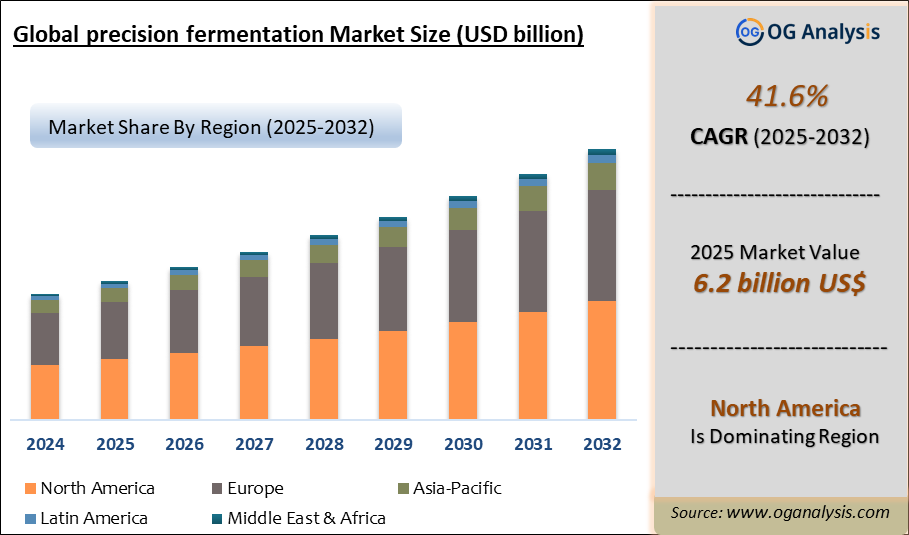

""The Precision Fermentation Market valued at $ 4.4 Billion in 2024, is expected to grow by 41.6% CAGR to reach market size worth $ 145.6 Billion by 2034.""

Precision fermentation is revolutionizing the global biotechnology sector, with significant advancements in 2024 positioning the market for considerable growth in the near future. This cutting-edge technology uses microbes to produce specific compounds and ingredients, offering industries the ability to scale sustainable alternatives to traditional animal-based or chemically synthesized products. Industries ranging from food and beverage to pharmaceuticals are leveraging precision fermentation to create cleaner, more efficient production methods. This shift aligns with global trends focusing on sustainability, efficiency, and improved consumer health outcomes.

In 2024, precision fermentation made headlines with technological breakthroughs that pushed the boundaries of ingredient customization, producing novel proteins, enzymes, and bio-based materials. These developments signaled the onset of a larger movement in 2025, where precision fermentation is expected to penetrate deeper into industries such as cosmetics, biofuels, and textiles. With increasing consumer awareness and pressure to reduce environmental impacts, companies are rapidly adopting precision fermentation technologies to meet both regulatory requirements and evolving consumer demands.

The Global Precision Fermentation Market Analysis Report will provide a comprehensive assessment of business dynamics, offering detailed insights into how companies can navigate the evolving landscape to maximize their market potential through 2034. This analysis will be crucial for stakeholders aiming to align with the latest industry trends and capitalize on emerging market opportunities.

North America is the leading region in the precision fermentation market, propelled by robust biotechnology infrastructure, significant investments in food-tech startups, and a supportive regulatory environment that fosters innovation in sustainable and animal-free food production. The dairy alternatives segment is the dominating segment in the precision fermentation market, driven by increasing consumer demand for sustainable and animal-free dairy products, advancements in fermentation technologies enabling the production of dairy-identical proteins like whey and casein, and the growing popularity of plant-based diets.

Key Insights Of Precision Fermentation Market

-

Transition from niche innovation to scaling alternative proteins

Precision fermentation has moved from lab-scale proof-of-concept into pilot and early commercial scale, especially for food proteins and specialty ingredients. Historic work focused on enzymes and vitamins; today, the emphasis is on animal-free dairy, egg and heme proteins. This evolution is reshaping the narrative from “experimental tech” to a viable pillar of the alternative protein industry. -

Dairy and egg proteins remain the flagship product categories

Animal-free whey, casein and egg white proteins are the most advanced and visible precision-fermentation outputs in food. These proteins offer near-identical functionality to their animal-derived counterparts, enabling realistic cheese, ice cream, yogurts and bakery products. Their success has created the template for B2B ingredient business models and co-branding with consumer-facing food manufacturers. -

