"Global Plant Based Meat Market is valued at USD 10.2 billion in 2025. Further, the market is expected to grow at a CAGR of 17.9% to reach USD 45 billion by 2034."

Plant-Based Meat Market Overview

The plant-based meat market is rapidly evolving as consumer preferences shift toward sustainable and ethical food choices without compromising on taste or texture. These products, made from protein sources such as soy, pea, wheat, and mycoprotein, aim to replicate the sensory and nutritional attributes of traditional meat. The rising demand is fueled by concerns over animal welfare, environmental sustainability, and health consciousness, particularly among flexitarians and younger demographics. Technological advancements in food science, including extrusion techniques and flavor engineering, have significantly improved the quality and appeal of plant-based meat. Additionally, the foodservice sector is playing a crucial role in mainstream adoption, with restaurants, fast-food chains, and retailers expanding their plant-based offerings to cater to the growing demand.

In 2024, the plant-based meat market witnessed significant developments, driven by product innovation and strategic partnerships. Major food companies introduced next-generation plant-based meat products with enhanced texture and flavor, closely mimicking conventional meat. The year also saw an increase in hybrid meat solutions—blending plant proteins with cultivated meat or fermentation-derived ingredients—to enhance taste and nutritional value. Regulatory bodies in key markets, including the U.S. and Europe, provided clearer labeling guidelines to improve transparency and consumer trust. Additionally, private-label brands gained traction as retailers launched affordable plant-based meat alternatives, making them more accessible to a wider consumer base. With inflationary pressures impacting consumer spending, brands focused on cost-effective production methods, including sustainable ingredient sourcing and localized manufacturing.

Looking ahead to 2025 and beyond, the plant-based meat industry is expected to expand further, with new innovations in ingredient technology and manufacturing processes. Advances in precision fermentation and novel protein sources, such as fungi and algae, will contribute to improved nutritional profiles and reduced production costs. Emerging markets in Asia and Latin America are projected to be major growth drivers, with increasing investment in alternative protein infrastructure. As consumers become more health-conscious, demand for clean-label and minimally processed plant-based meat products will rise, prompting brands to optimize formulations with fewer additives. Sustainability will remain a key focus, with companies prioritizing regenerative agriculture and carbon-neutral production practices. Additionally, partnerships between plant-based meat brands and foodservice providers will continue to accelerate market penetration, making plant-based options a mainstream choice for consumers worldwide.

Key Insights

- The core demand base has shifted from a small vegan and vegetarian audience to a much larger flexitarian population reducing meat without abandoning it completely. This broadens the addressable market but also raises expectations that plant based meat must compete directly with conventional meat on taste, texture, convenience, and price. Brands that position products as “meat-like” rather than purely lifestyle-oriented capture more mainstream occasions.

- Burgers and patties remain the flagship format, yet growth increasingly comes from sausages, nuggets, mince, meatballs, and prepared meals that fit into familiar recipes. These formats allow plant based meat to penetrate home cooking, snacking, breakfast, and family occasions rather than being confined to burger-focused eating. Diversification into ethnic and regional dishes further embeds plant based options into local food cultures.

- Protein sourcing is a critical strategic lever, with soy, pea, and wheat proteins forming the backbone of many formulations, while newer inputs such as fava, chickpea, and mixed-plant blends gain traction. Each source carries different implications for allergenicity, sustainability, cost, and mouthfeel. Companies increasingly adopt multi-protein systems to balance functionality, risk management, and consumer perception around ingredients.

- Nutritional positioning is moving beyond basic “plant-based” claims toward more nuanced profiles that emphasize protein content, reduced saturated fat, lower sodium, and the absence of artificial additives. Some brands target performance nutrition and weight management, while others stress comfort-food attributes with better nutritional balance than conventional meat. This stratification supports premium, mid-range, and value tiers within the category.

- Clean-label and ingredient-transparency expectations are reshaping formulation strategies, as consumers scrutinize long ingredient lists and unfamiliar additives. Early-generation products often relied heavily on flavorings, texturizers, and colorants to mimic meat, but newer launches strive for simpler recipes without sacrificing sensory quality. Achieving this balance is a central innovation challenge and a key source of differentiation among leading brands.

