"The Software Defined Data Center Market was valued at $ 82.84 billion in 2025 and is projected to reach $ 396.64 billion by 2034, growing at a CAGR of 19.01%."

The Software Defined Data Center (SDDC) market represents a fundamental shift in enterprise IT infrastructure, where all core components compute, storage, networking, and security are virtualized, abstracted from physical hardware, and managed via intelligent software. SDDCs enable organizations to move away from rigid, hardware-dependent data center models toward agile, automated, and policy-driven architectures that improve scalability, flexibility, and efficiency. This transformation is closely tied to the rise of virtualization technologies, cloud computing, and orchestration platforms that support dynamic provisioning and seamless workload management across private, public, and hybrid environments. Enterprises are increasingly adopting SDDC frameworks to reduce operational complexity, improve disaster recovery capabilities, and support digital transformation goals. The demand is being fueled by industries such as banking, telecom, healthcare, and e-commerce, where agility, uptime, and real-time responsiveness are crucial. Organizations are turning to SDDC to create programmable infrastructure environments that allow for faster deployment, centralized control, and lower total cost of ownership.

As the SDDC market continues to evolve, emerging technologies such as AI-driven automation, intent-based networking, and zero-trust security models are being integrated to further enhance agility, resilience, and control. Enterprises are deploying SDDC platforms to support distributed workloads across edge, core, and cloud environments, making hybrid and multi-cloud architectures more seamless and efficient. The trend toward composable infrastructure is gaining traction, allowing businesses to assemble flexible, application-specific infrastructure stacks on demand. SDDCs are also becoming instrumental in supporting DevOps, containerized environments, and microservices by enabling infrastructure as code (IaC) and continuous delivery pipelines. Furthermore, sustainability has entered the conversation, with SDDC technologies offering improved energy efficiency through intelligent workload placement, capacity optimization, and dynamic resource allocation. As regulatory requirements tighten and business continuity becomes non-negotiable, enterprises are investing in SDDC solutions not only for cost reduction but also for strategic competitiveness. Vendors that provide open, interoperable platforms with robust APIs and security integration are positioned to lead in this increasingly software-defined era of data center management.

Key Market Insights

- The Software Defined Data Center market is gaining strong momentum as enterprises shift from hardware-centric infrastructure toward agile, software-defined environments that enhance automation, scalability, and centralized management across hybrid IT landscapes.

- Core components of SDDC including compute, storage, and networking are now virtualized and abstracted from physical hardware, allowing organizations to provision resources dynamically and adapt to changing workload demands in real time.

- Demand for SDDC is accelerating in sectors like finance, healthcare, and telecommunications where scalability, regulatory compliance, and business continuity are top priorities, making software-defined infrastructure a strategic enabler of digital transformation.

- Integration with AI and machine learning is advancing the SDDC market by enabling predictive analytics, intelligent workload orchestration, and proactive infrastructure management, leading to improved performance and operational efficiency.

- The rise of DevOps, containers, and microservices is fueling SDDC adoption, as software-defined infrastructure supports infrastructure as code (IaC) and continuous delivery pipelines essential for modern application development environments.

- Hybrid and multi-cloud deployments are pushing organizations to adopt SDDC frameworks that provide seamless interoperability, consistent policy enforcement, and unified control across on-premises and cloud-based environments.

- Composable infrastructure is emerging as a key trend within the SDDC space, allowing IT teams to disaggregate resources and dynamically compose custom configurations tailored to specific application workloads.

- Security is a growing focus within the SDDC market, with zero-trust architectures, micro-segmentation, and software-defined perimeters being integrated into virtualized environments to enhance data protection and regulatory compliance.

- Sustainability and energy efficiency are increasingly influencing purchasing decisions, as SDDC solutions offer intelligent resource allocation and workload consolidation features that help reduce power consumption and carbon footprint.

- Vendors that offer open, modular, and interoperable SDDC platforms with strong API ecosystems are gaining competitive advantage, as enterprises prioritize flexibility, vendor neutrality, and integration with existing IT investments.