Broadening portfolio into fats, specialty ingredients and hybrids

Beyond proteins, precision fermentation is increasingly used to produce lipids, flavor compounds, sweeteners, vitamins and colorants. These high-value ingredients improve texture, stability and sensory performance of plant-based or hybrid meat and dairy analogues. As portfolios diversify, suppliers can de-risk reliance on a single hero molecule and serve multiple end-use categories. -

Technological progress in strain engineering and bioprocess design

Advances in synthetic biology, genome editing, metabolic pathway optimization and AI-supported strain design are improving yields and productivity. Modular bioreactors, continuous fermentation and improved downstream processing are gradually lowering production costs. Over the medium term, these technology gains are critical for approaching price parity with conventional animal ingredients. -

Sustainability and resource efficiency as strategic demand drivers

Precision fermentation enables production of proteins and ingredients with significantly lower land, water and greenhouse gas footprints compared to traditional livestock. Brands and retailers view these ingredients as tools to meet climate targets, deforestation commitments and ESG expectations. This sustainability narrative is a core differentiator in winning partnerships with global CPGs and foodservice players. -

Regulatory pathways and novel food approvals shape go-to-market speed

Regulatory clarity for precision-fermented ingredients is improving but remains uneven across regions. Jurisdictions with defined novel food frameworks and clear guidance on GMO/non-GMO classification are attracting early launches and investment. Over the forecast period, faster and more predictable approvals will be a critical factor determining regional leadership and timing of scale-up. -

B2B ingredient model and strategic partnerships drive commercialization

Most precision fermentation companies operate as B2B suppliers, partnering with established dairy, bakery, beverage and meat alternative brands. Long-term supply agreements, co-development pipelines and joint marketing help de-risk capex-heavy capacity build-out. As capacity grows, we see a shift from small premium launches to integration in mainstream SKUs across retail and foodservice. -

Cost of goods, feedstock strategy and capacity build-out remain constraints

Fermentation feedstocks (sugars, agricultural side streams) and energy costs heavily influence unit economics. Companies are experimenting with cheaper carbon sources, side-stream valorization and regional co-location with sugar or starch processing hubs. However, large-scale stainless-steel capacity and downstream infrastructure still require substantial capital, slowing the pace at which products can reach mass-market price points. -

Geographic clustering and ecosystem development accelerate innovation

Innovation hubs in North America, Europe, Israel and parts of Asia-Pacific combine startups, biofoundries, CDMOs, universities and investors. These ecosystems provide access to shared infrastructure, talent and regulatory expertise, shortening development timelines. Over time, regional specialization is emerging—for example, some hubs focusing on dairy proteins, others on fats, flavors or non-food applications. -

Future expansion into non-food sectors and new application domains

While food and beverage is the current focal market, precision fermentation is expanding into pet nutrition, cosmetics, biopharmaceuticals, biomaterials and specialty chemicals. Multifunctional ingredients that deliver nutrition, performance and sustainability will gain traction across these sectors. This cross-industry opportunity underpins long-term growth prospects and supports continued investment in platform technologies.

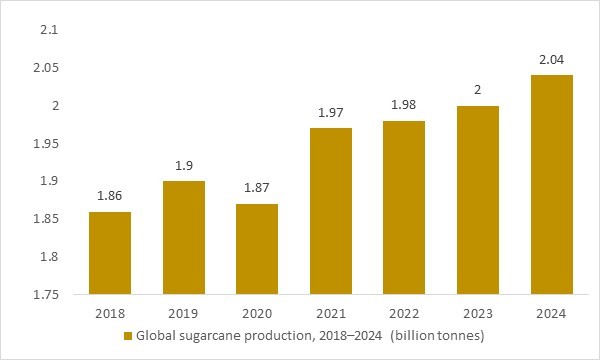

Global sugarcane production, 2018–2024 (billion tonnes)

Figure: Global sugarcane production – a key source of sucrose and molasses used as carbon feedstock in industrial fermentation – increased from around 1.9 billion tonnes in 2019 to just over 2.0 billion tonnes by 2023, with further growth expected in 2024. This large and expanding sugar base underpins the scalability of precision fermentation, lowering feedstock risk for producers of alternative proteins, bio-based fats, specialty enzymes and functional ingredients. OG Analysis estimates, aligned with international crop statistics and agricultural outlooks, highlight how upstream carbohydrate availability supports long-term growth in the precision fermentation market.

