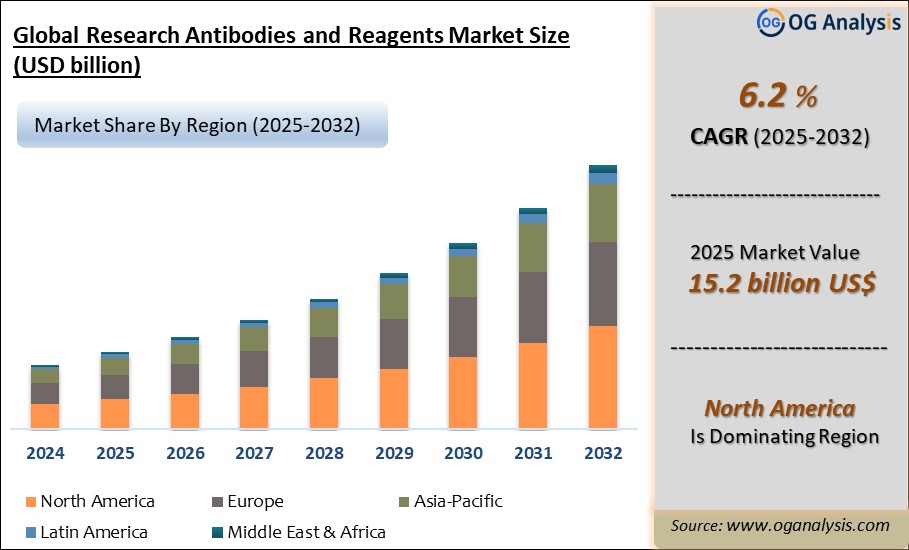

"The Global Research Antibodies and Reagents Market valued at USD 14.3 Billion in 2024, is expected to grow by 6.2% CAGR to reach market size worth USD 26.6 Billion by 2034."

The Research Antibodies and Reagents market plays a vital role in life sciences, biotechnology, and pharmaceutical R&D by enabling scientists to identify, isolate, and analyze proteins, cells, and other biomolecules. Antibodies and associated reagents are essential tools for immunoassays, flow cytometry, western blotting, immunohistochemistry, and drug discovery research. Market growth is being driven by increasing investment in biomedical and genomic research, rising demand for targeted therapeutics, and the global expansion of academic and commercial laboratories. Governments, universities, and private institutions continue to allocate significant funding for cancer, neurology, infectious diseases, and stem cell research—sectors where antibodies are critical. As personalized medicine gains momentum, antibodies are increasingly used to validate biomarkers, understand disease mechanisms, and support the development of companion diagnostics. The COVID-19 pandemic further boosted the use of antibodies in diagnostics, virology, and vaccine development, creating long-term opportunities in the research ecosystem.

The competitive landscape of the Research Antibodies and Reagents market is shaped by the presence of global life science leaders, niche biotech firms, and academic suppliers. Companies are focusing on product specificity, reproducibility, and validation standards to address concerns over inconsistent antibody performance. There is also a growing shift toward recombinant antibodies, monoclonal formats, and antibody panels designed for high-throughput applications. Strategic collaborations between biotech firms, academic institutions, and contract research organizations (CROs) are accelerating the co-development of specialized reagents and tools tailored to cutting-edge research. Additionally, the adoption of AI and machine learning in antibody design, and the development of custom antibody services, are enhancing discovery workflows and reducing development timelines. North America and Europe dominate the market due to their advanced research infrastructure, while Asia-Pacific is emerging rapidly with growing biotechnology investment and expansion of academic research. As R&D becomes more data-driven, and demand for high-quality, validated reagents continues to rise, the market is expected to maintain strong growth in the years ahead.

North America is the leading region in the Research Antibodies and Reagents Market, fueled by strong biomedical research funding, advanced healthcare infrastructure, and other key driving factors.

Research Antibodies and Reagents Market Strategy, Price Trends, Drivers, Challenges and Opportunities to 2034

-

The rise of precision medicine is significantly boosting the demand for high-specificity research antibodies. These antibodies are instrumental in identifying disease-related biomarkers, enabling targeted therapy development, and advancing diagnostic accuracy in areas like oncology, neurology, and metabolic disorders, where personalized treatment strategies are increasingly adopted by pharmaceutical and academic research institutions worldwide.