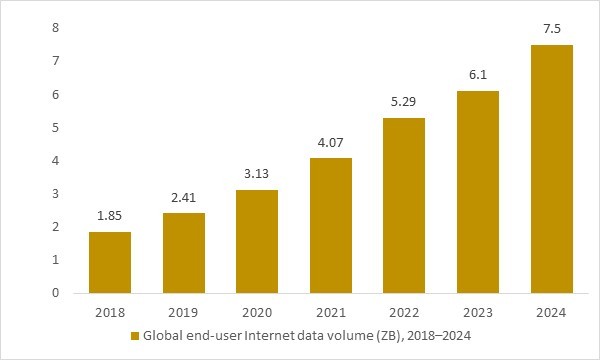

Global end-user Internet data volume (ZB), 2018–2024

Figure: Global end-user Internet data volume increased from an estimated 1.9 zettabytes in 2018 to around 7.5 zettabytes in 2024e, reflecting the rapid expansion of digital applications, cloud services, and data-intensive workloads worldwide. As enterprises, hyperscalers, and service providers handle growing volumes of data across fixed and mobile broadband networks, demand intensifies for scalable, automated, and software-driven infrastructure architectures. OG Analysis estimates, derived from ITU Internet data indicators and global digital infrastructure studies, illustrate how sustained growth in Internet data volumes reinforces long-term adoption of software-defined networking, storage virtualization, and orchestration platforms within modern software defined data centers.

- Global end-user Internet data volume expanded sharply from about 1.9 zettabytes in 2018 to an estimated 7.5 zettabytes in 2024e, highlighting the accelerating scale of digital workloads worldwide. This surge reflects rising adoption of cloud computing, data-intensive applications, and always-on connectivity across enterprises and consumers. Managing such growth efficiently requires highly virtualized, automated, and policy-driven infrastructure rather than rigid hardware-centric data centers. As a result, software defined data center architectures are increasingly adopted to deliver scalability, flexibility, and cost optimization in modern digital environments.

Regional Insights

North America Software Defined Data Center Market

The Software Defined Data Center market in North America is driven by widespread cloud adoption, mature virtualization infrastructure, and increasing demand for automated data center management. Enterprises across the region are integrating AI-driven orchestration, infrastructure as code, and software-defined storage and networking to improve agility and reduce operational complexity. The presence of major cloud providers and managed service operators further accelerates adoption, as businesses seek scalable platforms that support hybrid and multi-cloud strategies. With strong emphasis on cybersecurity, regulatory compliance, and real-time infrastructure management, vendors offering integrated, secure, and modular SDDC solutions are well-positioned to capture significant opportunities in this technologically advanced market.

Asia Pacific Software Defined Data Center Market

Asia Pacific is emerging as a high-growth region for the Software Defined Data Center market, fueled by rapid digital transformation, increasing enterprise IT modernization, and the expansion of cloud-native applications. Organizations in the region are adopting SDDC architectures to meet demands for flexibility, automation, and resource optimization across expanding digital infrastructure. The growth of edge computing, smart cities, and 5G deployments is also contributing to market momentum. Vendors providing cost-efficient, scalable, and localized SDDC platforms are gaining traction, especially among enterprises looking to streamline IT operations and deploy software-defined solutions that support hybrid workloads and regional compliance needs.

Europe Software Defined Data Center Market

In Europe, the Software Defined Data Center market is evolving steadily, supported by strong regulatory frameworks, sustainability goals, and a growing preference for modular and secure IT infrastructures. Enterprises are increasingly adopting SDDC platforms to reduce hardware dependency, enhance energy efficiency, and ensure compliance with regional data protection standards. Demand is particularly strong in sectors such as finance, healthcare, and government where agility and data sovereignty are critical. Companies offering software-defined solutions that support hybrid cloud environments, automated compliance monitoring, and green data center initiatives are well-positioned to succeed in this diverse and regulation-driven market landscape.

