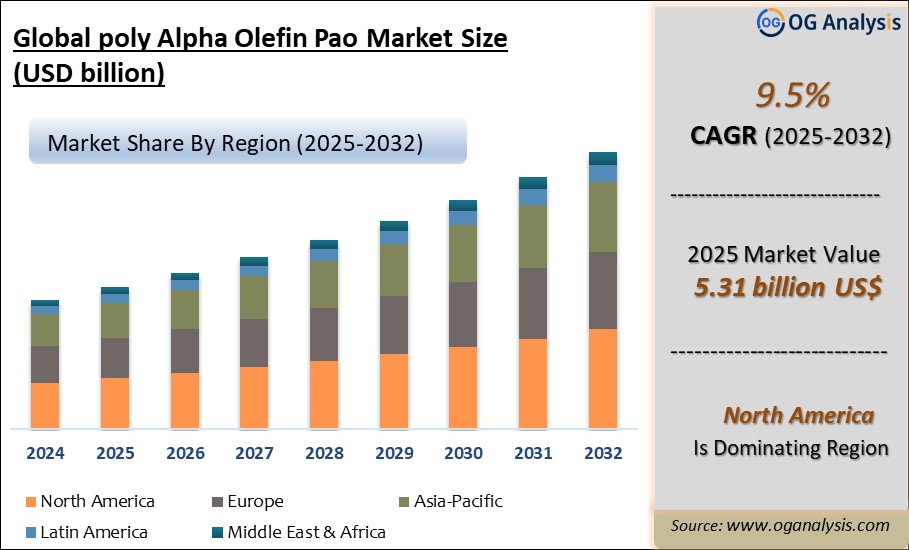

"The Global Poly Alpha Olefin (PAO) Market is valued at USD 5.31 billion in 2025. Worldwide sales of Poly Alpha Olefin (PAO) Market are expected to grow at a significant CAGR of 9.5%, reaching USD 10.1 billion by the end of the forecast period in 2032."

The Poly Alpha Olefin (PAO) market is experiencing notable growth, driven by increasing demand for high-performance lubricants across various industries. PAOs are synthetic hydrocarbons known for their superior thermal stability, low volatility, and excellent viscosity performance, making them essential components in modern lubricants.

Trade Intelligence- Poly Alpha Olefin (PAO) market

| Global Polymers of propylene or of other olefins Trade, Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 2,887 | 3,744 | 3,756 | 3,394 | 3,345 |

| China | 609 | 846 | 719 | 648 | 726 |

| Germany | 262 | 337 | 370 | 319 | 278 |

| Belgium | 165 | 187 | 190 | 167 | 189 |

| United States of America | 154 | 173 | 216 | 143 | 186 |

| France | 190 | 227 | 234 | 215 | 176 |

|

| |||||

| Source: OGAnalysis | |||||

- China, Germany, Belgium, United States of America and France are the top five countries importing 46.5% of global Polymers of propylene or of other olefins in 2024

- China accounts for 21.7% of global Polymers of propylene or of other olefins trade in 2024

- Germany accounts for 8.3% of global Polymers of propylene or of other olefins trade in 2024

- Belgium accounts for 5.7% of global Polymers of propylene or of other olefins trade in 2024

| Global Polymers of propylene or of other olefins Export Prices, USD/Ton, 2020-24 |

| |

| Source: OGAnalysis |

Key Market Insights:

- Companies are investing in research and development to enhance PAO production technologies, aiming to improve product performance and sustainability. Key industry players are forming partnerships to expand their market presence and leverage combined expertise in developing innovative PAO formulations.

- There is a growing emphasis on developing bio-based and biodegradable PAO products to meet environmental regulations and consumer preferences for eco-friendly lubricants.

- There's an increasing preference for synthetic lubricants over conventional mineral oils due to their superior performance characteristics, better thermal stability and longer service life.

- The rise of EVs is influencing PAO demand, as these vehicles require specialized lubricants for battery cooling and drivetrain efficiency.

- The expanding automotive sector, particularly in emerging economies, boosts demand for high-quality lubricants, thereby propelling the PAO market.

- Rapid industrial growth necessitates efficient machinery and equipment, increasing the need for PAO-based lubricants known for their high performance and durability.

