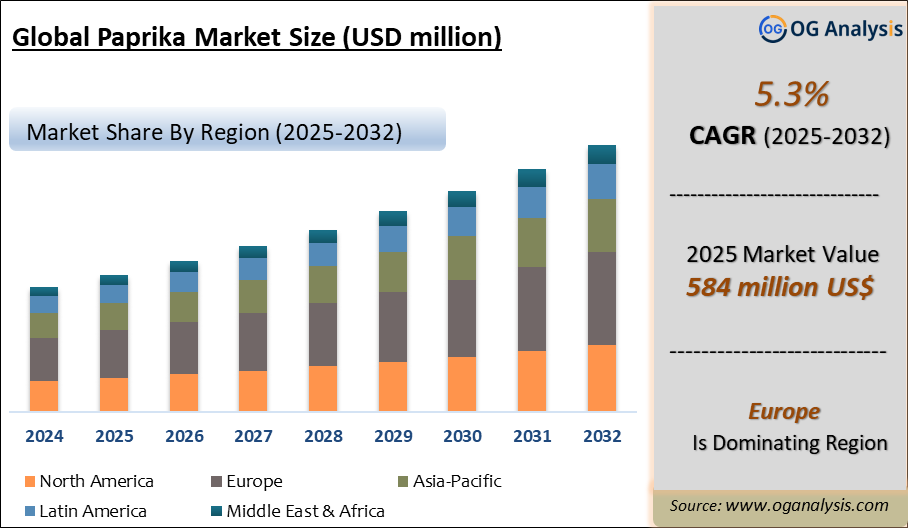

"The Global Paprika Market Size was valued at USD 559 million in 2024 and is projected to reach USD 584 million in 2025. Worldwide sales of Paprika are expected to grow at a significant CAGR of 5.3%, reaching USD 942 million by the end of the forecast period in 2034."

Introduction and Overview

The paprika market has seen a vibrant evolution in recent years, driven by its diverse culinary applications and increasing demand for natural food colorants. Paprika, a spice derived from ground Capsicum annuum, is widely used in various cuisines to add flavor, color, and heat. Originating from Central and South America, it has become an integral component in dishes worldwide. The market is characterized by a broad range of paprika varieties, including sweet, hot, and smoked, each offering unique sensory attributes. With a growing consumer preference for natural and organic ingredients, paprika has gained popularity beyond traditional uses, finding its way into health foods, snacks, and even dietary supplements. This expanding application base has bolstered market growth, making paprika a staple in both household and commercial kitchens globally.

In recent years, the paprika market has experienced significant growth due to the rising awareness of the spice’s health benefits, such as its high antioxidant content and potential anti-inflammatory properties. This shift towards health-conscious eating habits has spurred demand in both developed and emerging markets. Additionally, the increasing popularity of ethnic and gourmet cuisines has further driven market expansion. The market landscape is marked by a diverse range of players, from large-scale producers to niche suppliers, each contributing to the vibrant dynamics of paprika production and distribution. As global trade continues to evolve, the paprika market is expected to adapt, with innovations in cultivation and processing techniques enhancing its appeal and accessibility.

Key Insights Of The Market

-

Expanding Capsicum production underpins long-term raw material security

Growth in dry chillies and peppers cultivation across Asia, Africa and Latin America has expanded the Capsicum raw material base for paprika. This supports reliable supply for spice processors, oleoresin manufacturers and color houses. However, yield volatility due to weather and farm economics still drives periodic price spikes and quality fluctuations. -

Shift from synthetic to natural colors is a structural demand driver

Regulatory pressure and consumer preference are pushing food and beverage brands away from synthetic reds toward paprika-based natural colors. Paprika oleoresin and standardized color extracts are increasingly used to replace azo dyes in snacks, processed meat, sauces and ready meals. This structural shift supports higher-value, application-specific paprika ingredients. -

Paprika oleoresin and value-added extracts outpace commodity ground spice

While ground paprika remains important in retail and foodservice, the fastest growth lies in oleoresins, encapsulated colors and standardized ASTA-grade extracts. These products offer better dose control, color consistency and stability in complex formulations. This drives higher margins and deepens integration with ingredient and flavor houses. -

Strong pull from processed meat, snacks and convenience foods

Paprika is widely used for color and flavor in sausages, meat coatings, savory snacks, noodles, sauces and ready-to-eat meals. The global expansion of modern retail and QSR chains is raising demand for visually appealing, consistently colored products. As emerging markets upgrade cold chains and processed meat infrastructure, paprika usage per capita tends to rise. -

Paprika’s role in clean-label and “no artificial additives” reformulations

Food brands reformulating to “no artificial colors,” “clean label” or “short ingredient lists” are leaning on paprika as a recognizable kitchen ingredient. Label declarations such as “paprika extract” or “paprika (for color)” are more acceptable to consumers than coded synthetic dyes. This opens opportunities for premium clean-label paprika suppliers with strong traceability. -

