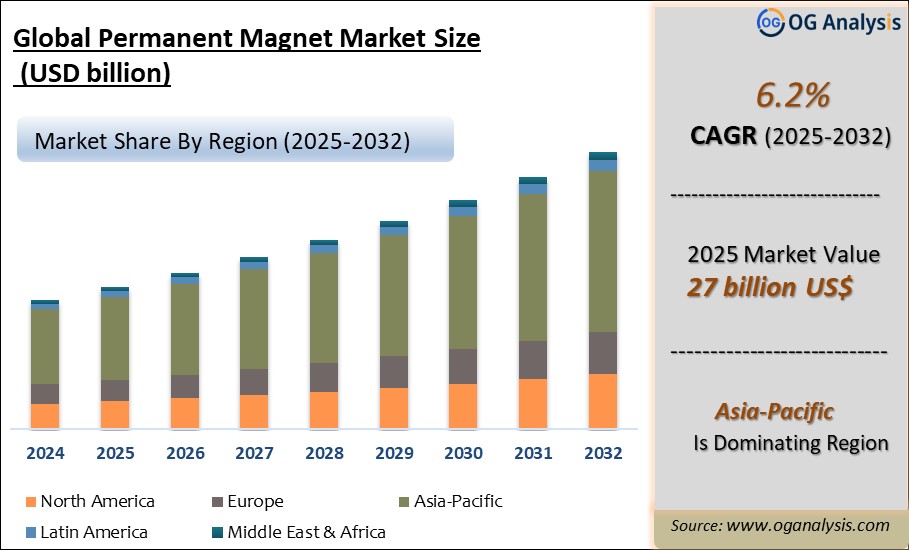

The Permanent Magnet Market is estimated at USD 25.4 billion in 2024. Further, the market is expected to grow from USD 27 billion in 2025 to USD 46.4 billion in 2034 at a CAGR of 6.2%.

Permanent Magnet Market Overview

Permanent magnets are a class of materials that exhibit a persistent magnetic field without the need for an external energy source. This magnetism stems from the alignment of electron spins within the material, leading to a macroscopic manifestation of magnetic properties. These materials are often characterized by their coercivity (the resistance to demagnetization), their remanence (the magnetic flux density that remains when the external field is removed), and their temperature stability. These characteristics determine the suitability of a particular type of permanent magnet in an application. Permanent magnets find an extensive array of applications across various industries, driven by their unique magnetic properties. They power the speakers and microphones in our electronic devices, enabling crisp sound reproduction. In electric motors and generators, permanent magnets generate the magnetic fields crucial for energy conversion and efficient propulsion.

Renewable energy sources like wind turbines harness their magnetic prowess for electricity generation. In medical technology, permanent magnets are pivotal in magnetic resonance imaging (MRI) machines, facilitating non-invasive and high-resolution diagnostics. Additionally, they contribute to the automotive sector's electrification, propelling electric and hybrid vehicles with increased efficiency. From aerospace systems and navigation to consumer electronics and beyond, the diverse applications of permanent magnets underscore their essential role in modern technological advancements.

Trade Intelligence for Permanent Magnet Market

|

Global permanent magnets of metal and articles Trade, Imports, USD million, 2020-24 |

|||||

|

|

2020 |

2021 |

2022 |

2023 |

2024 |

|

World |

3,504 |

5,146 |

6,745 |

5,850 |

4,918 |

|

Germany |

406 |

591 |

867 |

745 |

598 |

|

Japan |

369 |

557 |

854 |

769 |

578 |

|

United States of America |

329 |

508 |

663 |

558 |

478 |

|

Mexico |

155 |

226 |

292 |

309 |

333 |

|

Viet Nam |

228 |

297 |

341 |

283 |

313 |

|

Source: OGAnalysis, International Trade Centre (ITC) |

|||||

- Germany, Japan, United States of America, Mexico and Viet Nam are the top five countries importing 46.8% of global permanent magnets of metal and articles in 2024

