"The Global Space Exploration Technologies Market Size is valued at $ 653.5 Billion in 2025. Worldwide sales of Space Exploration Technologies Market are expected to grow at a significant CAGR of 18.2%, reaching $ 2489 Billion by the end of the forecast period in 2034."

Space Exploration Technologies Market Report Description

The Space Exploration Technologies market represents one of the most exciting and rapidly developing sectors within the aerospace industry. With the advent of reusable rockets, advancements in satellite technology, and increasing private sector involvement, the space exploration market has expanded beyond governmental missions to include a myriad of commercial ventures. This market encompasses a wide range of activities and products, from launch services and spacecraft manufacturing to space tourism and satellite deployment. The rise of private companies like SpaceX, Blue Origin, and Rocket Lab has revolutionized space travel, significantly reducing the cost of access to space and opening up new possibilities for exploration and commercialization. Governments worldwide continue to invest heavily in space exploration for national security, scientific research, and economic benefits. The increased collaboration between public and private sectors has led to unprecedented innovation and progress. This comprehensive market research report provides an in-depth analysis of the current state of the Space Exploration Technologies market, including market dynamics, competitive landscape, and future growth prospects.

North America is the leading region in the Space Exploration Technologies Market, fueled by substantial government investments, robust private sector involvement, and a well-established space infrastructure supported by agencies like NASA and innovative companies such as SpaceX.

Space Exploration Technologies Market Latest Trends

One of the most notable trends in the Space Exploration Technologies market is the development and deployment of reusable rocket technology. Companies like SpaceX have pioneered this technology, dramatically reducing the cost of launching payloads into space. Reusable rockets not only make space travel more economical but also increase the frequency of missions. Another significant trend is the miniaturization of satellites, leading to the proliferation of small satellite constellations. These smallsats and cubesats are being deployed for various applications, including earth observation, communication, and scientific research. Additionally, space tourism is emerging as a viable market, with companies like Blue Origin and Virgin Galactic conducting successful test flights and preparing for commercial operations. The growth of space tourism is expected to make space more accessible to private individuals, further expanding the market.

Space Exploration Technologies Market Drivers

The growth of the Space Exploration Technologies market is driven by several key factors. Increasing governmental investments in space exploration are a primary driver, as nations seek to enhance their technological capabilities, national security, and scientific knowledge. The strategic importance of space for defense and intelligence purposes has led to substantial funding for space programs. In the commercial sector, the demand for satellite-based services, such as global communications, broadband internet, and earth observation, is fueling market growth. The private sector's involvement, spurred by reduced launch costs and technological advancements, is also a significant driver. Companies are investing in space technologies to explore new business opportunities, such as asteroid mining, in-space manufacturing, and space tourism. Moreover, international collaborations and partnerships are fostering innovation and accelerating the development of space technologies.

Space Exploration Technologies Market Challenges

Despite the promising growth prospects, the Space Exploration Technologies market faces several challenges. One of the primary challenges is the high cost and risk associated with space missions. Although reusable rockets have reduced launch costs, space exploration remains a capital-intensive endeavor. Another significant challenge is the regulatory environment, which varies significantly across different countries. Navigating the complex web of international regulations, export controls, and space treaties can be daunting for companies. Additionally, the technical challenges of operating in space, such as radiation exposure, microgravity effects, and the harsh space environment, pose significant hurdles. Ensuring the safety and reliability of space missions is paramount, requiring continuous innovation and rigorous testing. The potential for space debris and the need for sustainable space operations also present challenges that need to be addressed to ensure the long-term viability of space exploration activities.