-

Recombinant and monoclonal antibodies are becoming the preferred formats due to their reproducibility, scalability, and high specificity. Unlike polyclonal antibodies, these formats offer consistent performance across experiments, making them essential tools in clinical research, drug development, and standardized assay platforms, particularly where data accuracy and repeatability are critical.

-

Academic institutions and government-funded research programs remain major drivers of the research antibodies and reagents market. Universities and public health agencies are leveraging funding initiatives to study disease mechanisms, discover therapeutic targets, and support life sciences education, resulting in sustained demand for validated antibodies and experimental reagents.

-

Automation and high-throughput screening technologies in drug discovery are fueling the use of antibody panels and multiplex reagents. These tools are essential for rapidly analyzing multiple targets, reducing manual error, and enhancing data generation in time-sensitive and large-scale experiments across pharmaceutical and academic laboratories.

-

Concerns over inconsistent antibody performance have led suppliers to improve product validation and standardization. Leading manufacturers are now offering thoroughly tested antibodies with independent verification data, enabling researchers to select reliable reagents and improve confidence in experimental reproducibility and publication credibility.

-

Artificial intelligence and bioinformatics are revolutionizing antibody development by streamlining epitope mapping, predicting antigen-binding sites, and designing synthetic antibodies. These advances significantly reduce development time and enable custom antibody solutions for novel research areas, including rare diseases and complex protein interactions.

-

Growing interest in cell and gene therapy is increasing the demand for antibodies used in flow cytometry, immune profiling, and cell isolation. These applications require highly specific reagents to characterize stem cells, monitor immune response, and validate therapeutic delivery, especially in clinical-stage biotechnology programs.

-

Partnerships between biotech startups and antibody suppliers are accelerating innovation in reagent development. These collaborations often result in custom antibody kits tailored for emerging research areas such as neuroinflammation, microbiome interactions, and regenerative medicine, filling gaps in commercially available reagents.

-

The Asia-Pacific region is experiencing rapid growth in the research antibodies and reagents market due to expanding biotech investments, government funding programs, and the emergence of academic centers of excellence. Countries like China, India, and South Korea are driving regional demand for both standard and advanced antibody products.

-

The COVID-19 pandemic created a surge in demand for antibodies targeting viral antigens and immune markers. Even post-pandemic, this demand continues as researchers explore long-term immunity, vaccine effectiveness, and virus-host interactions using antibody-based assays in epidemiological and therapeutic research programs.

North America Research Antibodies and Reagents Market Analysis

The North American Research Antibodies and Reagents market experienced strong growth in 2024, fueled by advancements in biopharmaceutical research, integration of digital health technologies, and rising demand for precision medicine. Key areas such as healthcare cloud platforms, IoT-enabled medical devices, and advanced wound care witnessed accelerated adoption, supported by favorable regulatory policies and a growing emphasis on next-generation therapeutic solutions. Looking ahead to 2025 and beyond, the market is projected to expand steadily, driven by increased investments in AI-powered diagnostics, mHealth applications, and real-world data platforms. Factors such as rising healthcare spending, a growing burden of chronic diseases, and a shift toward home-based care models continue to support long-term market growth. Additionally, innovation in active pharmaceutical ingredients (APIs), regenerative therapies, and genomic technologies is shaping market dynamics. The region's leadership in healthcare innovation is further demonstrated by the growing use of track-and-trace systems and advancements in preimplantation genetic testing, all contributing to a more data-driven and personalized approach to medicine.

Europe Research Antibodies and Reagents Market Outlook

The European healthcare and pharmaceuticals market experienced consistent growth in 2024, driven by the region’s strong commitment to sustainability, cutting-edge therapeutics, and digital innovation. Increased focus on biopharmaceuticals—particularly antibody-based treatments and regenerative medicine—has been complemented by rising investments in healthcare simulation, remote patient monitoring, and precision diagnostics. The Research Antibodies and Reagents market is expected to gain momentum in 2025, with sustained growth through 2034 supported by ongoing EU healthcare reforms, expanding applications of proteomics and single-cell analysis, and growing implementation of healthcare cloud solutions and sterilization technologies. The rising demand for advanced diagnostic and therapeutic tools is further underpinned by government-funded R&D programs and the expanding elderly population. Europe’s leadership in clinical trial modernization, together with the growing use of IoT-enabled medical devices and the prioritization of mental health screening, continues to strengthen the region’s position as a global hub for healthcare innovation.

