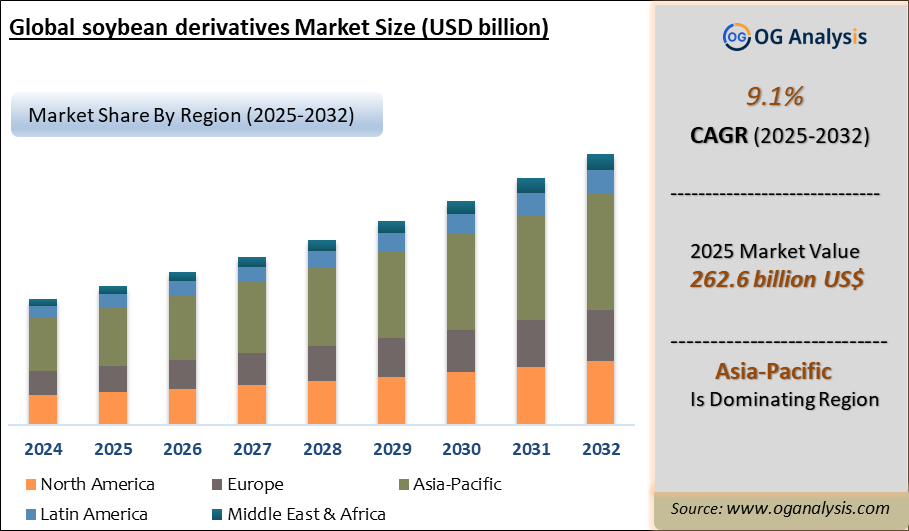

"Global Soybean Derivatives Market is valued at USD 262.6 billion in 2025. Further, the market is expected to grow at a CAGR of 9.1% to reach USD 576 billion by 2034."

The soybean derivatives market represents a vital segment of the global agriculture and food ingredients industry, encompassing a broad spectrum of products such as soybean oil, soybean meal, soy protein, soy lecithin, and soy isoflavones. These derivatives are widely used across food and beverage, animal feed, pharmaceutical, personal care, and industrial sectors. Soybean derivatives are valued not only for their nutritional benefits but also for their versatility, cost-effectiveness, and scalability in both developed and emerging economies. Soybean oil dominates edible oil consumption globally, while soybean meal is indispensable as a high-protein feedstock in poultry and livestock farming. The shift toward plant-based diets has further propelled demand for soy-based proteins and emulsifiers. Moreover, soy derivatives are integral to processed foods, functional beverages, bakery goods, and nutritional supplements. As sustainability and food security continue to influence agricultural trade and consumption patterns, soybean derivatives remain strategically important, especially in regions focused on improving nutritional accessibility and reducing reliance on animal-based inputs.

In 2024, the soybean derivatives market experienced moderate growth supported by stable global soybean production and evolving downstream demand. Soy protein concentrates and isolates gained traction in plant-based food innovations, particularly in Asia-Pacific and North America. Consumer packaged goods (CPG) companies expanded the use of soy lecithin in clean-label emulsifiers and nutraceutical formulations. In the animal feed sector, soybean meal remained the primary protein source, with feed manufacturers adopting enhanced processing techniques to improve digestibility and reduce anti-nutritional factors. Soybean oil saw increased usage in snack foods and sauces, although the edible oil segment faced price volatility due to climatic factors and shifting biodiesel policies. Meanwhile, non-GMO soy derivatives gained attention in premium markets, especially in Europe, driven by consumer preference for traceable and responsibly sourced ingredients. Industry players invested in supply chain traceability technologies, responding to heightened regulatory scrutiny around deforestation and land use in soybean-producing regions. These developments underscored the growing interplay between sustainability, consumer health trends, and industrial applications.

Looking forward to 2025 and beyond, the soybean derivatives market is expected to witness further diversification and technological integration. Innovations in enzyme-assisted processing and fermentation are poised to improve the functional properties and bioavailability of soy derivatives across food and pharma applications. As plant-based diets and flexitarian eating habits gain ground globally, demand for soy-based ingredients will expand in functional foods, sports nutrition, and meal replacements. Growth in animal protein production, especially in Latin America and Southeast Asia, will sustain high demand for soybean meal. Soy isoflavones and other bioactive compounds are projected to play a greater role in preventive health products, driven by aging populations and interest in hormone-balancing supplements. Furthermore, sustainability metrics will become central to procurement decisions, compelling producers to adopt regenerative farming practices and invest in low-carbon processing infrastructure. However, concerns over geopolitical trade dependencies and allergenicity of soy will continue to challenge market dynamics, prompting innovation in soy-alternative derivatives and broader transparency across the value chain.

