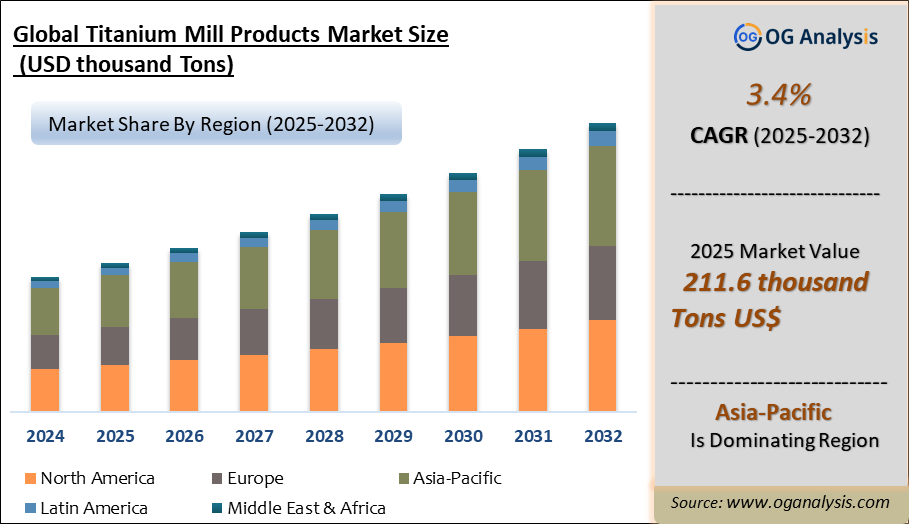

The Titanium Mill Products Market is estimated at 197.8 thousand tons in 2023. Further, the market is expected to grow from 204.7 thousand tons in 2024 to 259.3 thousand tons in 2031 at a CAGR of 3.4%.

The global titanium mill products market is witnessing steady growth driven by increasing demand from aerospace, defence, medical, chemical processing, and industrial applications. Titanium mill products include billets, bars, plates, sheets, and tubes produced through melting, forging, rolling, and extrusion processes. Their high strength-to-weight ratio, corrosion resistance, and biocompatibility make them critical materials for aircraft structural components, gas turbines, surgical implants, and chemical equipment. Rising commercial aircraft production, expanding defence investments, and growing medical device manufacturing are key growth drivers. Additionally, increasing adoption of titanium in automotive, marine, and energy industries for lightweight and durable components is supporting market expansion. Companies are focusing on capacity expansions, product innovations, and integrated supply chain strategies to strengthen their competitive positioning globally.

Asia-Pacific dominates the market driven by strong aerospace, medical, and industrial manufacturing bases in China, Japan, and India, alongside rising domestic titanium production capacities. North America remains a major market owing to established aerospace and defence sectors, while Europe witnesses stable growth supported by aerospace manufacturing hubs and medical device industries. Technological advancements in titanium alloy development, production processes, and recycling are enhancing cost efficiencies and sustainability. However, high processing costs, raw material price volatility, and supply chain disruptions remain key challenges. The market is expected to grow steadily as titanium applications expand into advanced manufacturing, renewable energy, and electric vehicle sectors with rising focus on material performance and sustainability goals worldwide.

By end-use industry, aerospace is the largest segment in the titanium mill products market due to titanium’s exceptional strength-to-weight ratio, corrosion resistance, and ability to withstand high temperatures—critical requirements for aircraft structural components, engines, and landing gear. The global expansion of commercial and military aerospace programs continues to drive high demand.

By product type, sheets & plates represent the fastest-growing segment, owing to their extensive use in aircraft skin, airframes, heat exchanger panels, and marine components. Their wide applicability across aerospace, defense, and industrial fabrication supports accelerated growth as manufacturers pursue lightweight, durable material solutions.