Asia-Pacific Healthcare & Pharmaceuticals Market

The Asia-Pacific healthcare and pharmaceuticals market is poised for robust growth, driven by rapid advancements in biotechnology, the expansion of digital healthcare ecosystems, and increased investment in healthcare infrastructure. Leading economies such as China and India are playing a pivotal role, fueling demand for mHealth platforms, biopreservation solutions, and smart medical technologies. The Research Antibodies and Reagents market is expected to witness the fastest growth globally from 2025 to 2034, propelled by improved healthcare access, demographic expansion, and a rising incidence of chronic diseases. The region is also embracing data-centric healthcare through the adoption of laboratory information systems (LIS), real-world evidence platforms, and advanced diagnostics like sepsis testing. Additionally, strategic collaborations in the biopharmaceutical processing equipment and consumables space, coupled with increasing interest in 3D cell culture and amniotic membrane technologies, are reinforcing Asia-Pacific’s emergence as a center for healthcare innovation and next-generation therapeutics.

Middle East, Africa, Latin America Research Antibodies and Reagents Market Overview

The Rest of the World Research Antibodies and Reagents market registering moderate growth in 2024, is driven by increasing healthcare initiatives in emerging markets and growing interest in telemedicine and at-home testing solutions. Investments in anesthesia drugs, animal health, and anti-counterfeit pharmaceuticals packaging are gaining traction, particularly in Latin America, Africa, and the Middle East. From 2025 through 2034, the market is expected to witness accelerated growth, fueled by expanding healthcare infrastructure and rising awareness of advanced healthcare solutions. Markets for remote patient monitoring, rehabilitation equipment, and radiation dose management systems are emerging as key areas of focus. Growth in these regions is supported by a rising middle-class population, greater healthcare access, and enhanced pharmaceutical supply chain capabilities. The adoption of smart medical devices and clinical trial innovations also underscores the evolving healthcare landscape in the Middle East, Africa, Latin America regions.

Research Antibodies and Reagents Market Dynamics and Future Analytics

The research analyses the Research Antibodies and Reagents parent market, derived market, intermediaries’ market, raw material market, and substitute market are all evaluated to better prospect the Research Antibodies and Reagents market outlook. Geopolitical analysis, demographic analysis, and Porter’s five forces analysis are prudently assessed to estimate the best Research Antibodies and Reagents market projections.

Recent deals and developments are considered for their potential impact on Research Antibodies and Reagents's future business. Other metrics analyzed include the Threat of New Entrants, Threat of New Substitutes, Product Differentiation, Degree of Competition, Number of Suppliers, Distribution Channel, Capital Needed, Entry Barriers, Govt. Regulations, Beneficial Alternative, and Cost of Substitute in Research Antibodies and Reagents market.

Research Antibodies and Reagents trade and price analysis helps comprehend Research Antibodies and Reagents's international market scenario with top exporters/suppliers and top importers/customer information. The data and analysis assist our clients in planning procurement, identifying potential vendors/clients to associate with, understanding Research Antibodies and Reagents price trends and patterns, and exploring new Research Antibodies and Reagents sales channels. The research will be updated to the latest month to include the impact of the latest developments such as the Russia-Ukraine war on the Research Antibodies and Reagents market.

Research Antibodies and Reagents Market Structure, Competitive Intelligence and Key Winning Strategies

The report presents detailed profiles of top companies operating in the Research Antibodies and Reagents market and players serving the Research Antibodies and Reagents value chain along with their strategies for the near, medium, and long term period.

OGAnalysis’ proprietary company revenue and product analysis model unveils the Research Antibodies and Reagents market structure and competitive landscape. Company profiles of key players with a business description, product portfolio, SWOT analysis, Financial Analysis, and key strategies are covered in the report. It identifies top-performing Research Antibodies and Reagents products in global and regional markets. New Product Launches, Investment & Funding updates, Mergers & Acquisitions, Collaboration & Partnership, Awards and Agreements, Expansion, and other developments give our clients the Research Antibodies and Reagents market update to stay ahead of the competition.

Company offerings in different segments across Asia-Pacific, Europe, the Middle East, Africa, and South and Central America are presented to better understand the company strategy for the Research Antibodies and Reagents market. The competition analysis enables users to assess competitor strategies and helps align their capabilities and resources for future growth prospects to improve their market share.

