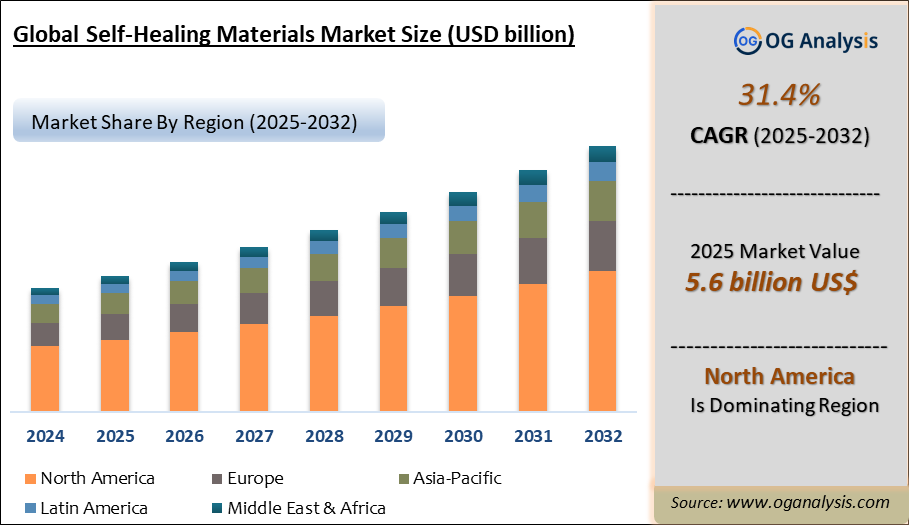

"The Global Self-Healing Materials Market valued at USD 4.3 Billion in 2024, is expected to grow by 31.4% CAGR to reach market size worth USD 66.6 Billion by 2034."

The self-healing materials market is emerging as a transformative segment within the advanced materials industry, driven by their ability to autonomously repair damages without external intervention, thereby extending product life and reducing maintenance costs. These materials include polymers, composites, coatings, and concrete that can repair micro-cracks and surface damages caused by mechanical stress, thermal fluctuations, or environmental exposure. Initially developed for aerospace and defense applications, self-healing materials are now gaining adoption across automotive, electronics, construction, and healthcare industries due to increasing demand for safety, durability, and sustainability. The market is supported by advancements in microencapsulation, vascular networks, and intrinsic self-healing chemistries that enable reliable healing performance in structural and functional applications. Rising focus on reducing lifecycle costs, enhancing structural integrity, and improving operational safety is propelling investments and commercial deployments in self-healing technologies globally.

In the coming years, market growth will be fueled by rapid infrastructure developments, stringent environmental regulations, and the push for lightweight, high-performance materials in automotive and aerospace sectors. Europe and North America lead in R&D investments and early commercial adoption, while Asia Pacific is witnessing growing interest due to expanding manufacturing capabilities and demand for durable consumer electronics. However, high material costs, scalability challenges, and the need for proven long-term performance remain key restraints for broader market penetration. Leading players are focusing on collaborative research with universities, patenting novel self-healing mechanisms, and piloting niche applications to demonstrate value. Additionally, innovations in bio-based self-healing materials are gaining traction as industries seek sustainable alternatives, positioning the self-healing materials market as a critical enabler for the next generation of smart, resilient products.

Polymer is the largest product segment in the self-healing materials market. Its dominance is driven by wide applicability in coatings, automotive components, electronics, and packaging due to versatile self-healing mechanisms such as microencapsulation and reversible chemistry. Polymers offer cost-effective integration, lightweight properties, and reliable healing performance, supporting their extensive use across industries globally.

Intrinsic form is the largest segment in the self-healing materials market. This is because intrinsic self-healing materials possess inherent reversible chemical bonds enabling autonomous repair without additional healing agents. Their simplicity in design, long-term reliability, and ability to maintain structural integrity under repeated damage make them highly preferred for advanced engineering and coating applications.