Report Scope

| Parameter | Poly Alpha Olefin (PAO) market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Type, By Application, and By end user industry |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Poly Alpha Olefin (PAO) Market Segmentation

By Type

- Low Viscosity PAO

- Medium Viscosity PAO

- High Viscosity PAO

By Application

- Automotive Oils

- Industrial Lubricants

- Greases

- Other Applications

By End-Use Industry

- Automotive

- Industrial

- Aerospace

- Marine

- Military and Defense

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players Presented in the Report Include

ExxonMobil Chemical Company

INEOS Oligomers

Chevron Phillips Chemical Company LLC

LANXESS

NACO Corporation

Idemitsu Kosan Co., Ltd.

RB Products, Inc.

Shenyang HCPAO

Dowpol Corporation

Sasol

Recent Developments

- Chevron Phillips Chemical and INEOS expanded PAO production capacity, with both investing in new or enlarged facilities to meet growing global demand for synthetic lubricant base oils.

- ExxonMobil and other major producers remain focused on refining PAO formulations with enhanced thermal stability and oxidation resistance, targeting high-performance applications in automotive and industrial sectors.

- Leading companies such as SK Global Chemical, Borealis, Lotte Chemical, SABIC, and TotalEnergies are expanding their global footprint through strategic partnerships and investments to secure growth in regional markets.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Poly Alpha Olefin (PAO) Market Latest Trends, Drivers and Challenges, 2024- 2032

2.1 Poly Alpha Olefin (PAO) Market Overview

2.2 Market Strategies of Leading Poly Alpha Olefin (PAO) Companies

2.3 Poly Alpha Olefin (PAO) Market Insights, 2024- 2032

2.3.1 Leading Poly Alpha Olefin (PAO) Types, 2024- 2032

2.3.2 Leading Poly Alpha Olefin (PAO) End-User industries, 2024- 2032

2.3.3 Fast-growing countries for Poly Alpha Olefin (PAO) sales, 2024- 2032

2.4 Poly Alpha Olefin (PAO) Market Drivers and Restraints

2.4.1 Poly Alpha Olefin (PAO) Demand Drivers to 2032

2.4.2 Poly Alpha Olefin (PAO) Challenges to 2032

2.5 Poly Alpha Olefin (PAO) Market- Five Forces Analysis

2.5.1 Poly Alpha Olefin (PAO) Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Poly Alpha Olefin (PAO) Market Value, Market Share, and Forecast to 2032