Asia-Pacific is the leading region in the soybean derivatives market, propelled by rising demand for plant-based protein, expanding livestock feed consumption, and other key driving factors. Soybean meal is the dominating segment in the soybean derivatives market, fueled by its widespread use in animal feed, increasing global meat consumption, and other supportive market trends.

Key Trends in the Soybean Derivatives Market

- Growing use of soy lecithin as a clean-label emulsifier in bakery, confectionery, and health supplements is driving demand for non-GMO and allergen-friendly variants.

- Expansion of soy protein applications in sports nutrition and dairy alternatives is reshaping product portfolios across functional food and beverage categories.

- Increased focus on traceability and sustainable sourcing is encouraging investment in digital supply chain tools to monitor soybean cultivation and reduce environmental impacts.

- Soy isoflavones are gaining popularity in nutraceuticals for their antioxidant and hormone-balancing benefits, especially in products targeting menopausal and cardiovascular health.

- Biotechnological advancements are enabling the development of enzyme-treated and fermented soy derivatives with improved digestibility and flavor profiles for diverse consumer needs.

Key Drivers of the Soybean Derivatives Market

- Rising global protein demand in both food and feed sectors is fueling consistent consumption of soybean meal and soy protein derivatives across key markets.

- Shifts toward plant-based and flexitarian diets are accelerating the use of soy derivatives in meat alternatives, dairy-free products, and wellness foods.

- Economic efficiency and yield advantages of soybean cultivation make soy derivatives a preferred raw material for large-scale manufacturing in emerging markets.

- Regulatory support for bio-based and sustainable food ingredients is encouraging wider adoption of soy derivatives in eco-conscious and health-forward product formulations.

Key Challenge in the Soybean Derivatives Market

- Ongoing concerns around soy allergenicity and GMO labeling restrictions present hurdles in consumer acceptance, especially in sensitive markets, requiring manufacturers to enhance product education, transparency, and development of hypoallergenic or identity-preserved soy derivatives.

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Type, By Lecithin, By sales channel, By Application |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Type

- Soy Oil

- Soy Milk

- Soy meal

- Other Types

By Lecithin

- Water

- Acid

- Enzyme

By Sales Channel

- Departmental Stores

- Supermarkets

- Online Retail

- Other Channels

By Application

- Food And Beverages

- Feed Industry

- Others

- soy-based wood adhesives

- soy ink

- soy crayons

- soy-based lubricants and many more

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

- Bunge Ltd

- Archer Daniels Midland and Company

- Louis Dreyfus Commodities B.V.

- Cargill Incorporated

- Wilmar International Limited

- Noble Group Ltd.

- AG Processing Inc.

- Cenex Harvest States Inc.

- DuPont Nutrition and Health

- Ruchi Soya Industries Limited

- Gavyadhar Organic Private Limited

- Terra Firma Organic Private Limited

- Ingredion Incorporated

- Calbee Inc.

- Solbar Industries Ltd.

- SunOpta Inc.

- Scoular Company

- Ceres Global Ag Corp

- American Natural Processors Inc.

- Iowa Soybean Processors (ISP)

- The Scoular Company

- Batory Foods

- Fuerst Day Lawson Holdings Limited

- Fuji Vegetable Oil Inc.

- Pilgrim's Pride Corporation

- Sojaprotein

- Arizona Grain Inc.

- Jiangsu Hongda New Material Co. Ltd.

- Cosucra

- Vippy Industries Ltd. .

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Soybean Derivatives Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Soybean Derivatives Market Overview

2.2 Soybean Derivatives Market Developments

2.2.1 Soybean Derivatives Market -Supply Chain Disruptions

2.2.2 Soybean Derivatives Market -Direct/Indirect Impact of Tariff Changes and Trade Restrictions

2.2.3 Soybean Derivatives Market -Price Development

2.2.4 Soybean Derivatives Market -Regulatory and Compliance Management

2.2.5 Soybean Derivatives Market -Consumer Expectations and Trends

2.2.6 Soybean Derivatives Market -Market Structure and Competition

2.2.7 Soybean Derivatives Market -Technological Adaptation

2.2.8 Soybean Derivatives Market -Changing Retail Dynamics

2.3 Soybean Derivatives Market Insights, 2025- 2034

2.3.1 Prominent Soybean Derivatives Market product types, 2025- 2034

2.3.2 Leading Soybean Derivatives Market End-User markets, 2025- 2034

2.3.3 Fast-Growing countries for Soybean Derivatives Market sales, 2025- 2034

2.4 Soybean Derivatives Market Drivers and Restraints

2.4.1 Soybean Derivatives Market Demand Drivers to 2034

2.4.2 Soybean Derivatives Market Challenges to 2034

2.5 Soybean Derivatives Market- Five Forces Analysis

2.5.1 Soybean Derivatives Market Industry Attractiveness Index, 2025

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Soybean Derivatives Market Value, Market Share, and outlook to 2034