Trade Intelligence- self-healing materials market

| Global Chemical products and preparations Trade, Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 35,660 | 45,517 | 51,209 | 51,538 | 48,535 |

| China | 6,527 | 8,299 | 7,213 | 6,515 | 6,842 |

| United States of America | 4,302 | 4,215 | 6,300 | 7,856 | 6,245 |

| Germany | 2,446 | 2,901 | 2,983 | 2,843 | 2,829 |

| Hungary | 503 | 1,069 | 2,363 | 3,723 | 2,093 |

| Korea, Republic of | 1,713 | 1,886 | 1,819 | 1,694 | 1,698 |

|

| |||||

| Source: OGAnalysis | |||||

- China, United States of America, Germany, Hungary and Korea, Republic of are the top five countries importing 40.6% of global Chemical products and preparations in 2024

- China accounts for 14.1% of global Chemical products and preparations trade in 2024

- United States of America accounts for 12.9% of global Chemical products and preparations trade in 2024

- Germany accounts for 5.8% of global Chemical products and preparations trade in 2024

| Global Chemical products and preparations Export Prices, USD/Ton, 2020-24 |

| |

| Source: OGAnalysis |

Key Insights

- The self-healing materials market is driven by increasing demand for advanced materials with extended service life and minimal maintenance needs, particularly in sectors such as aerospace, automotive, and civil infrastructure. These materials help reduce operational downtime and maintenance costs while enhancing safety and reliability.

- Polymers and composites are the largest segments, widely adopted due to their ease of integration in coatings, structural parts, and consumer products. Their healing properties through microencapsulation and reversible chemistry mechanisms have proven effective in preventing crack propagation and structural failures.

- Europe and North America lead in market share, supported by robust R&D investments, stringent quality standards, and early adoption of smart materials in high-value industries. Countries like Germany, the US, and the UK have pioneered self-healing coatings and structural composites for industrial and defense applications.

- Asia Pacific is witnessing rapid growth in demand, driven by expanding automotive manufacturing, electronics production, and infrastructure development. China, Japan, and South Korea are investing in integrating self-healing technologies into automotive coatings and flexible electronic components to improve durability and consumer value.

- Concrete self-healing materials are gaining traction in the construction industry, with technologies such as bacterial and microcapsule-based healing additives addressing crack formation and water ingress, thus enhancing the lifespan and safety of buildings, bridges, and tunnels.

- High costs of self-healing material formulations and scalability challenges remain barriers to widespread adoption. Companies are investing in research to optimize formulations, reduce production costs, and ensure performance consistency under various operational conditions.

- Innovations in bio-based self-healing materials are emerging as a sustainable alternative, utilizing natural polymers and bio-inspired healing mechanisms to reduce environmental impact while maintaining effective healing properties in structural and coating applications.

- Leading companies are focusing on partnerships with research institutions and universities to accelerate technology commercialization, validate performance under real-life conditions, and secure intellectual property for competitive advantage in emerging application segments.

- The electronics industry is exploring self-healing materials for use in flexible displays, wearable devices, and energy storage systems. These materials can repair scratches or minor damages autonomously, thereby extending product life and enhancing consumer satisfaction.

- The competitive landscape is characterized by technology-driven differentiation, with players investing in proprietary self-healing chemistries, microvascular designs, and responsive coating formulations to cater to the evolving durability and performance needs of global industries.

Report Scope

| Parameter | self-healing materials market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Form, By End Use Industry |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Product:

Polymer

Concrete

Metal

Coating

Ceramic

others

By Form:

Intrinsic

Extrinsic

By End-use Industry

Transportation

Consumer Goods

Building & Construction

Energy Generation

Healthcare

Others

By Geography

North America (USA, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

The Middle East and Africa (Middle East, Africa)

South and Central America (Brazil, Argentina, Rest of SCA)

List Of Companies

Acciona S.A. (Spain)

AkzoNobel N.V. (Netherlands)

Applied Thin Films, Inc. (U.S.)

Arkema SA (France)

Autonomic Materials Inc. (U.S.)

Avecom N.V. (Belgium)

BASF SE (Germany)

Covestro AG (Germany)

E.I. Du Pont De Nemours and Company (U.S.)

Evonik Industries (Germany)

Sensor Coating Systems Ltd. (U.K.)

Slips Technologies, Inc. (U.S.)

What You Receive

• Global Selfhealing Materials market size and growth projections (CAGR), 2024- 2034

• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Selfhealing Materials.

• Selfhealing Materials market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Selfhealing Materials market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Selfhealing Materials market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Selfhealing Materials market, Selfhealing Materials supply chain analysis.

• Selfhealing Materials trade analysis, Selfhealing Materials market price analysis, Selfhealing Materials Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Selfhealing Materials market news and developments.

The Selfhealing Materials Market international scenario is well established in the report with separate chapters on North America Selfhealing Materials Market, Europe Selfhealing Materials Market, Asia-Pacific Selfhealing Materials Market, Middle East and Africa Selfhealing Materials Market, and South and Central America Selfhealing Materials Markets. These sections further fragment the regional Selfhealing Materials market by type, application, end-user, and country.