Research Antibodies and Reagents Market Research Scope

• Global Research Antibodies and Reagents market size and growth projections (CAGR), 2024- 2034

• Policies of USA New President Trump, Russia-Ukraine War, Israel-Palestine, Middle East Tensions Impact on the Research Antibodies and Reagents Trade and Supply-chain

• Research Antibodies and Reagents market size, share, and outlook across 5 regions and 27 countries, 2023- 2034

• Research Antibodies and Reagents market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2023- 2034

• Short and long-term Research Antibodies and Reagents market trends, drivers, restraints, and opportunities

• Porter’s Five Forces analysis, Technological developments in the Research Antibodies and Reagents market, Research Antibodies and Reagents supply chain analysis

• Research Antibodies and Reagents trade analysis, Research Antibodies and Reagents market price analysis, Research Antibodies and Reagents supply/demand

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products

• Latest Research Antibodies and Reagents market news and developments

The Research Antibodies and Reagents Market international scenario is well established in the report with separate chapters on North America Research Antibodies and Reagents Market, Europe Research Antibodies and Reagents Market, Asia-Pacific Research Antibodies and Reagents Market, Middle East and Africa Research Antibodies and Reagents Market, and South and Central America Research Antibodies and Reagents Markets. These sections further fragment the regional Research Antibodies and Reagents market by type, application, end-user, and country.

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, and By End User |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways

1. The report provides 2024 Research Antibodies and Reagents market sales data at the global, regional, and key country levels with a detailed outlook to 2034 allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Research Antibodies and Reagents market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Research Antibodies and Reagents market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Research Antibodies and Reagents business prospects by region, key countries, and top companies' information to channel their investments.

Available Customizations

The standard syndicate report is designed to serve the common interests of Research Antibodies and Reagents Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.

However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below –

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Research Antibodies and Reagents Pricing and Margins Across the Supply Chain, Research Antibodies and Reagents Price Analysis / International Trade Data / Import-Export Analysis,

Supply Chain Analysis, Supply – Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Research Antibodies and Reagents market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note Latest developments will be updated in the report and delivered within 2 to 3 working days

Market Segmentation

By Product:

Antibodies

Reagents

By Technology:

Western Blot

Flow Cytometry

ELISA

By Application:

Proteomics

Genomics

By End User:

Pharma

Biotech

CRO

By Geography

North America (USA, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

The Middle East and Africa (Middle East, Africa)

South and Central America (Brazil, Argentina, Rest of SCA)

List Of Companies

Abcam Plc.

Thermo Fischer Scientific, Inc.

Merck KGaA

F. Hoffmann-La Roche Ltd.

Bio-Rad laboratories, Inc.

Agilent Technologies, Inc.

Danaher corporation

Lonza Group Ltd.

Genscript Biotech Corporation

Recent Developments

-

July 2025 Fortis Life Sciences launched its Abcore VHH discovery and spatial biology platform, expanding its catalog of nanobody and spatial biology reagents across North America through a partnership with Avantor.

-

June 2025 AdipoGen Life Sciences introduced 25 µg trial-size antibody vials, offering researchers affordable, small-scale reagent options ideal for pilot experiments and assay development before full-scale deployment.

-

June 2025 Bio-Rad Laboratories expanded its portfolio of recombinant anti-idiotypic antibodies to include specificities for pertuzumab, canakinumab, belimumab, and emicizumab, along with a new Human IgM-Fc SpyCatcher reagent to enhance drug development.

-

June 2025 Ecolab Life Sciences launched Purolite AP+50, a 50-micron bead affinity resin aimed at improving monoclonal antibody purification by increasing dynamic binding capacity, operational consistency, and production efficiency.

-

June 2025 LOTTE BIOLOGICS signed a manufacturing agreement with Ottimo Pharma to produce the PD1/VEGFR2 dual-pathway antibody therapeutic Jankistomig at its Syracuse Bio Campus, strengthening its antibody drug contract manufacturing capabilities.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Global Research Antibodies and Reagents Market Review, 2024