- Global permanent magnets of metal and articles Imports increased by 40.3% between 2020 and 2024

- Germany accounts for 12.2% of global permanent magnets of metal and articles trade in 2024

- Japan accounts for 11.8% of global permanent magnets of metal and articles trade in 2024

- United States of America accounts for 9.7% of global permanent magnets of metal and articles trade in 2024

|

Global permanent magnets of metal and articles Export Prices, USD/Ton, 2020-24 |

|

|

|

Source: OGAnalysis |

Latest Trends in the Permanent Magnet Market

Increasing Demand From The Automotive Industry:

Permanent Magnets are widely used in the automobile industry, where they can be found in electric vehicle motors, hybrid vehicle motors, and fuel injection systems. With the growing demand for electric vehicles and the necessity for energy-efficient solutions, Permanent Magnet demand is likely to rise further. Key applications of Permanent Magnets in the automobile industry include - Electric motors: Permanent Magnets are used in electric motors in hybrid and electric vehicles. They are used to generate a magnetic field that rotates the motor's rotor, which in turn drives the vehicle.

Alternators and generators: Permanent Magnets are used in alternators and generators to produce an electromagnetic field that generates electricity. These devices are used to charge the battery and power the electrical systems in the vehicle. Magnetic sensors: Permanent Magnets are used in magnetic sensors that detect the position and speed of the vehicle's components, such as the wheels, crankshaft, and camshaft. This information is used to control the engine and transmission systems.

Driving Factors

Increasing demand for electric vehicles:

With growing concern about environmental pollution and the need to cut carbon emissions, demand for electric vehicles (EVs) is rapidly expanding. Permanent Magnets are widely employed in EV motors, which is propelling the Permanent Magnet market forward. Permanent Magnets are widely utilized in electric vehicles (EVs) for a variety of purposes. A major application of Ferrite Magnets in EVs is the electric motors that power the vehicle. The magnets are used in the rotor of the motor, where they create a magnetic field that interacts with the stator to produce rotational motion. Permanent Magnets are popular for use in electric motors gaining from their low-cost and better magnetic properties.

Permanent Magnets are also used in the charging systems of EVs. The magnets are used in the charging cable, where they create a magnetic field that is used to transfer power wirelessly from the charging station to the EV. This wireless charging technology is becoming increasingly popular in the EV market, as it allows for convenient and efficient charging without the need for cables or plugs.

Market Challenges

Limited Availability of Raw Materials:

The permanent magnet market faces a significant challenge in its reliance on specific raw materials, particularly rare-earth elements like neodymium, samarium, and cobalt. The supply chain for these materials is often concentrated in a handful of countries, posing geopolitical risks and vulnerability to disruptions. As these materials are vital for magnet manufacturing, any disruption in their supply can have far-reaching consequences, impacting industries ranging from renewable energy to electronics.

Another key concern is the competition for raw materials from other sectors. For example, strontium and barium are utilized in a variety of other items, including fireworks, glass manufacture, and medical uses. As demand for these items grows, the availability of raw materials for Permanent Magnet production may decrease, resulting in higher pricing and even shortages. However, Permanent Magnet makers are exploring options to diversify raw material sources, investing in recycling and waste reduction technologies, and creating alternative manufacturing procedures to use fewer raw materials or alternative materials. These efforts are expected to secure a consistent supply of raw materials for the future manufacturing of Permanent Magnets.

Companies Mentioned

TDK Corporation

PROTERIAL, Ltd. (Hitachi Metals Pvt. Ltd.)

DAIDO STEEL CO., LTD.