Trade Intelligence for titanium mill products market

|

Global Articles of titanium, n.e.s. Trade, Imports, USD million, 2020-24 |

|||||

|

|

2020 |

2021 |

2022 |

2023 |

2024 |

|

World |

4,326 |

3,753 |

4,752 |

5,839 |

6,643 |

|

France |

453 |

374 |

617 |

836 |

1,017 |

|

China |

454 |

471 |

552 |

607 |

705 |

|

Germany |

465 |

386 |

524 |

582 |

629 |

|

United Kingdom |

409 |

249 |

316 |

468 |

490 |

|

United States of America |

355 |

277 |

280 |

324 |

383 |

|

Source: OGAnalysis, International Trade Centre (ITC) |

|||||

- France, China, Germany, United Kingdom and United States of America are the top five countries importing 48.5% of global Articles of titanium, n.e.s. in 2024

- Global Articles of titanium, n.e.s. Imports increased by 53.5% between 2020 and 2024

- France accounts for 15.3% of global Articles of titanium, n.e.s. trade in 2024

- China accounts for 10.6% of global Articles of titanium, n.e.s. trade in 2024

- Germany accounts for 9.5% of global Articles of titanium, n.e.s. trade in 2024

|

Global Articles of titanium, n.e.s. Export Prices, USD/Ton, 2020-24 |

|

|

|

Source: OGAnalysis |

Key Insights

- The titanium mill products market is primarily driven by aerospace applications, where titanium’s high strength-to-weight ratio and heat resistance are essential for aircraft structural components, engine parts, and landing gear, supporting lightweighting and fuel efficiency goals in commercial and military aviation programs globally.

- Titanium plates and sheets hold significant market share due to their widespread use in aircraft skins, airframes, heat exchangers, and medical implants, with rising demand from aerospace OEMs, shipbuilding, and industrial heat transfer equipment manufacturers worldwide.

- The medical sector is witnessing growing titanium consumption for surgical implants, prosthetics, and dental applications due to its biocompatibility, non-toxicity, and corrosion resistance, supporting market growth amid rising surgical procedures and ageing populations globally.

- Asia-Pacific dominates the titanium mill products market with strong demand from aerospace, defence, and industrial sectors, supported by expanding titanium production capacities and government initiatives to develop indigenous aerospace and medical manufacturing capabilities.

- In the chemical processing industry, titanium mill products are used extensively for fabrication of heat exchangers, reactors, and pressure vessels due to their excellent corrosion resistance against acids, chlorides, and seawater, ensuring operational durability and safety compliance.

- Key companies are investing in capacity expansions, strategic acquisitions, and technological advancements to optimise production processes, enhance alloy performance, and strengthen supply chains to meet growing global titanium demand efficiently.

- High raw material costs and energy-intensive processing requirements remain major challenges, prompting companies to explore advanced manufacturing technologies, titanium recycling, and vertical integration strategies to mitigate cost volatility and ensure supply security.

- Emerging applications of titanium mill products in automotive, marine, and renewable energy sectors for lightweight and durable components are creating new growth opportunities, driven by fuel efficiency, emission reduction, and long-service life demands globally.

- Technological advancements in titanium alloy development are enabling superior mechanical properties, formability, and temperature resistance, expanding their applications in next-generation aircraft, electric vehicles, medical devices, and industrial equipment manufacturing.

- North America continues to witness stable demand for titanium mill products with strong aerospace and defence manufacturing bases, supported by significant investments in aircraft fleet expansion, defence modernisation programs, and medical implant production capacities.

Report Scope

|

Parameter |

titanium mill products market scope Detail |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Market Size-Units |

USD billion |

|

Market Splits Covered |

By product type, By End-User, |

|

Countries Covered |

North America (USA, Canada, Mexico) |

|

Analysis Covered |

Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

|

Customization |

10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

|

Post-Sale Support |

4 analyst hours, available up to 4 weeks |

|

Delivery Format |

The Latest Updated PDF and Excel Data file |

Market Segmentation

By End-Use Industry

- Aerospace

- Industrial

- Others

By Product Type

- Sheets & Plates

- Billets & Bars

- Tubes & Pipes

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Malaysia, Vietnam, Rest of APAC)

- The Middle East and Africa (Saudi Arabia, South Africa, UAE, Iran, Egypt, Rest of MEA)

- South and Central America (Brazil, Argentina, Chile, Rest of SCA)

What You Receive

• Global Titanium Mill Products market size and growth projections (CAGR), 2024- 2034

• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Titanium Mill Products.

• Titanium Mill Products market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Titanium Mill Products market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Titanium Mill Products market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Titanium Mill Products market, Titanium Mill Products supply chain analysis.

• Titanium Mill Products trade analysis, Titanium Mill Products market price analysis, Titanium Mill Products Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Titanium Mill Products market news and developments.