Global sugarcane output – a proxy for fermentable sugar feedstock – expanded from about 1.9 billion tonnes in 2019 to roughly 2.0 billion tonnes in 2023, with OG Analysis projecting it to exceed 2.0 billion tonnes in 2024. Sugarcane, together with sugar beet, underpins the world’s supply of sucrose and molasses that are refined into glucose syrups used as the main carbon source in industrial fermentation. As the sugarcane base grows and sugar supply remains abundant, precision-fermentation players benefit from a large, scalable pool of low-cost carbohydrate feedstock, enabling the transition from pilot to commercial-scale production of alternative proteins, bio-based fats, specialty enzymes and functional ingredients.

North America Precision Fermentation Market Analysis

The North America Precision Fermentation market experienced notable developments in 2024, driven by rising consumer demand for premium, health-focused, and convenience-oriented products. Growth was further supported by innovations in product formulations and packaging, alongside increasing investments in advanced processing technologies. Anticipated growth from 2025 is underpinned by the region's robust distribution networks, a surge in plant-based alternatives, and growing awareness of sustainable production practices. The competitive landscape remains dynamic, with key players focusing on product diversification, strategic partnerships, and direct-to-consumer sales channels to capitalize on evolving consumer preferences. Regulatory advancements favoring clean-label and traceable sourcing also provide a strong growth foundation, positioning North America as a leading market for Precision Fermentation innovation.

Europe Precision Fermentation Market Outlook

In 2024, the Europe Precision Fermentation market demonstrated steady progress, buoyed by heightened interest in organic and eco-friendly offerings, alongside a growing preference for locally sourced ingredients. Anticipated growth from 2025 is supported by the increasing adoption of plant-based diets, government policies encouraging sustainable food systems, and advancements in manufacturing capabilities. The competitive landscape in Europe is marked by extensive R&D initiatives and collaborations between leading players and retailers to meet stringent quality standards and consumer expectations. Key market drivers include innovative packaging solutions, the popularity of premium segments, and rising e-commerce penetration, shaping a resilient and adaptive market environment.

Asia-Pacific Precision Fermentation Market Forecast

The Asia-Pacific Precision Fermentation market witnessed accelerated growth in 2024, spurred by urbanization, expanding middle-class demographics, and a shift toward convenient and functional foods. From 2025 onward, growth is expected to thrive on increasing disposable incomes, greater consumer awareness of health benefits, and the rapid expansion of online retail platforms. The competitive landscape is characterized by significant investments in regional production facilities and targeted marketing campaigns tailored to diverse consumer preferences. The adoption of advanced technologies, such as AI-driven personalization and blockchain-enabled supply chain transparency, is driving market differentiation and fostering trust among consumers.

Middle East, Africa, Latin America Precision Fermentation Market Overview

In 2024, the Middle East, Africa, Latin America Precision Fermentation market exhibited growth fueled by the increasing penetration of Western dietary trends, coupled with the growing influence of local cuisine innovations. Expected growth from 2025 is anchored in expanding infrastructure for food processing and distribution, as well as a rising focus on affordability and nutritional value. The competitive landscape highlights the strategic entry of global players through joint ventures and localized product offerings to cater to region-specific tastes and regulatory requirements. Sustainability initiatives and efforts to reduce food waste are becoming key differentiators, reinforcing the market's potential for long-term growth.

Market Scope

| Parameter | Precision fermentation Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Precision Fermentation Ingredients Market Segmentation

By Ingredient Type

- Whey & Casein Protein

- Egg White

- Collagen Protein

- Heme Protein

- Enzymes

- Others

By Microbe Type

- Yeast

- Algae

- Fungi

- Bacteria

By Application

- Meat & Seafood Alternatives

- Dairy Alternatives

- Egg Alternatives

- Others

By End-User

- Food & Beverage Industry

- Pharmaceutical Industry

- Cosmetics & Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Precision Fermentation Companies

- Geltor

- Perday Day Inc

- The Every Co.

