forecast, 2024 - 2034 (US$ billion)

5.3 Europe Paper and Paperboard Packaging Market Size and Share Outlook By Product Type, 2024 - 2034

5.4 Europe Paper and Paperboard Packaging Market Size and Share Outlook By Grade, 2024 - 2034

5.5 Europe Paper and Paperboard Packaging Market Size and Share Outlook By End Users, 2024 – 2034

5.6 Europe Paper and Paperboard Packaging Market Size and Share Outlook By Segment4, 2024 - 2034

5.7 Europe Paper and Paperboard Packaging Market Size and Share Outlook by Country, 2024 - 2034

6. North America Paper and Paperboard Packaging Market Value, Market Share and Forecast to 2034

6.1 North America Paper and Paperboard Packaging Market Overview, 2024

6.2 North America Paper and Paperboard Packaging Market Revenue and Forecast, 2024 - 2034 (US$ billion)

6.3 North America Paper and Paperboard Packaging Market Size and Share Outlook By Product Type, 2024 - 2034

6.4 North America Paper and Paperboard Packaging Market Size and Share Outlook By Grade, 2024 - 2034

6.5 North America Paper and Paperboard Packaging Market Size and Share Outlook By End Users, 2024 – 2034

6.6 North America Paper and Paperboard Packaging Market Size and Share Outlook By Segment4, 2024 - 2034

6.7 North America Paper and Paperboard Packaging Market Size and Share Outlook by Country, 2024 - 2034

7. South and Central America Paper and Paperboard Packaging Market Value, Market Share and Forecast to 2034

7.1 South and Central America Paper and Paperboard Packaging Market Overview, 2024

7.2 South and Central America Paper and Paperboard Packaging Market Revenue and Forecast, 2024 - 2034 (US$ billion)

7.3 South and Central America Paper and Paperboard Packaging Market Size and Share Outlook By Product Type, 2024 - 2034

7.4 South and Central America Paper and Paperboard Packaging Market Size and Share Outlook By Grade, 2024 - 2034

7.5 South and Central America Paper and Paperboard Packaging Market Size and Share Outlook By End Users, 2024 – 2034

7.6 South and Central America Paper and Paperboard Packaging Market Size and Share Outlook By Segment4, 2024 - 2034

7.7 South and Central America Paper and Paperboard Packaging Market Size and Share Outlook by Country, 2024 - 2034

8. Middle East Africa Paper and Paperboard Packaging Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Paper and Paperboard Packaging Market Overview, 2024

8.2 Middle East and Africa Paper and Paperboard Packaging Market Revenue and Forecast, 2024 - 2034 (US$ billion)

8.3 Middle East Africa Paper and Paperboard Packaging Market Size and Share Outlook By Product Type, 2024 - 2034

8.4 Middle East Africa Paper and Paperboard Packaging Market Size and Share Outlook By Grade, 2024 - 2034

8.5 Middle East Africa Paper and Paperboard Packaging Market Size and Share Outlook By End Users, 2024 – 2034

8.6 Middle East Africa Paper and Paperboard Packaging Market Size and Share Outlook By Segment4, 2024 - 2034

8.7 Middle East Africa Paper and Paperboard Packaging Market Size and Share Outlook by Country, 2024 - 2034

9. Paper and Paperboard Packaging Market Structure

9.1 Key Players

9.2 Paper and Paperboard Packaging Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Paper and Paperboard Packaging Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Paper and Paperboard Packaging Market is estimated to generate USD 376.81 billion in revenue in 2025.

The Global Paper and Paperboard Packaging Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.39% during the forecast period from 2025 to 2034.

The Paper and Paperboard Packaging Market is estimated to reach USD 604.59 billion by 2034.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!