Adams Magnetic Products

JPMF Guangdong Co., Ltd

Arnold Magnetic Technologies

Report Scope

|

Parameter |

Permanent Magnet market scope Detail |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Market Size-Units |

USD billion |

|

Market Splits Covered |

By material, By Ferrite Process, By Ferrite Type, and By End-User |

|

Countries Covered |

North America (USA, Canada, Mexico) |

|

Analysis Covered |

Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

|

Customization |

10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

|

Post-Sale Support |

4 analyst hours, available up to 4 weeks |

|

Delivery Format |

The Latest Updated PDF and Excel Data file |

Market Segmentation

|

|

|

|

By Material |

|

|

By Ferrite Process |

|

|

By Ferrite Type |

|

|

By End-Use |

|

|

By Geography |

|

Recent Developments

- Sept 2025: USA Rare Earth acquired UK firm LCM to accelerate its “mine-to-magnet” integration in rare earth metals and alloy production outside China.

- Sept 2025: Energy Fuels announced its NdPr oxide (mined & processed in U.S.) has been qualified to be manufactured into permanent magnets for EV/hybrid drive motors.

- Aug 2025: General Motors signed a multi-year supply agreement with Noveon Magnetics for domestically produced NdFeB magnets for its trucks/SUVs.

- Jul 2025: MP Materials and Apple entered a long-term agreement for MP to supply recycled rare earth magnets produced in the U.S. for Apple’s products.

- Jun 2025: Tata Motors disclosed that it is actively seeking alternative rare earth magnet suppliers in response to China’s export restrictions, while maintaining sufficient internal inventory.

- Mar 2025: Korean researchers developed a grain boundary diffusion method enabling high-performance permanent magnets without heavy rare earth elements.