- Impossible Foods Inc.

- Motif FoodWorks Inc.

- Formo

- Eden Brew

- Mycorena

- Change Foods

- MycoTechnology

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Global Precision Fermentation Market Review, 2024

2.1 Precision Fermentation Industry Overview

2.2 Research Methodology

3. Precision Fermentation Market Insights

3.1 Precision Fermentation Market Trends to 2034

3.2 Future Opportunities in Precision Fermentation Market

3.3 Dominant Applications of Precision Fermentation, 2024 Vs 2034

3.4 Key Types of Precision Fermentation, 2024 Vs 2034

3.5 Leading End Uses of Precision Fermentation Market, 2024 Vs 2034

3.6 High Prospect Countries for Precision Fermentation Market, 2024 Vs 2034

4. Precision Fermentation Market Trends, Drivers, and Restraints

4.1 Latest Trends and Recent Developments in Precision Fermentation Market

4.2 Key Factors Driving the Precision Fermentation Market Growth

4.2 Major Challenges to the Precision Fermentation industry, 2025- 2034

4.3 Impact of Wars and geo-political tensions on Precision Fermentation supply chain

5 Five Forces Analysis for Global Precision Fermentation Market

5.1 Precision Fermentation Industry Attractiveness Index, 2024

5.2 Precision Fermentation Market Threat of New Entrants

5.3 Precision Fermentation Market Bargaining Power of Suppliers

5.4 Precision Fermentation Market Bargaining Power of Buyers

5.5 Precision Fermentation Market Intensity of Competitive Rivalry

5.6 Precision Fermentation Market Threat of Substitutes

6. Global Precision Fermentation Market Data – Industry Size, Share, and Outlook

6.1 Precision Fermentation Market Annual Sales Outlook, 2025- 2034 ($ Million)

6.1 Global Precision Fermentation Market Annual Sales Outlook by Type, 2025- 2034 ($ Million)

6.2 Global Precision Fermentation Market Annual Sales Outlook by Application, 2025- 2034 ($ Million)

6.3 Global Precision Fermentation Market Annual Sales Outlook by End-User, 2025- 2034 ($ Million)

6.4 Global Precision Fermentation Market Annual Sales Outlook by Region, 2025- 2034 ($ Million)

7. Asia Pacific Precision Fermentation Industry Statistics – Market Size, Share, Competition and Outlook

7.1 Asia Pacific Market Insights, 2024

7.2 Asia Pacific Precision Fermentation Market Revenue Forecast by Type, 2025- 2034 (USD Million)

7.3 Asia Pacific Precision Fermentation Market Revenue Forecast by Application, 2025- 2034(USD Million)

7.4 Asia Pacific Precision Fermentation Market Revenue Forecast by End-User, 2025- 2034 (USD Million)

7.5 Asia Pacific Precision Fermentation Market Revenue Forecast by Country, 2025- 2034 (USD Million)

7.5.1 China Precision Fermentation Analysis and Forecast to 2034

7.5.2 Japan Precision Fermentation Analysis and Forecast to 2034

7.5.3 India Precision Fermentation Analysis and Forecast to 2034

7.5.4 South Korea Precision Fermentation Analysis and Forecast to 2034

7.5.5 Australia Precision Fermentation Analysis and Forecast to 2034

7.5.6 Indonesia Precision Fermentation Analysis and Forecast to 2034

7.5.7 Malaysia Precision Fermentation Analysis and Forecast to 2034

7.5.8 Vietnam Precision Fermentation Analysis and Forecast to 2034

7.6 Leading Companies in Asia Pacific Precision Fermentation Industry

8. Europe Precision Fermentation Market Historical Trends, Outlook, and Business Prospects

8.1 Europe Key Findings, 2024

8.2 Europe Precision Fermentation Market Size and Percentage Breakdown by Type, 2025- 2034 (USD Million)

8.3 Europe Precision Fermentation Market Size and Percentage Breakdown by Application, 2025- 2034 (USD Million)

8.4 Europe Precision Fermentation Market Size and Percentage Breakdown by End-User, 2025- 2034 (USD Million)

8.5 Europe Precision Fermentation Market Size and Percentage Breakdown by Country, 2025- 2034 (USD Million)

8.5.1 2024 Germany Precision Fermentation Market Size and Outlook to 2034

8.5.2 2024 United Kingdom Precision Fermentation Market Size and Outlook to 2034