2.1 Research Antibodies and Reagents Industry Overview

2.2 Research Methodology

3. Research Antibodies and Reagents Market Insights

3.1 Research Antibodies and Reagents Market Trends to 2034

3.2 Future Opportunities in Research Antibodies and Reagents Market

3.3 Dominant Applications of Research Antibodies and Reagents, 2024 Vs 2034

3.4 Key Types of Research Antibodies and Reagents, 2024 Vs 2034

3.5 Leading End Uses of Research Antibodies and Reagents Market, 2024 Vs 2034

3.6 High Prospect Countries for Research Antibodies and Reagents Market, 2024 Vs 2034

4. Research Antibodies and Reagents Market Trends, Drivers, and Restraints

4.1 Latest Trends and Recent Developments in Research Antibodies and Reagents Market

4.2 Key Factors Driving the Research Antibodies and Reagents Market Growth

4.2 Major Challenges to the Research Antibodies and Reagents industry, 2025- 2034

4.3 Impact of Wars and geo-political tensions on Research Antibodies and Reagents supply chain

5 Five Forces Analysis for Global Research Antibodies and Reagents Market

5.1 Research Antibodies and Reagents Industry Attractiveness Index, 2024

5.2 Research Antibodies and Reagents Market Threat of New Entrants

5.3 Research Antibodies and Reagents Market Bargaining Power of Suppliers

5.4 Research Antibodies and Reagents Market Bargaining Power of Buyers

5.5 Research Antibodies and Reagents Market Intensity of Competitive Rivalry

5.6 Research Antibodies and Reagents Market Threat of Substitutes

6. Global Research Antibodies and Reagents Market Data – Industry Size, Share, and Outlook

6.1 Research Antibodies and Reagents Market Annual Sales Outlook, 2025- 2034 ($ Million)

6.1 Global Research Antibodies and Reagents Market Annual Sales Outlook by Type, 2025- 2034 ($ Million)

6.2 Global Research Antibodies and Reagents Market Annual Sales Outlook by Application, 2025- 2034 ($ Million)

6.3 Global Research Antibodies and Reagents Market Annual Sales Outlook by End-User, 2025- 2034 ($ Million)

6.4 Global Research Antibodies and Reagents Market Annual Sales Outlook by Region, 2025- 2034 ($ Million)

7. Asia Pacific Research Antibodies and Reagents Industry Statistics – Market Size, Share, Competition and Outlook

7.1 Asia Pacific Market Insights, 2024

7.2 Asia Pacific Research Antibodies and Reagents Market Revenue Forecast by Type, 2025- 2034 (USD Million)

7.3 Asia Pacific Research Antibodies and Reagents Market Revenue Forecast by Application, 2025- 2034(USD Million)

7.4 Asia Pacific Research Antibodies and Reagents Market Revenue Forecast by End-User, 2025- 2034 (USD Million)

7.5 Asia Pacific Research Antibodies and Reagents Market Revenue Forecast by Country, 2025- 2034 (USD Million)

7.5.1 China Research Antibodies and Reagents Analysis and Forecast to 2034

7.5.2 Japan Research Antibodies and Reagents Analysis and Forecast to 2034

7.5.3 India Research Antibodies and Reagents Analysis and Forecast to 2034

7.5.4 South Korea Research Antibodies and Reagents Analysis and Forecast to 2034

7.5.5 Australia Research Antibodies and Reagents Analysis and Forecast to 2034

7.5.6 Indonesia Research Antibodies and Reagents Analysis and Forecast to 2034

7.5.7 Malaysia Research Antibodies and Reagents Analysis and Forecast to 2034

7.5.8 Vietnam Research Antibodies and Reagents Analysis and Forecast to 2034

7.6 Leading Companies in Asia Pacific Research Antibodies and Reagents Industry

8. Europe Research Antibodies and Reagents Market Historical Trends, Outlook, and Business Prospects

8.1 Europe Key Findings, 2024

8.2 Europe Research Antibodies and Reagents Market Size and Percentage Breakdown by Type, 2025- 2034 (USD Million)

8.3 Europe Research Antibodies and Reagents Market Size and Percentage Breakdown by Application, 2025- 2034 (USD Million)

8.4 Europe Research Antibodies and Reagents Market Size and Percentage Breakdown by End-User, 2025- 2034 (USD Million)

8.5 Europe Research Antibodies and Reagents Market Size and Percentage Breakdown by Country, 2025- 2034 (USD Million)

8.5.1 2024 Germany Research Antibodies and Reagents Market Size and Outlook to 2034

8.5.2 2024 United Kingdom Research Antibodies and Reagents Market Size and Outlook to 2034

8.5.3 2024 France Research Antibodies and Reagents Market Size and Outlook to 2034