- Foodservice and quick-service restaurants play an outsized role in awareness-building and trial, serving as gateways for consumers to experience plant based meat in trusted formats such as burgers, tacos, sandwiches, and pizzas. Successful collaborations between brands and major chains significantly accelerate penetration, while smaller independent outlets use plant based options to signal modern, inclusive menus. Repeat purchase at retail often follows a positive foodservice experience.

- Retail dynamics are intensifying as supermarkets refine shelf placement, merchandising, and private-label strategies. Many retailers position plant based meat adjacent to conventional meat or in dedicated plant-based zones to encourage cross-category shopping. Private-label ranges offer more affordable options and put price pressure on branded players, pushing them to invest in strong brand identity, storytelling, and innovation to justify premiums.

- Technological progress in high-moisture extrusion, shear-cell structuring, flavor encapsulation, and plant-based fat systems is gradually closing the sensory gap with animal meat. These technologies enable more convincing bite, juiciness, and cooking behavior, expanding plant based meat from simple patties to shredded, sliced, and whole-cut applications. Over time, such advances support expansion into foodservice formats that require robust culinary performance.

- Regulatory, labelling, and communications frameworks strongly influence market development, particularly debates over the use of meat-related terms and nutritional comparisons. Companies must navigate different regional rules while maintaining clear consumer messaging on how to cook, use, and nutritionally interpret plant based meat. Transparent communication around processing levels and ingredient origins is increasingly important to maintain trust.

- Sustainability narratives around greenhouse gas emissions, land use, and animal welfare remain foundational but are being evaluated more critically by consumers and retailers. Brands are responding with more rigorous life-cycle assessments, local sourcing strategies, and packaging improvements to substantiate environmental claims. As climate and ethical considerations become embedded in retailer and foodservice procurement policies, plant based meat stands to gain from institutional commitments to lower-impact menus.

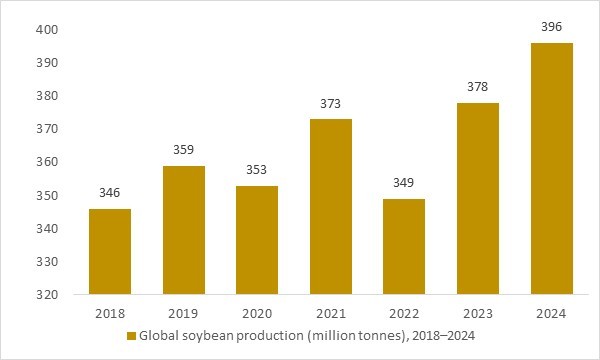

Global soybean production (million tonnes), 2018–2024

Figure: Global soybean production increased from around 346 million tonnes in 2018 to nearly 396 million tonnes in 2024. As farmers expand soybean acreage and yields in major producers, this growing plant-protein feedstock base directly supports the availability of soy protein isolates, concentrates and textured vegetable protein used in plant based meat products. OG Analysis estimates, supported by international crop statistics, highlight how rising soybean output underpins long-term growth opportunities in the plant based meat market.

- Global soybean production increased steadily from 2018 to 2024, reflecting the expanding supply base of plant proteins critical for formulating high-quality plant based meat products. As more countries boost soybean acreage and implement advanced cultivation practices, the availability of soy protein isolates and textured vegetable protein strengthens, supporting innovation, affordability, and wider consumer adoption in the plant based meat market. OG Analysis insights highlight how rising raw material capacity underpins long-term growth opportunities across retail and foodservice channels.

Regional Insights

North America Plant based meat market

North America is one of the most commercially advanced regions for the plant based meat market, supported by well-established distribution across retail and foodservice. Quick-service restaurants and casual dining chains continue to drive consumer trial and visibility, even as retail sales growth normalizes after earlier surges. Product innovation now focuses on better nutrition, simpler ingredients, and competitive pricing to accelerate repeat purchases among flexitarian consumers. Competition is intense, with specialists, traditional meat processors, and private labels all expanding presence. Regulatory updates and consumer health perceptions are prompting reformulations to reduce sodium and perceived processing while maintaining sensory performance.