Recent Developments

- PPG Industries launched a next-generation self-healing automotive coating designed to reduce minor scratch repair needs and improve vehicle durability.

- IIT Bhilai researchers developed a room-temperature self-healing polymer that is impact-resistant and thermally stable, able to re-bond after cuts or scratches with little performance loss.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Global Self-Healing Materials Market Review, 2024

2.1 Self-Healing Materials Industry Overview

2.2 Research Methodology

3. Self-Healing Materials Market Insights

3.1 Self-Healing Materials Market Trends to 2034

3.2 Future Opportunities in Self-Healing Materials Market

3.3 Dominant Applications of Self-Healing Materials, 2024 Vs 2034

3.4 Key Types of Self-Healing Materials, 2024 Vs 2034

3.5 Leading End Uses of Self-Healing Materials Market, 2024 Vs 2034

3.6 High Prospect Countries for Self-Healing Materials Market, 2024 Vs 2034

4. Self-Healing Materials Market Trends, Drivers, and Restraints

4.1 Latest Trends and Recent Developments in Self-Healing Materials Market

4.2 Key Factors Driving the Self-Healing Materials Market Growth

4.2 Major Challenges to the Self-Healing Materials industry, 2025- 2034

4.3 Impact of Wars and geo-political tensions on Self-Healing Materials supply chain

5 Five Forces Analysis for Global Self-Healing Materials Market

5.1 Self-Healing Materials Industry Attractiveness Index, 2024

5.2 Self-Healing Materials Market Threat of New Entrants

5.3 Self-Healing Materials Market Bargaining Power of Suppliers

5.4 Self-Healing Materials Market Bargaining Power of Buyers

5.5 Self-Healing Materials Market Intensity of Competitive Rivalry

5.6 Self-Healing Materials Market Threat of Substitutes

6. Global Self-Healing Materials Market Data – Industry Size, Share, and Outlook

6.1 Self-Healing Materials Market Annual Sales Outlook, 2025- 2034 ($ Million)

6.1 Global Self-Healing Materials Market Annual Sales Outlook by Type, 2025- 2034 ($ Million)

6.2 Global Self-Healing Materials Market Annual Sales Outlook by Application, 2025- 2034 ($ Million)

6.3 Global Self-Healing Materials Market Annual Sales Outlook by End-User, 2025- 2034 ($ Million)

6.4 Global Self-Healing Materials Market Annual Sales Outlook by Region, 2025- 2034 ($ Million)

7. Asia Pacific Self-Healing Materials Industry Statistics – Market Size, Share, Competition and Outlook

7.1 Asia Pacific Market Insights, 2024

7.2 Asia Pacific Self-Healing Materials Market Revenue Forecast by Type, 2025- 2034 (USD Million)

7.3 Asia Pacific Self-Healing Materials Market Revenue Forecast by Application, 2025- 2034(USD Million)

7.4 Asia Pacific Self-Healing Materials Market Revenue Forecast by End-User, 2025- 2034 (USD Million)

7.5 Asia Pacific Self-Healing Materials Market Revenue Forecast by Country, 2025- 2034 (USD Million)

7.5.1 China Self-Healing Materials Analysis and Forecast to 2034

7.5.2 Japan Self-Healing Materials Analysis and Forecast to 2034

7.5.3 India Self-Healing Materials Analysis and Forecast to 2034

7.5.4 South Korea Self-Healing Materials Analysis and Forecast to 2034

7.5.5 Australia Self-Healing Materials Analysis and Forecast to 2034

7.5.6 Indonesia Self-Healing Materials Analysis and Forecast to 2034

7.5.7 Malaysia Self-Healing Materials Analysis and Forecast to 2034

7.5.8 Vietnam Self-Healing Materials Analysis and Forecast to 2034

7.6 Leading Companies in Asia Pacific Self-Healing Materials Industry

8. Europe Self-Healing Materials Market Historical Trends, Outlook, and Business Prospects

8.1 Europe Key Findings, 2024

8.2 Europe Self-Healing Materials Market Size and Percentage Breakdown by Type, 2025- 2034 (USD Million)

8.3 Europe Self-Healing Materials Market Size and Percentage Breakdown by Application, 2025- 2034 (USD Million)

8.4 Europe Self-Healing Materials Market Size and Percentage Breakdown by End-User, 2025- 2034 (USD Million)

8.5 Europe Self-Healing Materials Market Size and Percentage Breakdown by Country, 2025- 2034 (USD Million)