The Titanium Mill Products Market international scenario is well established in the report with separate chapters on North America Titanium Mill Products Market, Europe Titanium Mill Products Market, Asia-Pacific Titanium Mill Products Market, Middle East and Africa Titanium Mill Products Market, and South and Central America Titanium Mill Products Markets. These sections further fragment the regional Titanium Mill Products market by type, application, end-user, and country.

Recent Developments

- Sep 2025: IperionX accelerates U.S. titanium capacity expansion, increasing nameplate powder capacity by 60% to 200 tpa and targeting 1,400 tpa with unit cost cuts via HAMR/HSPT technology.

- Sep 2025: IperionX receives an additional US$25 million funding from U.S. Department of War under IBAS to support scale-up of its Virginia titanium manufacturing campus.

- Sep 2025: STS Metals extends long-term supply agreement with Boeing to continue supplying titanium rod, bar and plate for commercial airplane programs.

- Jul 2025: ATI Inc. expands and extends its long-term titanium supply agreement with Boeing to cover both narrowbody and widebody aircraft programs.

- Jul 2025: Tekna secures a CA$1.6 million order from a U.S. aerospace/defense customer for high-performance Ti-64 powder, marking a fivefold increase in monthly volume.

- Aug 2025: Messer partners with U.S. titanium producers to provide industrial gas solutions (argon, helium) critical for titanium processing operations.

- May 2025: Aerolloy Technologies (PTC Industries) inaugurates world’s largest aerospace-grade titanium & superalloy materials plant in Lucknow, India under the Defence corridor initiative.

- Jul 2025: IperionX raises ~US$46 million via private placement to accelerate ordering of long-lead HAMR and HSPT modules and expansion of forging capacity.

- Jul 2025: Rio Tinto considers divesting its titanium business segment due to weak returns and cost pressures on its titanium operations.