Europe Plant based meat market

Europe demonstrates strong structural support for plant based meat due to high adoption of vegan and flexitarian lifestyles, robust sustainability commitments, and strong retailer involvement. Western and Northern countries lead in per-capita consumption, with broad availability of sausages, burgers, mince, and ready meals. However, some companies are rationalizing portfolios where demand has softened, focusing instead on profitable, high-rotation product lines. Ongoing labelling discussions around the use of meat-like terminology influence packaging and brand messaging. Products with verified environmental benefits, traceable sourcing, and familiar taste profiles continue to outperform the broader category.

Asia-Pacific Plant based meat market

Asia-Pacific is the fastest-growing regional market, driven by urbanization, increasing disposable incomes, and rapid expansion of modern retail and foodservice formats. Longstanding familiarity with soy-based proteins supports acceptance, while new formulations tailored to local flavors help broaden appeal among mainstream consumers. Large cities are emerging as hubs for product launches including burger patties, nuggets, dumpling fillings, and items suitable for hotpot and street-food formats. Growth is strongly linked to younger consumers prioritizing wellness, sustainability, and modern eating experiences. Regional governments are also showing growing interest in alternative proteins as part of food security and innovation strategies.

Market Scope

| Parameter | Plant based meat Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Product Type

- Burger Patties

- Sausages

- Strips

- Nuggets

- Meatballs

- Other Product Types

By Source

- Soy

- Wheat

- Pea

- Other Sources

By Distribution Channel

- Grocery Stores

- Food & Drinks Specialty Stores

- Convenience Stores

- Restaurants

- Online Stores

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

- Abbots Laboratories Inc.

- Kraft Heinz Company Inc.

- Maple Leaf Foods Inc.

- Morningstar Farms Inc.

- Amy’s Kitchen Inc.

- Beyond Meat Inc.

- Impossible Foods Inc.

- Quorn Foods Inc.

- Greenleaf Foods LLC

- Don Lee Farms Inc.

- The Vegetarian Butcher LLC.

- Sweet Earth Inc.

- LightLife Foods Inc.

- Atlantic Natural Foods Inc.

- Gardein Inc.

- Ojah BV

- Tofurky Inc.

- The Very Good Food Company Inc.

- Next Level Burger LLC.

- Gold&Green Foods Ltd.

- Gold&Green Foods Ltd Oy

- Hungry Planet Inc.

- Monks Meats Inc.

- No Evil Foods Inc.

- Ocean Hugger Foods Inc.

- Sophie's Kitchen Inc.

- Yves Veggie Cuisine Inc.

- VBites Inc.

- Dr. Praeger’s Inc.

- Good Catch Foods Inc.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Plant Based Meat Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Plant Based Meat Market Overview

2.2 Plant Based Meat Market Developments

2.2.1 Plant Based Meat Market -Supply Chain Disruptions

2.2.2 Plant Based Meat Market -Direct/Indirect Impact of Tariff Changes and Trade Restrictions

2.2.3 Plant Based Meat Market -Price Development

2.2.4 Plant Based Meat Market -Regulatory and Compliance Management

2.2.5 Plant Based Meat Market -Consumer Expectations and Trends

2.2.6 Plant Based Meat Market -Market Structure and Competition

2.2.7 Plant Based Meat Market -Technological Adaptation

2.2.8 Plant Based Meat Market -Changing Retail Dynamics

2.3 Plant Based Meat Market Insights, 2025- 2034

2.3.1 Prominent Plant Based Meat Market product types, 2025- 2034

2.3.2 Leading Plant Based Meat Market End-User markets, 2025- 2034

2.3.3 Fast-Growing countries for Plant Based Meat Market sales, 2025- 2034

2.4 Plant Based Meat Market Drivers and Restraints

2.4.1 Plant Based Meat Market Demand Drivers to 2034

2.4.2 Plant Based Meat Market Challenges to 2034

2.5 Plant Based Meat Market- Five Forces Analysis

2.5.1 Plant Based Meat Market Industry Attractiveness Index, 2025

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Plant Based Meat Market Value, Market Share, and outlook to 2034