Report Scope

| Parameter | Software Defined Data Center Market Scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Software Defined Data Center Market Segments Covered In The Report

By Type

- Software Defined Computing (SDC)

- Software-Defined Storage (SDS)

- Software-Defined Data Center Networking (SDDCN)

- Automation and Orchestration

By Component

- Hardware

- Software

- Services

By Organization Size

- Small And Medium-Sized Enterprises (SMEs)

- Large enterprises

By Vertical

- Banking

- Financial Services And Insurance (BFSI)

- Information Technology (IT) And Telecom

- Government And Defense

- Healthcare

- Education

- Retail

- Manufacturing

- Others Verticals

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

VMware Inc., Microsoft Corporation, Hewlett Packard Enterprise Company, Dell Technologies Inc., Oracle Corporation, Cisco Systems Inc., Citrix Systems Inc., International Business Machines Corporation, SAP SE, Hitachi Ltd., Fujitsu Ltd., NEC Corporation, Juniper Networks Inc., Western Digital Corporation, Nutanix, Red Hat Inc., Huawei Technologies Co. Ltd., Lenovo Group Limited, NetApp Inc., Pure Storage Inc., Tintri Inc., DataCore Software, Scale Computing, Pivot, StratoScale, Coho Data Inc., Maxta Inc., Hedvig Inc., Diamanti Inc., Robin Systems Inc.

Recent Industry Developments

August 2025 – Apollo acquired a majority stake in Stream Data Centers to capitalize on the growing demand for AI-driven digital infrastructure. This move expands Apollo’s capacity to develop high-performance data center campuses tailored to hyperscaler requirements.

June 2025 – Cisco and NTT Data partnered to launch AI-powered software-defined infrastructure services, aimed at modernizing enterprise IT and data center architectures with enhanced automation and cost efficiency.

April 2025 – Dell Technologies introduced disaggregated, software-defined infrastructure innovations designed for AI-ready data centers—featuring shared compute, storage, and networking pools managed through software-driven automation.

June 2025 – Broadcom unveiled the Jericho 4 Ethernet fabric router, optimized to interconnect over one million processors across multiple data centers, meeting the growing bandwidth and low-latency demands of distributed AI workloads.

What You Receive

• Global Software Defined Data Center market size and growth projections (CAGR), 2024- 2034

• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Software Defined Data Center.

• Software Defined Data Center market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Software Defined Data Center market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Software Defined Data Center market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Software Defined Data Center market, Software Defined Data Center supply chain analysis.

• Software Defined Data Center trade analysis, Software Defined Data Center market price analysis, Software Defined Data Center Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Software Defined Data Center market news and developments.

The Software Defined Data Center Market international scenario is well established in the report with separate chapters on North America Software Defined Data Center Market, Europe Software Defined Data Center Market, Asia-Pacific Software Defined Data Center Market, Middle East and Africa Software Defined Data Center Market, and South and Central America Software Defined Data Center Markets. These sections further fragment the regional Software Defined Data Center market by type, application, end-user, and country.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Software Defined Data Center Market Latest Trends, Drivers and Challenges, 2024 - 2034

2.1 Software Defined Data Center Market Overview

2.2 Market Strategies of Leading Software Defined Data Center Companies

2.3 Software Defined Data Center Market Insights, 2024 - 2034

2.3.1 Leading Software Defined Data Center Types, 2024 - 2034

2.3.2 Leading Software Defined Data Center End-User industries, 2024 - 2034

2.3.3 Fast-Growing countries for Software Defined Data Center sales, 2024 - 2034

2.4 Software Defined Data Center Market Drivers and Restraints

2.4.1 Software Defined Data Center Demand Drivers to 2034

2.4.2 Software Defined Data Center Challenges to 2034

2.5 Software Defined Data Center Market- Five Forces Analysis

2.5.1 Software Defined Data Center Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Software Defined Data Center Market Value, Market Share, and Forecast to 2034

3.1 Global Software Defined Data Center Market Overview, 2024

3.2 Global Software Defined Data Center Market Revenue and Forecast, 2024 - 2034 (US$ billion)

3.3 Global Software Defined Data Center Market Size and Share Outlook By Type, 2024 - 2034

3.4 Global Software Defined Data Center Market Size and Share Outlook By Component, 2024 - 2034

3.5 Global Software Defined Data Center Market Size and Share Outlook By Organization Size, 2024 – 2034

3.6 Global Software Defined Data Center Market Size and Share Outlook By Vertical, 2024 - 2034

3.7 Global Software Defined Data Center Market Size and Share Outlook by Region, 2024 - 2034

4. Asia Pacific Software Defined Data Center Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Software Defined Data Center Market Overview, 2024