3.1 Global Poly Alpha Olefin (PAO) Market Overview, 2024

3.2 Global Poly Alpha Olefin (PAO) Market Revenue and Forecast, 2024- 2032 (US$ Million)

3.3 Global Poly Alpha Olefin (PAO) Market Size and Share Outlook By Type, 2024- 2032

3.3.1 Low Viscosity PAO

3.3.2 Medium Viscosity PAO

3.3.3 High Viscosity PAO

3.4 Global Poly Alpha Olefin (PAO) Market Size and Share Outlook By Application, 2024- 2032

3.4.1 Automotive Oils

3.4.2 Industrial Lubricants

3.4.3 Greases

3.4.4 Other Applications

3.5 Global Poly Alpha Olefin (PAO) Market Size and Share Outlook By End-Use Industry, 2024- 2032

3.5.1 Automotive

3.5.2 Industrial

3.5.3 Aerospace

3.5.4 Marine

3.5.5 Military and Defense

3.6 Global Poly Alpha Olefin (PAO) Market Size and Share Outlook 0, 2024- 2032

3.7 Global Poly Alpha Olefin (PAO) Market Size and Share Outlook by Region, 2024- 2032

4. Asia Pacific Poly Alpha Olefin (PAO) Market Value, Market Share and Forecast to 2032

4.1 Asia Pacific Poly Alpha Olefin (PAO) Market Overview, 2024

4.2 Asia Pacific Poly Alpha Olefin (PAO) Market Revenue and Forecast, 2024- 2032 (US$ Million)

4.3 Asia Pacific Poly Alpha Olefin (PAO) Market Size and Share Outlook By Type, 2024- 2032

4.4 Asia Pacific Poly Alpha Olefin (PAO) Market Size and Share Outlook By Application, 2024- 2032

4.5 Asia Pacific Poly Alpha Olefin (PAO) Market Size and Share Outlook By End-Use Industry, 2024- 2032

4.6 Asia Pacific Poly Alpha Olefin (PAO) Market Size and Share Outlook 0, 2024- 2032

4.7 Asia Pacific Poly Alpha Olefin (PAO) Market Size and Share Outlook by Country, 2024- 2032

4.8 Key Companies in Asia Pacific Poly Alpha Olefin (PAO) Market

5. Europe Poly Alpha Olefin (PAO) Market Value, Market Share, and Forecast to 2032

5.1 Europe Poly Alpha Olefin (PAO) Market Overview, 2024

5.2 Europe Poly Alpha Olefin (PAO) Market Revenue and Forecast, 2024- 2032 (US$ Million)

5.3 Europe Poly Alpha Olefin (PAO) Market Size and Share Outlook By Type, 2024- 2032

5.4 Europe Poly Alpha Olefin (PAO) Market Size and Share Outlook By Application, 2024- 2032

5.5 Europe Poly Alpha Olefin (PAO) Market Size and Share Outlook By End-Use Industry, 2024- 2032

5.6 Europe Poly Alpha Olefin (PAO) Market Size and Share Outlook 0, 2024- 2032

5.7 Europe Poly Alpha Olefin (PAO) Market Size and Share Outlook by Country, 2024- 2032

5.8 Key Companies in Europe Poly Alpha Olefin (PAO) Market

6. North America Poly Alpha Olefin (PAO) Market Value, Market Share and Forecast to 2032

6.1 North America Poly Alpha Olefin (PAO) Market Overview, 2024

6.2 North America Poly Alpha Olefin (PAO) Market Revenue and Forecast, 2024- 2032 (US$ Million)

6.3 North America Poly Alpha Olefin (PAO) Market Size and Share Outlook By Type, 2024- 2032

6.4 North America Poly Alpha Olefin (PAO) Market Size and Share Outlook By Application, 2024- 2032

6.5 North America Poly Alpha Olefin (PAO) Market Size and Share Outlook By End-Use Industry, 2024- 2032

6.6 North America Poly Alpha Olefin (PAO) Market Size and Share Outlook 0, 2024- 2032

6.7 North America Poly Alpha Olefin (PAO) Market Size and Share Outlook by Country, 2024- 2032

6.8 Key Companies in North America Poly Alpha Olefin (PAO) Market

7. South and Central America Poly Alpha Olefin (PAO) Market Value, Market Share and Forecast to 2032

7.1 South and Central America Poly Alpha Olefin (PAO) Market Overview, 2024

7.2 South and Central America Poly Alpha Olefin (PAO) Market Revenue and Forecast, 2024- 2032 (US$ Million)

7.3 South and Central America Poly Alpha Olefin (PAO) Market Size and Share Outlook By Type, 2024- 2032

7.4 South and Central America Poly Alpha Olefin (PAO) Market Size and Share Outlook By Application, 2024- 2032

7.5 South and Central America Poly Alpha Olefin (PAO) Market Size and Share Outlook By End-Use Industry, 2024- 2032

7.6 South and Central America Poly Alpha Olefin (PAO) Market Size and Share Outlook 0, 2024- 2032

7.7 South and Central America Poly Alpha Olefin (PAO) Market Size and Share Outlook by Country, 2024- 2032

7.8 Key Companies in South and Central America Poly Alpha Olefin (PAO) Market

8. Middle East Africa Poly Alpha Olefin (PAO) Market Value, Market Share and Forecast to 2032

8.1 Middle East Africa Poly Alpha Olefin (PAO) Market Overview, 2024

8.2 Middle East and Africa Poly Alpha Olefin (PAO) Market Revenue and Forecast, 2024- 2032 (US$ Million)

8.3 Middle East Africa Poly Alpha Olefin (PAO) Market Size and Share Outlook By Type, 2024- 2032

8.4 Middle East Africa Poly Alpha Olefin (PAO) Market Size and Share Outlook By Application, 2024- 2032

8.5 Middle East Africa Poly Alpha Olefin (PAO) Market Size and Share Outlook By End-Use Industry, 2024- 2032

8.6 Middle East Africa Poly Alpha Olefin (PAO) Market Size and Share Outlook 0, 2024- 2032

8.7 Middle East Africa Poly Alpha Olefin (PAO) Market Size and Share Outlook by Country, 2024- 2032

8.8 Key Companies in Middle East Africa Poly Alpha Olefin (PAO) Market

9. Poly Alpha Olefin (PAO) Market Structure

9.1 Key Players

9.2 Poly Alpha Olefin (PAO) Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Poly Alpha Olefin (PAO) Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!