3.1 Global Soybean Derivatives Market Overview, 2025

3.2 Global Soybean Derivatives Market Revenue and Forecast, 2025- 2034 (US$ Million)

3.3 Global Soybean Derivatives Market Size and Share Outlook by Type, 2025- 2034

3.4 Global Soybean Derivatives Market Size and Share Outlook by End-User, 2025- 2034

3.5 Global Soybean Derivatives Market Size and Share Outlook by Region, 2025- 2034

4. Asia Pacific Soybean Derivatives Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Soybean Derivatives Market Overview, 2025

4.2 Asia Pacific Soybean Derivatives Market Revenue and Forecast, 2025- 2034 (US$ Million)

4.3 Asia Pacific Soybean Derivatives Market Size and Share Outlook by Type, 2025- 2034

4.4 Asia Pacific Soybean Derivatives Market Size and Share Outlook by End-User, 2025- 2034

4.5 Asia Pacific Soybean Derivatives Market Size and Share Outlook by Country, 2025- 2034

4.6 Key Companies in Asia Pacific Soybean Derivatives Market

5. Europe Soybean Derivatives Market Value, Market Share, and Forecast to 2034

5.1 Europe Soybean Derivatives Market Overview, 2025

5.2 Europe Soybean Derivatives Market Revenue and Forecast, 2025- 2034 (US$ Million)

5.3 Europe Soybean Derivatives Market Size and Share Outlook by Type, 2025- 2034

5.4 Europe Soybean Derivatives Market Size and Share Outlook by End-User, 2025- 2034

5.5 Europe Soybean Derivatives Market Size and Share Outlook by Country, 2025- 2034

5.6 Key Companies in Europe Soybean Derivatives Market

6. North America Soybean Derivatives Market Value, Market Share, and Forecast to 2034

6.1 North America Soybean Derivatives Market Overview, 2025

6.2 North America Soybean Derivatives Market Revenue and Forecast, 2025- 2034 (US$ Million)

6.3 North America Soybean Derivatives Market Size and Share Outlook by Type, 2025- 2034

6.4 North America Soybean Derivatives Market Size and Share Outlook by End-User, 2025- 2034

6.5 North America Soybean Derivatives Market Size and Share Outlook by Country, 2025- 2034

6.6 Key Companies in North America Soybean Derivatives Market

7. South and Central America Soybean Derivatives Market Value, Market Share, and Forecast to 2034

7.1 South and Central America Soybean Derivatives Market Overview, 2025

7.2 South and Central America Soybean Derivatives Market Revenue and Forecast, 2025- 2034 (US$ Million)

7.3 South and Central America Soybean Derivatives Market Size and Share Outlook by Type, 2025- 2034

7.4 South and Central America Soybean Derivatives Market Size and Share Outlook by End-User, 2025- 2034

7.5 South and Central America Soybean Derivatives Market Size and Share Outlook by Country, 2025- 2034

7.6 Key Companies in South and Central America Soybean Derivatives Market

8. Middle East Africa Soybean Derivatives Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Soybean Derivatives Market Overview, 2025

8.2 Middle East and Africa Soybean Derivatives Market Revenue and Forecast, 2025- 2034 (US$ Million)

8.3 Middle East Africa Soybean Derivatives Market Size and Share Outlook by Type, 2025- 2034

8.4 Middle East Africa Soybean Derivatives Market Size and Share Outlook by End-User, 2025- 2034

8.5 Middle East Africa Soybean Derivatives Market Size and Share Outlook by Country, 2025- 2034

8.6 Key Companies in Middle East Africa Soybean Derivatives Market

9. Soybean Derivatives Market Players Analysis

9.1 Soybean Derivatives Market Companies - Key Strategies and Financial Analysis

9.1.1 Snapshot

9.1.2 Business Description

9.1.3 Products and Services

9.1.4 Financial Analysis

10. Soybean Derivatives Market Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Soybean Derivatives Market is estimated to generate USD 262.6 billion in revenue in 2025.

The Global Soybean Derivatives Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.1% during the forecast period from 2025 to 2034.

The Soybean Derivatives Market is estimated to reach USD 576 billion by 2034.

$2900- 5%

$4350- 10%

$5800- 15%

$2150- 5%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!