Quality differentiation through ASTA color value, pungency and origin

End users increasingly specify paprika based on ASTA color units, heat levels and microbiological quality. Origins such as Spain, Hungary, India, China, Peru and Mexico have carved niches based on flavor profile, color intensity and sustainability credentials. Suppliers that can guarantee consistent ASTA ratings, low contaminants and stable pricing gain preferred-vendor status. -

Innovation in encapsulation and heat-stable formulations

Technological advances such as microencapsulation, emulsified color systems and improved antioxidants are enhancing color stability and shelf life. These innovations enable paprika use in challenging matrices like high-fat snacks, bakery and UHT-processed foods. Heat-stable paprika solutions are particularly important as manufacturers push for higher processing temperatures and longer shelf life. -

Rising traction in plant-based and flexitarian product portfolios

Paprika is gaining new relevance in plant-based meat, vegetarian sausages, burger patties and alternative protein products to mimic the appearance of grilled or cured meat. Its natural reddish hue and flavor help bridge sensory gaps versus conventional meat. As flexitarian and plant-based diets expand, this application cluster becomes an important growth pocket. -

Organic, sustainably sourced and certified paprika segments emerging

Demand for organic, fair-trade and sustainably produced paprika is increasing among premium brands and retailers, particularly in Europe and North America. Certification for organic farming, residue control and ethical sourcing provides differentiation in crowded spice aisles. This favors vertically integrated players that can control farming practices and traceability. -

Competitive landscape consolidating around integrated spice and ingredient players

The market is seeing consolidation as large spice companies, oleoresin manufacturers and ingredient multinationals acquire regional paprika processors. Integrated players control everything from contract farming and drying to extraction and blending, improving cost efficiency and quality control. Smaller processors survive by specializing in niche origins, artisanal products or customized blends for regional cuisines.

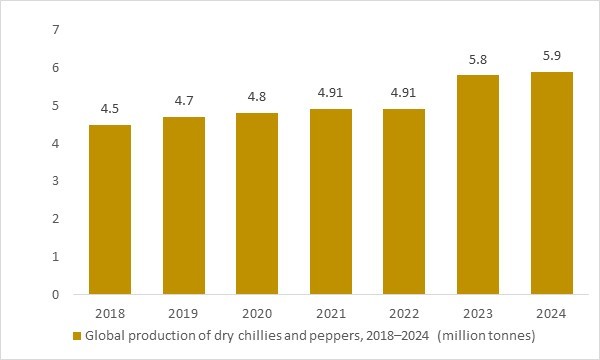

Global production of dry chillies and peppers, 2018–2024 (million tonnes)

Figure: Global production of dry chillies and peppers – the core Capsicum raw material for paprika – increased from an estimated 4.5 million tonnes in 2018 to almost 6 million tonnes by 2024. This expanding supply base underpins long-term growth in the paprika market, ensuring consistent availability of pods for powders, flakes and oleoresins used across snacks, meat products, sauces, ready meals and foodservice. OG Analysis estimates, aligned with FAO statistics and recent chilli production studies, highlight how rising Capsicum output supports demand for paprika ingredients worldwide.

Global production of dry chillies and peppers – the core raw material for paprika powders, flakes and oleoresins – expanded from an estimated 4.5 million tonnes in 2018 to almost 6 million tonnes by 2024. FAO-based statistics show world output of “chillies and peppers, dry” around 4.9 million tonnes in 2021–2022, while more recent research indicates production surged to roughly 5.8 million tonnes in 2023 as India and other Asian and African suppliers ramped up acreage and yields. This expanding supply base of dried Capsicum peppers underpins long-term growth in the paprika market, ensuring consistent availability of raw pods for colour and flavour extraction, stabilising input costs, and enabling paprika processors to serve rising demand from snack, meat, sauce, ready-meal and foodservice applications worldwide.

Report Scope

| Parameter | Paprika Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Product

- Vegetable

- Spice Powder

- Paprika Oleoresin

- Colorant paprika

- Others

By Form

- Powder

- Flakes

- Other Forms

By Application

- Food

- Pharmaceuticals

- Cosmetics

- Others

By Nature

- Organic

- Conventional

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Market Players

- Adani Pharmachem Private Limited

- Chr. Hansen

- EVESA

- Frutarom Industries Ltd

- Givaudan

- Ingredients Naturales Seleccionados

- Kalsec Natural Ingredients

- Kancor Ingredients Limited

- Naturex

- Ozone Naturals

- Plant Lipids

- Synthite Industries Ltd

- Ungerer & Company Unilever Food Solutions

- Unilever Food Solutions.

- Universal Oleoresi

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Paprika Market is estimated to generate USD 559 million in revenue in 2024.

The Global Paprika Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.3% during the forecast period from 2025 to 2032.

The Paprika Market is estimated to reach USD 845 million by 2032.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!