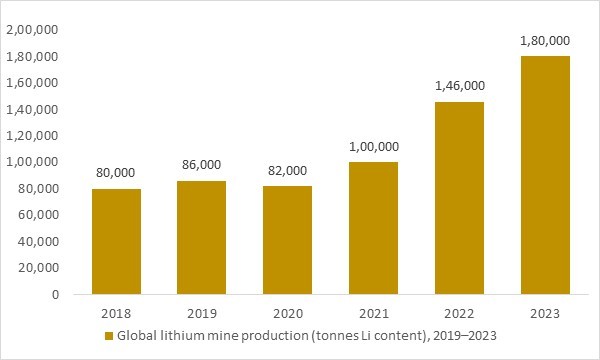

Global lithium mine production (tonnes Li content), 2019–2023

Figure: Global lithium mine production has more than doubled since 2019, reflecting rapid growth in battery materials supply. This expanding lithium base is critical for advanced space exploration technologies that rely on high-energy lithium-ion batteries in satellites, launch systems, rovers and deep-space missions.

- The development of space exploration technologies is increasingly tied to the availability of high-energy battery materials. Lithium, a critical input for lithium-ion batteries used in satellites, crewed spacecraft, rovers and ground segment power systems, has seen rapid growth in global mine output. According to the U.S. Geological Survey, world lithium mine production (excluding the United States) increased from roughly 86 thousand tons of lithium content in 2019 to around 180 thousand tons in 2023. This more than doubling of supply in just four years underscores the scale of upstream investment into battery materials, providing a broader industrial foundation for the next generation of all-electric satellites, deep-space missions and surface power systems that underpin the space exploration technologies market.

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Technology Type, By Application, By End use |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Technology Type

- Launch Vehicles

- Spacecraft

- Satellites

- Space Stations

By Application

- Communication

- Earth Observation

- Scientific Research

- Space Tourism

- National Security

By End User

- Government

- Commercial

- Research Organizations

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Major Players in the Space Exploration Technologies Market

1. SpaceX

2. Blue Origin

3. Rocket Lab

4. Northrop Grumman Corporation

5. Lockheed Martin Corporation

6. Boeing Defense, Space & Security

7. Airbus Defence and Space

8. Virgin Galactic

9. Sierra Nevada Corporation

10. Thales Alenia Space

11. Maxar Technologies

12. Relativity Space

13. Planet Labs

14. OneWeb

15. United Launch Alliance (ULA)

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Space Exploration Technologies Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Space Exploration Technologies Market Overview

2.2 Key Strategies of Leading Space Exploration Technologies Companies

2.3 Space Exploration Technologies Market Insights, 2024- 2034

2.3.1 Leading Space Exploration Technologies Types, 2024- 2034

2.3.2 Leading Space Exploration Technologies End-User industries, 2024- 2034

2.3.3 Fast-Growing countries for Space Exploration Technologies sales, 2024- 2034

2.4 Space Exploration Technologies Market Drivers and Restraints

2.4.1 Space Exploration Technologies Demand Drivers to 2034

2.4.2 Space Exploration Technologies Challenges to 2034

2.5 Space Exploration Technologies Market- Five Forces Analysis

2.5.1 Space Exploration Technologies Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Space Exploration Technologies Market Value, Market Share, and Forecast to 2034

3.1 Global Space Exploration Technologies Market Overview, 2024

3.2 Global Space Exploration Technologies Market Revenue and Forecast, 2024- 2034 (US$ Million)

3.3 Global Space Exploration Technologies Market Size and Share Outlook By Technology Type, 2024- 2034

3.3.1 Launch Vehicles

3.3.2 Spacecraft

3.3.3 Satellites

3.3.4 Space Stations

3.4 Global Space Exploration Technologies Market Size and Share Outlook By Application , 2024- 2034

3.4.1 Communication

3.4.2 Earth Observation

3.4.3 Scientific Research

3.4.4 Space Tourism

3.4.5 National Security

3.5 Global Space Exploration Technologies Market Size and Share Outlook By End User, 2024- 2034

3.5.1 Government

3.5.2 Commercial

3.5.3 Research Organizations

3.6 Global Space Exploration Technologies Market Size and Share Outlook by Region, 2024- 2034

4. Asia Pacific Space Exploration Technologies Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Space Exploration Technologies Market Overview, 2024