8.5.1 2024 Germany Self-Healing Materials Market Size and Outlook to 2034

8.5.2 2024 United Kingdom Self-Healing Materials Market Size and Outlook to 2034

8.5.3 2024 France Self-Healing Materials Market Size and Outlook to 2034

8.5.4 2024 Italy Self-Healing Materials Market Size and Outlook to 2034

8.5.5 2024 Spain Self-Healing Materials Market Size and Outlook to 2034

8.5.6 2024 BeNeLux Self-Healing Materials Market Size and Outlook to 2034

8.5.7 2024 Russia Self-Healing Materials Market Size and Outlook to 2034

8.6 Leading Companies in Europe Self-Healing Materials Industry

9. North America Self-Healing Materials Market Trends, Outlook, and Growth Prospects

9.1 North America Snapshot, 2024

9.2 North America Self-Healing Materials Market Analysis and Outlook by Type, 2025- 2034($ Million)

9.3 North America Self-Healing Materials Market Analysis and Outlook by Application, 2025- 2034($ Million)

9.4 North America Self-Healing Materials Market Analysis and Outlook by End-User, 2025- 2034($ Million)

9.5 North America Self-Healing Materials Market Analysis and Outlook by Country, 2025- 2034($ Million)

9.5.1 United States Self-Healing Materials Market Analysis and Outlook

9.5.2 Canada Self-Healing Materials Market Analysis and Outlook

9.5.3 Mexico Self-Healing Materials Market Analysis and Outlook

9.6 Leading Companies in North America Self-Healing Materials Business

10. Latin America Self-Healing Materials Market Drivers, Challenges, and Growth Prospects

10.1 Latin America Snapshot, 2024

10.2 Latin America Self-Healing Materials Market Future by Type, 2025- 2034($ Million)

10.3 Latin America Self-Healing Materials Market Future by Application, 2025- 2034($ Million)

10.4 Latin America Self-Healing Materials Market Future by End-User, 2025- 2034($ Million)

10.5 Latin America Self-Healing Materials Market Future by Country, 2025- 2034($ Million)

10.5.1 Brazil Self-Healing Materials Market Analysis and Outlook to 2034

10.5.2 Argentina Self-Healing Materials Market Analysis and Outlook to 2034

10.5.3 Chile Self-Healing Materials Market Analysis and Outlook to 2034

10.6 Leading Companies in Latin America Self-Healing Materials Industry

11. Middle East Africa Self-Healing Materials Market Outlook and Growth Prospects

11.1 Middle East Africa Overview, 2024

11.2 Middle East Africa Self-Healing Materials Market Statistics by Type, 2025- 2034 (USD Million)

11.3 Middle East Africa Self-Healing Materials Market Statistics by Application, 2025- 2034 (USD Million)

11.4 Middle East Africa Self-Healing Materials Market Statistics by End-User, 2025- 2034 (USD Million)

11.5 Middle East Africa Self-Healing Materials Market Statistics by Country, 2025- 2034 (USD Million)

11.5.1 South Africa Self-Healing Materials Market Outlook

11.5.2 Egypt Self-Healing Materials Market Outlook

11.5.3 Saudi Arabia Self-Healing Materials Market Outlook

11.5.4 Iran Self-Healing Materials Market Outlook

11.5.5 UAE Self-Healing Materials Market Outlook

11.6 Leading Companies in Middle East Africa Self-Healing Materials Business

12. Self-Healing Materials Market Structure and Competitive Landscape

12.1 Key Companies in Self-Healing Materials Business

12.2 Self-Healing Materials Key Player Benchmarking

12.3 Self-Healing Materials Product Portfolio

12.4 Financial Analysis

12.5 SWOT and Financial Analysis Review

14. Latest News, Deals, and Developments in Self-Healing Materials Market

14.1 Self-Healing Materials trade export, import value and price analysis

15 Appendix

15.1 Publisher Expertise

15.2 Self-Healing Materials Industry Report Sources and Methodology

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Self-Healing Materials Market is estimated to generate USD 5.5 Billion in revenue in 2025.

The Global Self-Healing Materials Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 31.4% during the forecast period from 2025 to 2034.

The Self-Healing Materials Market is estimated to reach USD 66.6 Billion by 2034.

$3950- 30%

$5850- 40%

$7850- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!