3.1 Global Plant Based Meat Market Overview, 2025

3.2 Global Plant Based Meat Market Revenue and Forecast, 2025- 2034 (US$ Million)

3.3 Global Plant Based Meat Market Size and Share Outlook by Type, 2025- 2034

3.4 Global Plant Based Meat Market Size and Share Outlook by End-User, 2025- 2034

3.5 Global Plant Based Meat Market Size and Share Outlook by Region, 2025- 2034

4. Asia Pacific Plant Based Meat Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Plant Based Meat Market Overview, 2025

4.2 Asia Pacific Plant Based Meat Market Revenue and Forecast, 2025- 2034 (US$ Million)

4.3 Asia Pacific Plant Based Meat Market Size and Share Outlook by Type, 2025- 2034

4.4 Asia Pacific Plant Based Meat Market Size and Share Outlook by End-User, 2025- 2034

4.5 Asia Pacific Plant Based Meat Market Size and Share Outlook by Country, 2025- 2034

4.6 Key Companies in Asia Pacific Plant Based Meat Market

5. Europe Plant Based Meat Market Value, Market Share, and Forecast to 2034

5.1 Europe Plant Based Meat Market Overview, 2025

5.2 Europe Plant Based Meat Market Revenue and Forecast, 2025- 2034 (US$ Million)

5.3 Europe Plant Based Meat Market Size and Share Outlook by Type, 2025- 2034

5.4 Europe Plant Based Meat Market Size and Share Outlook by End-User, 2025- 2034

5.5 Europe Plant Based Meat Market Size and Share Outlook by Country, 2025- 2034

5.6 Key Companies in Europe Plant Based Meat Market

6. North America Plant Based Meat Market Value, Market Share, and Forecast to 2034

6.1 North America Plant Based Meat Market Overview, 2025

6.2 North America Plant Based Meat Market Revenue and Forecast, 2025- 2034 (US$ Million)

6.3 North America Plant Based Meat Market Size and Share Outlook by Type, 2025- 2034

6.4 North America Plant Based Meat Market Size and Share Outlook by End-User, 2025- 2034

6.5 North America Plant Based Meat Market Size and Share Outlook by Country, 2025- 2034

6.6 Key Companies in North America Plant Based Meat Market

7. South and Central America Plant Based Meat Market Value, Market Share, and Forecast to 2034

7.1 South and Central America Plant Based Meat Market Overview, 2025

7.2 South and Central America Plant Based Meat Market Revenue and Forecast, 2025- 2034 (US$ Million)

7.3 South and Central America Plant Based Meat Market Size and Share Outlook by Type, 2025- 2034

7.4 South and Central America Plant Based Meat Market Size and Share Outlook by End-User, 2025- 2034

7.5 South and Central America Plant Based Meat Market Size and Share Outlook by Country, 2025- 2034

7.6 Key Companies in South and Central America Plant Based Meat Market

8. Middle East Africa Plant Based Meat Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Plant Based Meat Market Overview, 2025

8.2 Middle East and Africa Plant Based Meat Market Revenue and Forecast, 2025- 2034 (US$ Million)

8.3 Middle East Africa Plant Based Meat Market Size and Share Outlook by Type, 2025- 2034

8.4 Middle East Africa Plant Based Meat Market Size and Share Outlook by End-User, 2025- 2034

8.5 Middle East Africa Plant Based Meat Market Size and Share Outlook by Country, 2025- 2034

8.6 Key Companies in Middle East Africa Plant Based Meat Market

9. Plant Based Meat Market Players Analysis

9.1 Plant Based Meat Market Companies - Key Strategies and Financial Analysis

9.1.1 Snapshot

9.1.2 Business Description

9.1.3 Products and Services

9.1.4 Financial Analysis

10. Plant Based Meat Market Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Plant Based Meat Market is estimated to generate USD 10.2 billion in revenue in 2025.

The Global Plant Based Meat Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 17.9% during the forecast period from 2025 to 2034.

The Plant Based Meat Market is estimated to reach USD 45 billion by 2034.

$2900- 30%

$4350- 40%

$5800- 50%

$2150- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!