8.5.3 2024 France Precision Fermentation Market Size and Outlook to 2034

8.5.4 2024 Italy Precision Fermentation Market Size and Outlook to 2034

8.5.5 2024 Spain Precision Fermentation Market Size and Outlook to 2034

8.5.6 2024 BeNeLux Precision Fermentation Market Size and Outlook to 2034

8.5.7 2024 Russia Precision Fermentation Market Size and Outlook to 2034

8.6 Leading Companies in Europe Precision Fermentation Industry

9. North America Precision Fermentation Market Trends, Outlook, and Growth Prospects

9.1 North America Snapshot, 2024

9.2 North America Precision Fermentation Market Analysis and Outlook by Type, 2025- 2034($ Million)

9.3 North America Precision Fermentation Market Analysis and Outlook by Application, 2025- 2034($ Million)

9.4 North America Precision Fermentation Market Analysis and Outlook by End-User, 2025- 2034($ Million)

9.5 North America Precision Fermentation Market Analysis and Outlook by Country, 2025- 2034($ Million)

9.5.1 United States Precision Fermentation Market Analysis and Outlook

9.5.2 Canada Precision Fermentation Market Analysis and Outlook

9.5.3 Mexico Precision Fermentation Market Analysis and Outlook

9.6 Leading Companies in North America Precision Fermentation Business

10. Latin America Precision Fermentation Market Drivers, Challenges, and Growth Prospects

10.1 Latin America Snapshot, 2024

10.2 Latin America Precision Fermentation Market Future by Type, 2025- 2034($ Million)

10.3 Latin America Precision Fermentation Market Future by Application, 2025- 2034($ Million)

10.4 Latin America Precision Fermentation Market Future by End-User, 2025- 2034($ Million)

10.5 Latin America Precision Fermentation Market Future by Country, 2025- 2034($ Million)

10.5.1 Brazil Precision Fermentation Market Analysis and Outlook to 2034

10.5.2 Argentina Precision Fermentation Market Analysis and Outlook to 2034

10.5.3 Chile Precision Fermentation Market Analysis and Outlook to 2034

10.6 Leading Companies in Latin America Precision Fermentation Industry

11. Middle East Africa Precision Fermentation Market Outlook and Growth Prospects

11.1 Middle East Africa Overview, 2024

11.2 Middle East Africa Precision Fermentation Market Statistics by Type, 2025- 2034 (USD Million)

11.3 Middle East Africa Precision Fermentation Market Statistics by Application, 2025- 2034 (USD Million)

11.4 Middle East Africa Precision Fermentation Market Statistics by End-User, 2025- 2034 (USD Million)

11.5 Middle East Africa Precision Fermentation Market Statistics by Country, 2025- 2034 (USD Million)

11.5.1 South Africa Precision Fermentation Market Outlook

11.5.2 Egypt Precision Fermentation Market Outlook

11.5.3 Saudi Arabia Precision Fermentation Market Outlook

11.5.4 Iran Precision Fermentation Market Outlook

11.5.5 UAE Precision Fermentation Market Outlook

11.6 Leading Companies in Middle East Africa Precision Fermentation Business

12. Precision Fermentation Market Structure and Competitive Landscape

12.1 Key Companies in Precision Fermentation Business

12.2 Precision Fermentation Key Player Benchmarking

12.3 Precision Fermentation Product Portfolio

12.4 Financial Analysis

12.5 SWOT and Financial Analysis Review

14. Latest News, Deals, and Developments in Precision Fermentation Market

14.1 Precision Fermentation trade export, import value and price analysis

15 Appendix

15.1 Publisher Expertise

15.2 Precision Fermentation Industry Report Sources and Methodology

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Precision Fermentation Market is estimated to reach USD 145.6 Billion by 2034.

The Global Precision Fermentation Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 41.6% during the forecast period from 2025 to 2034.

The Global Precision Fermentation Market is estimated to generate USD 6.2 Billion in revenue in 2025

$3950- 30%

$5850- 40%

$7850- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!