4.2 Asia Pacific Software Defined Data Center Market Revenue and Forecast, 2024 - 2034 (US$ billion)

4.3 Asia Pacific Software Defined Data Center Market Size and Share Outlook By Type, 2024 - 2034

4.4 Asia Pacific Software Defined Data Center Market Size and Share Outlook By Component, 2024 - 2034

4.5 Asia Pacific Software Defined Data Center Market Size and Share Outlook By Organization Size, 2024 – 2034

4.6 Asia Pacific Software Defined Data Center Market Size and Share Outlook By Vertical, 2024 - 2034

4.7 Asia Pacific Software Defined Data Center Market Size and Share Outlook by Country, 2024 - 2034

5. Europe Software Defined Data Center Market Value, Market Share, and Forecast to 2034

5.1 Europe Software Defined Data Center Market Overview, 2024

5.2 Europe Software Defined Data Center Market Revenue and Forecast, 2024 - 2034 (US$ billion)

5.3 Europe Software Defined Data Center Market Size and Share Outlook By Type, 2024 - 2034

5.4 Europe Software Defined Data Center Market Size and Share Outlook By Component, 2024 - 2034

5.5 Europe Software Defined Data Center Market Size and Share Outlook By Organization Size, 2024 – 2034

5.6 Europe Software Defined Data Center Market Size and Share Outlook By Vertical, 2024 - 2034

5.7 Europe Software Defined Data Center Market Size and Share Outlook by Country, 2024 - 2034

6. North America Software Defined Data Center Market Value, Market Share and Forecast to 2034

6.1 North America Software Defined Data Center Market Overview, 2024

6.2 North America Software Defined Data Center Market Revenue and Forecast, 2024 - 2034 (US$ billion)

6.3 North America Software Defined Data Center Market Size and Share Outlook By Type, 2024 - 2034

6.4 North America Software Defined Data Center Market Size and Share Outlook By Component, 2024 - 2034

6.5 North America Software Defined Data Center Market Size and Share Outlook By Organization Size, 2024 – 2034

6.6 North America Software Defined Data Center Market Size and Share Outlook By Vertical, 2024 - 2034

6.7 North America Software Defined Data Center Market Size and Share Outlook by Country, 2024 - 2034

7. South and Central America Software Defined Data Center Market Value, Market Share and Forecast to 2034

7.1 South and Central America Software Defined Data Center Market Overview, 2024

7.2 South and Central America Software Defined Data Center Market Revenue and Forecast, 2024 - 2034 (US$ billion)

7.3 South and Central America Software Defined Data Center Market Size and Share Outlook By Type, 2024 - 2034

7.4 South and Central America Software Defined Data Center Market Size and Share Outlook By Component, 2024 - 2034

7.5 South and Central America Software Defined Data Center Market Size and Share Outlook By Organization Size, 2024 – 2034

7.6 South and Central America Software Defined Data Center Market Size and Share Outlook By Vertical, 2024 - 2034

7.7 South and Central America Software Defined Data Center Market Size and Share Outlook by Country, 2024 - 2034

8. Middle East Africa Software Defined Data Center Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Software Defined Data Center Market Overview, 2024

8.2 Middle East and Africa Software Defined Data Center Market Revenue and Forecast, 2024 - 2034 (US$ billion)

8.3 Middle East Africa Software Defined Data Center Market Size and Share Outlook By Type, 2024 - 2034

8.4 Middle East Africa Software Defined Data Center Market Size and Share Outlook By Component, 2024 - 2034

8.5 Middle East Africa Software Defined Data Center Market Size and Share Outlook By Organization Size, 2024 – 2034

8.6 Middle East Africa Software Defined Data Center Market Size and Share Outlook By Vertical, 2024 - 2034

8.7 Middle East Africa Software Defined Data Center Market Size and Share Outlook by Country, 2024 - 2034

9. Software Defined Data Center Market Structure

9.1 Key Players

9.2 Software Defined Data Center Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Software Defined Data Center Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Software Defined Data Center Market is estimated to generate USD 82.84 billion in revenue in 2025.

The Global Software Defined Data Center Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 19.01% during the forecast period from 2025 to 2034.

The Software Defined Data Center Market is estimated to reach USD 396.64 billion by 2034.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!