TABLE OF CONTENTS

1. GLOBAL PERMANENT MAGNET INDUSTRY

1.1. Market Scope and Definition

1.2. Study Assumptions

2. PERMANENT MAGNET MARKET LATEST TRENDS, DRIVERS AND CHALLENGES, 2023-2031

2.1. Permanent Magnet Market Latest Trends

2.1.1. Increasing Demand From The Automotive Industry:

2.1.2. Growing Adoption Of Renewable Energy Sources:

2.1.3. Technological Advancements In Ferrite Magnet Manufacturing:

2.1.4. Shift Towards Sustainable And Recyclable Permanent Magnets:

2.1.5. Increasing Use Of Permanent Magnets In Medical Equipment:

2.2. Permanent Magnet Market Insights, 2023-2031

2.2.1. Leading Permanent Magnet Material, 2023-2031

2.2.2. Top Permanent Magnet End-Use Industry, 2023-2031

2.2.3. Fast-Growing Geographies for Permanent Magnet, 2023-2031

2.3. Permanent Magnet Market Drivers to 2031

2.3.1. Increasing demand for electric vehicles:

2.3.2. Growing adoption of automation and robotics:

2.3.3. Rising demand for consumer electronics:

2.3.4. Wide temperature tolerance:

2.4. Permanent Magnet Market Restraints to 2031

2.4.1. Limited Availability of Raw Materials:

2.4.2. Environmental Impact and Sustainability:

2.4.3. Technological Transitions and Innovation of Alternate Sustainable Materials:

2.5. Permanent Magnet Market-Five Forces Analysis

3. GLOBAL PERMANENT MAGNET MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

3.1. Global Permanent Magnet Market Overview, 2023

3.2. Global Permanent Magnet Market Size and Share Outlook, By Material, 2023-2031

3.2.1. Neodymium-Iron-Boron

3.2.2. Ferrite

3.2.3. Samarium Cobalt

3.2.4. Alnico and Other

3.3. Global Permanent Magnet Market Size and Share Outlook, By End-Use Industry, 2023-2031

3.3.1. Electronics & Appliances

3.3.2. Automotive

3.3.3. Industrial

3.3.4. Energy & Power

3.3.5. Medical

3.3.6. Other End-Use Industry

3.4. Global Permanent Magnet Market Size and Share Outlook by Region, 2023-2031

4. NORTH AMERICA PERMANENT MAGNET MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

4.1. North America Permanent Magnet Market Overview, 2023

4.2. North America Permanent Magnet Market Size and Share Outlook by Material, 2023-2031

4.2.1. North America Ferrite Magnet Market Size and Share Outlook, By Process, 2023-2031

4.2.2. North America Ferrite Magnet Market Size and Share Outlook, By Product Type, 2023-2031

4.3. North America Permanent Magnet Market Size and Share Outlook by End-Use Industry, 2023-2031

4.4. North America Permanent Magnet Market Size and Share Outlook by Country, 2023-2031

4.4.1. United States

4.4.2. Canada

4.4.3. Mexico

5. EUROPE PERMANENT MAGNET MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

5.1. Europe Permanent Magnet Market Overview, 2023

5.2. Europe Permanent Magnet Market Size and Share Outlook by Material, 2023-2031

5.2.1. Europe Ferrite Magnet Market Size and Share Outlook, By Process, 2023-2031

5.2.2. Europe Ferrite Magnet Market Size and Share Outlook, By Product Type, 2023-2031

5.3. Europe Permanent Magnet Market Size and Share Outlook by End-Use Industry, 2023-2031

5.4. Europe Permanent Magnet Market Size and Share Outlook by Country, 2023-2031

5.4.1. Germany

5.4.2. UK

5.4.3. Italy

5.4.4. France

5.4.5. Spain

5.4.6. Rest of Europe

6. ASIA PACIFIC PERMANENT MAGNET MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

6.1. Asia Pacific Permanent Magnet Market Overview, 2023

6.2. Asia Pacific Permanent Magnet Market Size and Share Outlook by Material, 2023-2031

6.2.1. Asia Pacific Ferrite Magnet Market Size and Share Outlook, By Process, 2023-2031

6.2.2. Asia Pacific Ferrite Magnet Market Size and Share Outlook, By Product Type, 2023-2031

6.3. Asia Pacific Permanent Magnet Market Size and Share Outlook by End-Use Industry, 2023-2031

6.4. Asia Pacific Permanent Magnet Market Size and Share Outlook by Country, 2023-2031

6.4.1. China

6.4.2. Japan

6.4.3. India

6.4.4. South Korea

6.4.5. Rest of Asia Pacific

7. SOUTH AND CENTRAL AMERICA PERMANENT MAGNET MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

7.1. South and Central America Permanent Magnet Market Overview, 2023

7.2. South and Central America Permanent Magnet Market Size and Share Outlook by Material, 2023-2031

7.2.1. South and Central America Ferrite Magnet Market Size and Share Outlook, By Process, 2023-2031

7.2.2. South and Central America Ferrite Magnet Market Size and Share Outlook, By Product Type, 2023-2031

7.3. South and Central America Permanent Magnet Market Size and Share Outlook by End-Use Industry, 2023-2031

7.4. South and Central America Permanent Magnet Market Size and Share Outlook by Country, 2023-2031

7.4.1. Brazil

7.4.2. Argentina

7.4.3. Rest of South and Central America

8. MIDDLE EAST AFRICA PERMANENT MAGNET MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

8.1. Middle East Africa Permanent Magnet Market Overview, 2023

8.2. Middle East Africa Permanent Magnet Market Size and Share Outlook by Material, 2023-2031

8.2.1. Middle East Africa Ferrite Magnet Market Size and Share Outlook, By Process, 2023-2031

8.2.2. Middle East Africa Ferrite Magnet Market Size and Share Outlook, By Product Type, 2023-2031

8.3. Middle East Africa Permanent Magnet Market Size and Share Outlook by End-Use Industry, 2023-2031

8.4. Middle East Africa Permanent Magnet Market Size and Share Outlook by Country, 2023-2031

8.4.1. Middle East

8.4.2. Africa

9. PERMANENT MAGNET MARKET STRUCTURE

9.1. TDK Corporation

9.2. PROTERIAL, Ltd. (Hitachi Metals Pvt. Ltd.)

9.3. DAIDO STEEL CO., LTD.

9.4. Adams Magnetic Products

9.5. JPMF Guangdong Co., Ltd

9.6. Arnold Magnetic Technologies

10. APPENDIX

10.1. Permanent Magnet Trade Data

10.2. About Us

10.3. Sources

10.4. Research Methodology

10.5. Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!