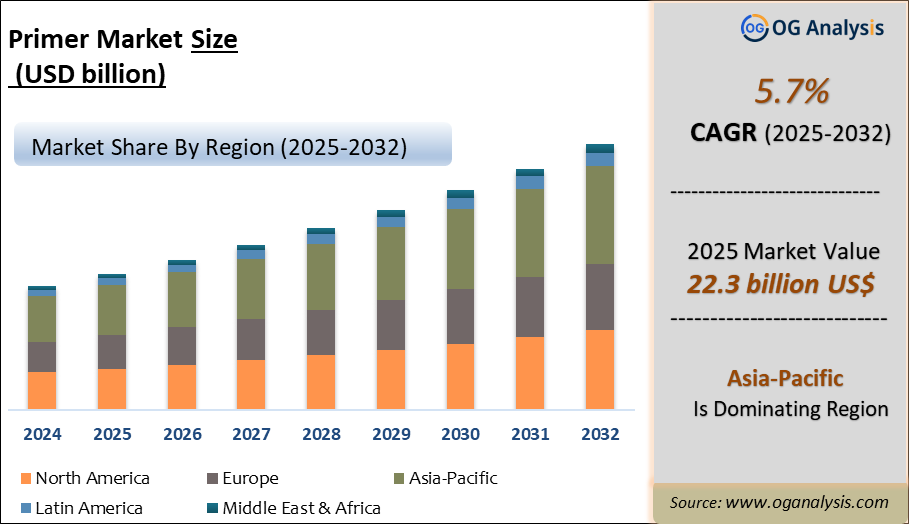

"The Global Primer Market Size was valued at USD 21.3 billion in 2024 and is projected to reach USD 22.3 billion in 2025. Worldwide sales of Primer are expected to grow at a significant CAGR of 5.7%, reaching USD 37.5 billion by the end of the forecast period in 2034."

The primer market, a critical segment of the global coatings and adhesives industry, encompasses products designed to enhance the adhesion between surfaces and the subsequent layers of paint or coating. Primers are essential in a variety of applications, including automotive, construction, and industrial sectors, where they improve surface preparation, corrosion resistance, and overall finish quality. The market has evolved significantly due to advancements in formulation technology and increased demand for environmentally friendly products. Innovations in primer formulations, such as water-based and low-VOC options, are driving growth and responding to stricter environmental regulations. The global primer market is projected to expand steadily as industries seek to improve performance and sustainability in their applications.

Geographically, the primer market demonstrates diverse growth patterns, influenced by regional construction booms, automotive industry expansions, and increasing infrastructure development. In North America and Europe, demand is driven by the need for high-performance primers in automotive and industrial applications, while the Asia-Pacific region experiences rapid growth due to burgeoning construction activities and rising consumer awareness of surface protection solutions. Key market players are focusing on strategic partnerships, mergers, and acquisitions to strengthen their market position and expand their product offerings. Overall, the primer market is positioned for continued growth, supported by technological advancements and increasing application areas.

Trade Intelligence for primer market

| Global Polyester-based paints & varnishes, non-aqueous, solvent solutions >50% by weight” Trade, Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 2,674 | 3,109 | 3,180 | 3,132 | 3,176 |

| Belgium | 123 | 141 | 145 | 182 | 204 |

| United States of America | 130 | 150 | 180 | 170 | 167 |

| Germany | 135 | 161 | 182 | 178 | 162 |

| Canada | 127 | 136 | 154 | 156 | 156 |

| France | 114 | 147 | 143 | 158 | 143 |

| Source: OGAnalysis, International Trade Centre (ITC) | |||||

- Belgium, United States of America, Germany, Canada and France are the top five countries importing 26.2% of global Polyester-based paints & varnishes, non-aqueous, solvent solutions >50% by weight” in 2024

- Global Polyester-based paints & varnishes, non-aqueous, solvent solutions >50% by weight” Imports increased by 18.8% between 2020 and 2024

- Belgium accounts for 6.4% of global Polyester-based paints & varnishes, non-aqueous, solvent solutions >50% by weight” trade in 2024

- United States of America accounts for 5.3% of global Polyester-based paints & varnishes, non-aqueous, solvent solutions >50% by weight” trade in 2024

- Germany accounts for 5.1% of global Polyester-based paints & varnishes, non-aqueous, solvent solutions >50% by weight” trade in 2024

| Global Polyester-based paints & varnishes, non-aqueous, solvent solutions >50% by weight” Export Prices, USD/Ton, 2020-24 |

|

|

| Source: OGAnalysis |

Latest Trends

One of the most significant trends in the primer market is the growing emphasis on eco-friendly and sustainable products. With increasing environmental awareness and regulatory pressure, manufacturers are developing primers with reduced volatile organic compounds (VOCs) and water-based formulations. These products not only minimize environmental impact but also meet stricter regulations set by various governments. The shift towards green technology is driving innovation in primer formulations, leading to the development of new products that offer superior performance while adhering to sustainability standards. This trend reflects a broader movement across industries toward environmentally responsible practices and products.