8.5.4 2024 Italy Research Antibodies and Reagents Market Size and Outlook to 2034

8.5.5 2024 Spain Research Antibodies and Reagents Market Size and Outlook to 2034

8.5.6 2024 BeNeLux Research Antibodies and Reagents Market Size and Outlook to 2034

8.5.7 2024 Russia Research Antibodies and Reagents Market Size and Outlook to 2034

8.6 Leading Companies in Europe Research Antibodies and Reagents Industry

9. North America Research Antibodies and Reagents Market Trends, Outlook, and Growth Prospects

9.1 North America Snapshot, 2024

9.2 North America Research Antibodies and Reagents Market Analysis and Outlook by Type, 2025- 2034($ Million)

9.3 North America Research Antibodies and Reagents Market Analysis and Outlook by Application, 2025- 2034($ Million)

9.4 North America Research Antibodies and Reagents Market Analysis and Outlook by End-User, 2025- 2034($ Million)

9.5 North America Research Antibodies and Reagents Market Analysis and Outlook by Country, 2025- 2034($ Million)

9.5.1 United States Research Antibodies and Reagents Market Analysis and Outlook

9.5.2 Canada Research Antibodies and Reagents Market Analysis and Outlook

9.5.3 Mexico Research Antibodies and Reagents Market Analysis and Outlook

9.6 Leading Companies in North America Research Antibodies and Reagents Business

10. Latin America Research Antibodies and Reagents Market Drivers, Challenges, and Growth Prospects

10.1 Latin America Snapshot, 2024

10.2 Latin America Research Antibodies and Reagents Market Future by Type, 2025- 2034($ Million)

10.3 Latin America Research Antibodies and Reagents Market Future by Application, 2025- 2034($ Million)

10.4 Latin America Research Antibodies and Reagents Market Future by End-User, 2025- 2034($ Million)

10.5 Latin America Research Antibodies and Reagents Market Future by Country, 2025- 2034($ Million)

10.5.1 Brazil Research Antibodies and Reagents Market Analysis and Outlook to 2034

10.5.2 Argentina Research Antibodies and Reagents Market Analysis and Outlook to 2034

10.5.3 Chile Research Antibodies and Reagents Market Analysis and Outlook to 2034

10.6 Leading Companies in Latin America Research Antibodies and Reagents Industry

11. Middle East Africa Research Antibodies and Reagents Market Outlook and Growth Prospects

11.1 Middle East Africa Overview, 2024

11.2 Middle East Africa Research Antibodies and Reagents Market Statistics by Type, 2025- 2034 (USD Million)

11.3 Middle East Africa Research Antibodies and Reagents Market Statistics by Application, 2025- 2034 (USD Million)

11.4 Middle East Africa Research Antibodies and Reagents Market Statistics by End-User, 2025- 2034 (USD Million)

11.5 Middle East Africa Research Antibodies and Reagents Market Statistics by Country, 2025- 2034 (USD Million)

11.5.1 South Africa Research Antibodies and Reagents Market Outlook

11.5.2 Egypt Research Antibodies and Reagents Market Outlook

11.5.3 Saudi Arabia Research Antibodies and Reagents Market Outlook

11.5.4 Iran Research Antibodies and Reagents Market Outlook

11.5.5 UAE Research Antibodies and Reagents Market Outlook

11.6 Leading Companies in Middle East Africa Research Antibodies and Reagents Business

12. Research Antibodies and Reagents Market Structure and Competitive Landscape

12.1 Key Companies in Research Antibodies and Reagents Business

12.2 Research Antibodies and Reagents Key Player Benchmarking

12.3 Research Antibodies and Reagents Product Portfolio

12.4 Financial Analysis

12.5 SWOT and Financial Analysis Review

14. Latest News, Deals, and Developments in Research Antibodies and Reagents Market

14.1 Research Antibodies and Reagents trade export, import value and price analysis

15 Appendix

15.1 Publisher Expertise

15.2 Research Antibodies and Reagents Industry Report Sources and Methodology

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Research Antibodies and Reagents Market is estimated to generate USD 15.0 Billion in revenue in 2025

The Global Research Antibodies and Reagents Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% during the forecast period from 2025 to 2034.

The Research Antibodies and Reagents Market is estimated to reach USD 26.6 Billion by 2034.

$3950- 30%

$5850- 40%

$7850- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!