4.2 Asia Pacific Space Exploration Technologies Market Revenue and Forecast, 2024- 2034 (US$ Million)

4.3 Asia Pacific Space Exploration Technologies Market Size and Share Outlook By Technology Type, 2024- 2034

4.4 Asia Pacific Space Exploration Technologies Market Size and Share Outlook By Application , 2024- 2034

4.5 Asia Pacific Space Exploration Technologies Market Size and Share Outlook By End User, 2024- 2034

4.6 Asia Pacific Space Exploration Technologies Market Size and Share Outlook by Country, 2024- 2034

4.7 Key Companies in Asia Pacific Space Exploration Technologies Market

5. Europe Space Exploration Technologies Market Value, Market Share, and Forecast to 2034

5.1 Europe Space Exploration Technologies Market Overview, 2024

5.2 Europe Space Exploration Technologies Market Revenue and Forecast, 2024- 2034 (US$ Million)

5.3 Europe Space Exploration Technologies Market Size and Share Outlook By Technology Type, 2024- 2034

5.4 Europe Space Exploration Technologies Market Size and Share Outlook By Application , 2024- 2034

5.5 Europe Space Exploration Technologies Market Size and Share Outlook By End User, 2024- 2034

5.6 Europe Space Exploration Technologies Market Size and Share Outlook by Country, 2024- 2034

5.7 Key Companies in Europe Space Exploration Technologies Market

6. North America Space Exploration Technologies Market Value, Market Share and Forecast to 2034

6.1 North America Space Exploration Technologies Market Overview, 2024

6.2 North America Space Exploration Technologies Market Revenue and Forecast, 2024- 2034 (US$ Million)

6.3 North America Space Exploration Technologies Market Size and Share Outlook By Technology Type, 2024- 2034

6.4 North America Space Exploration Technologies Market Size and Share Outlook By Application , 2024- 2034

6.5 North America Space Exploration Technologies Market Size and Share Outlook By End User, 2024- 2034

6.6 North America Space Exploration Technologies Market Size and Share Outlook by Country, 2024- 2034

6.7 Key Companies in North America Space Exploration Technologies Market

7. South and Central America Space Exploration Technologies Market Value, Market Share and Forecast to 2034

7.1 South and Central America Space Exploration Technologies Market Overview, 2024

7.2 South and Central America Space Exploration Technologies Market Revenue and Forecast, 2024- 2034 (US$ Million)

7.3 South and Central America Space Exploration Technologies Market Size and Share Outlook By Technology Type, 2024- 2034

7.4 South and Central America Space Exploration Technologies Market Size and Share Outlook By Application , 2024- 2034

7.5 South and Central America Space Exploration Technologies Market Size and Share Outlook By End User, 2024- 2034

7.6 South and Central America Space Exploration Technologies Market Size and Share Outlook by Country, 2024- 2034

7.7 Key Companies in South and Central America Space Exploration Technologies Market

8. Middle East Africa Space Exploration Technologies Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Space Exploration Technologies Market Overview, 2024

8.2 Middle East and Africa Space Exploration Technologies Market Revenue and Forecast, 2024- 2034 (US$ Million)

8.3 Middle East Africa Space Exploration Technologies Market Size and Share Outlook By Technology Type, 2024- 2034

8.4 Middle East Africa Space Exploration Technologies Market Size and Share Outlook By Application , 2024- 2034

8.5 Middle East Africa Space Exploration Technologies Market Size and Share Outlook By End User, 2024- 2034

8.6 Middle East Africa Space Exploration Technologies Market Size and Share Outlook by Country, 2024- 2034

8.7 Key Companies in Middle East Africa Space Exploration Technologies Market

9. Space Exploration Technologies Market Structure

9.1 Key Players

9.2 Space Exploration Technologies Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Space Exploration Technologies Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Space Exploration Technologies Market is estimated to reach USD 2,489 Billion by 2034.

The Global Space Exploration Technologies Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 18.2% during the forecast period from 2025 to 2034.

The Global Space Exploration Technologies Market is estimated to generate USD 653.5 Billion in revenue in 2025.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!