Another emerging trend is the integration of advanced technologies in primer applications. The use of nanotechnology and smart coatings is gaining traction, enhancing the performance and functionality of primers. Nanoparticle-based primers offer improved adhesion, durability, and resistance to environmental factors, making them ideal for demanding applications. Additionally, smart primers with self-healing properties or those that change color to indicate the need for maintenance are becoming more prevalent. These technological advancements are driving market growth by offering enhanced value and performance in various applications.

The rise in construction and renovation activities worldwide is also shaping the primer market. As urbanization accelerates and infrastructure projects expand, there is an increasing demand for high-quality primers that ensure long-lasting protection and finish. In particular, the residential and commercial construction sectors are significant contributors to market growth, with a focus on durable and efficient primer solutions. The demand for primers in these sectors is driven by the need for improved surface preparation and longevity, highlighting the critical role of primers in modern construction and renovation projects.

Drivers

Several key drivers are fueling the growth of the primer market. One primary driver is the rapid expansion of the construction and automotive industries, both of which heavily rely on primers for surface preparation and protection. As construction projects become more complex and automotive designs advance, the demand for high-performance primers that provide excellent adhesion, corrosion resistance, and durability is increasing. Additionally, the emphasis on enhancing aesthetic appeal and prolonging the lifespan of surfaces is driving the need for advanced primer solutions. The automotive sector, in particular, is seeing a surge in demand for specialized primers that meet stringent performance standards and environmental regulations.

Another significant driver is the technological advancements in primer formulations. Innovations such as the development of low-VOC and water-based primers are meeting the growing demand for environmentally friendly products. These advancements not only align with global sustainability trends but also offer improved performance characteristics, such as faster drying times and enhanced adhesion. Manufacturers are investing in research and development to create next-generation primers that offer superior properties and address the evolving needs of various industries, further driving market growth.

The increasing consumer awareness of maintenance and surface protection is also a crucial driver for the primer market. As individuals and businesses recognize the importance of maintaining and protecting surfaces, there is a growing demand for high-quality primers that ensure long-lasting results. This awareness is particularly evident in sectors such as residential construction, where homeowners seek durable and aesthetically pleasing finishes for their properties. The emphasis on surface protection and maintenance drives the adoption of advanced primer products, contributing to the overall growth of the market.

Market Challenges

Despite the positive outlook for the primer market, several challenges impact its growth and development. One major challenge is the fluctuating prices of raw materials used in primer formulations. The volatility in the prices of key ingredients such as resins, solvents, and pigments can affect production costs and pricing strategies. Manufacturers need to navigate these fluctuations while maintaining product quality and competitive pricing. Additionally, the increasing regulatory requirements related to environmental standards pose challenges for primer manufacturers. Compliance with stringent regulations on VOC emissions and hazardous substances requires significant investment in research and development, as well as adjustments in production processes.

Market Players

1. Akzo Nobel NV

2. Asian Paints

3. Axalta Coating Systems, LLC

4. BASF SE

5. Berger Paints India Limited

6. Hempel AS

7. Jotun

8. Kansai Paint Co. Ltd.

9. Masco Corporation

10. NIPSEA GROUP

11. PPG Industries Inc.

12. RPM International Inc.

13. The Sherwin-Williams Company

14. Tikkurila

Report Scope

| Parameter | primer market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By ingredient , By Application, By End-User |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

- By Ingredient

- Acrylic

- Epoxy

- Poly Vinyl Acetate

- Dispersant

- Biocides

- Surface Modifier

- Other

- By Application

- Concrete

- Wood

- Metal

- Plastic

- Others

- By End-user Industry

- Automotive

- Building and Construction

- Furniture

- Industrial

- Packaging

- Other End-user Industries

- By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Recent Developments

- PPG introduced its PRIMERON® powder primer series, highlighting enhanced adhesion, corrosion resistance, and eco-friendly features for industrial finishing applications.

- JSW Paints received regulatory clearance to acquire a majority stake in AkzoNobel India, strengthening its position in the coatings and primer market.

- AkzoNobel released a sustainability-focused white paper to help packaging and coatings customers navigate reporting standards, regulatory compliance, and emission-reduction strategies.

- AkzoNobel supplied advanced marine coatings, including protective and fouling-control primer layers, for the world’s first sail-assisted Aframax tanker to improve fuel efficiency.

- AkzoNobel launched a “sunscreen” coating system in China with a radiative-cooling topcoat and thermal barrier midcoat to reduce urban surface temperatures significantly.

- AkzoNobel introduced Sikkens Autowave Optima, a waterborne basecoat system that integrates primer functionality, cutting process times and material usage for refinish applications.

- AkzoNobel developed RUBBOL WF 3350, a waterborne wood coating with bio-based content, balancing sustainability with high performance in protective coatings.

- Sherwin-Williams adjusted its earnings outlook due to weaker-than-expected demand across primer and coatings markets in construction-related segments.

- Axalta launched its Fast Cure Low Energy clearcoat and surfacer system, which improves durability and simplifies handling in refinish and repair environments.

- PPG and other leading companies reported mixed financial results, with focus on driving margin improvements and innovation in primers and adjacent coating systems.

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Primer Market is estimated to generate USD 21.3 billion in revenue in 2024.

The Global Primer Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.7% during the forecast period from 2025 to 2032.

The Primer Market is estimated to reach USD 33.2 billion by 2032.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!