TABLE OF CONTENTS

1. GLOBAL TITANIUM MILL PRODUCTS INDUSTRY

1.1. Market Scope and Definition

1.2. Study Assumptions

2. GLOBAL TITANIUM MILL PRODUCTS MARKET REVIEW, 2023

3. TITANIUM MILL PRODUCTS MARKET INSIGHTS

3.1. Titanium Mill Products Market Insights, 2023-2031

3.1.1. Leading Titanium Mill Products, by End-User Industry, 2023-2031

3.1.2. Leading Titanium Mill Products, by Product Type, 2023-2031

3.1.3. Fast-Growing Geographies for Titanium Mill Products, 2023-2031

4. TITANIUM MILL PRODUCTS MARKET TRENDS, DRIVERS, AND RESTRAINTS

4.1. Titanium Mill Products Market Latest Trends

4.1.1. Increasing Demand from Aerospace Industry

4.1.2. Ability to absorb supply chain disruptions

4.1.3. Surging Demand from Chemical and Petro-chemical industries

4.1.4. Advancement in titanium alloys:

4.1.5. Growing focus on sustainability:

4.1.6. Potential consolidation:

4.1.7. Government initiations and policies:

4.1.8. Adoption of New marketing strategy:

4.1.9. Higher use of carbon fiber compatible with titanium:

4.2. Titanium Mill Products Market Drivers to 2031

4.2.1. Growing demand in the aerospace and defense industry:

4.2.2. Increased usage in medical implants:

4.2.3. The rapid growth of industrial applications:

4.2.4. Growing demand in the Automobile sector:

4.2.5. Technological advancements in manufacturing industries:

4.2.6. Increasing demand for Renewable energy:

4.2.7. Development of new alloys and manufacturing techniques:

4.3. Titanium Mill Products Market Restraints to 2031

4.3.1. High raw material cost

4.3.2. Stringent regulations:

4.3.3. Dependency on Russia

4.3.4. Volatility in raw material prices:

5. FIVE FORCES ANALYSIS FOR GLOBAL TITANIUM MILL PRODUCTS MARKET

5.1. Porter’s Five Forces Analysis

6. GLOBAL TITANIUM MILL PRODUCTS MARKET DATA - INDUSTRY SIZE, SHARE, AND OUTLOOK

6.1. Global Titanium Mill Products Market Overview, Tons, 2023

6.2. Global Titanium Mill Products Market Size and Share Outlook, By End-User Industry, 2023-2031

6.2.1. Aerospace

6.2.2. Industrial

6.2.3. Other End-User Industries

6.3. Global Titanium Mill Products Market Size and Share Outlook, By Product Type, 2023-2031

6.3.1. Sheets & Plates

6.3.2. Billets & Bars

6.3.3. Tubes & Pipes

6.3.4. Other Products

6.4. Global Titanium Mill Products Market Size and Share Outlook by Region, 2023-2031

7. GLOBAL TITANIUM MILL PRODUCTS MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

7.1. Global Titanium Mill Products Market Overview, $ Million, 2023

7.2. Global Titanium Mill Products Market Size and Share Outlook, By End-User Industry, 2023-2031

7.2.1. Aerospace

7.2.2. Industrial

7.2.3. Other End-User Industries

7.3. Global Titanium Mill Products Market Size and Share Outlook, By Product Type, 2023-2031

7.3.1. Sheets & Plates

7.3.2. Billets & Bars

7.3.3. Tubes & Pipes

7.3.4. Other Products

7.4. Global Titanium Mill Products Market Size and Share Outlook by Region, 2023-2031

8. ASIA PACIFIC TITANIUM MILL PRODUCTS MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

8.1. Asia Pacific Titanium Mill Products Market Overview, 2023

8.2. Asia Pacific Titanium Mill Products Market Size and Share Outlook, By Product Type, 2023-2031

8.3. Asia Pacific Titanium Mill Products Market Size and Share Outlook, By End-User Industry, 2023-2031

8.4. Asia Pacific Titanium Mill Products Market Size and Share Outlook by Country, 2023-2031

8.4.1. China

8.4.2. Japan

8.4.3. India

8.4.4. Rest of Asia Pacific

9. EUROPE TITANIUM MILL PRODUCTS MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

9.1. Europe Titanium Mill Products Market Overview, 2023

9.2. Europe Titanium Mill Products Market Size and Share Outlook, By Product Type, 2023-2031

9.3. Europe Titanium Mill Products Market Size and Share Outlook, By End-User Industry, 2023-2031

9.4. Europe Titanium Mill Products Market Size and Share Outlook by Country, 2023-2031

9.4.1. Germany

9.4.2. France

9.4.3. UK

9.4.4. Italy

9.4.5. Spain

9.4.6. Rest of Europe

10. NORTH AMERICA TITANIUM MILL PRODUCTS MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

10.1. North America Titanium Mill Products Market Overview, 2023

10.2. North America Titanium Mill Products Market Size and Share Outlook, By Product Type, 2023-2031

10.3. North America Titanium Mill Products Market Size and Share Outlook, By End-User Industry, 2023-2031

10.4. North America Titanium Mill Products Market Size and Share Outlook by Country, 2023-2031

10.4.1. United States

10.4.2. Canada

10.4.3. Mexico

11. SOUTH AND CENTRAL AMERICA TITANIUM MILL PRODUCTS MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

11.1. South and Central America Titanium Mill Products Market Overview, 2023

11.2. South and Central America Titanium Mill Products Market Size and Share Outlook, By Product Type, 2023-2031

11.3. South and Central America Titanium Mill Products Market Size and Share Outlook, By End-User Industry, 2023-2031

11.4. South and Central America Titanium Mill Products Market Size and Share Outlook by Country, 2023-2031

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South and Central America

12. MIDDLE EAST AFRICA TITANIUM MILL PRODUCTS MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

12.1. Middle East Africa Titanium Mill Products Market Overview, 2023

12.2. Middle East Africa Titanium Mill Products Market Size and Share Outlook, By Product Type, 2023-2031

12.3. Middle East Africa Titanium Mill Products Market Size and Share Outlook, By End-User Industry, 2023-2031

12.4. Middle East Africa Titanium Mill Products Market Size and Share Outlook by Country, 2023-2031

12.4.1. Middle East

12.4.2. Africa

13. TITANIUM MILL PRODUCTS MARKET STRUCTURE AND COMPETITIVE LANDSCAPE

13.1. Titanium Metal Corp. (TIMET)

13.2. Allegheny Technologies Inc. (ATI)

13.3. RTI International Metals (RTI) / Alcoa Corp.

13.4. VSMPO–AVISMA Corp. (VSMPO)

13.5. KOBE STEEL, LTD.

14. LATEST NEWS, DEALS, AND DEVELOPMENTS IN TITANIUM MILL PRODUCTS MARKET

15. APPENDIX

15.1. About Us

15.2. Sources

15.3. Research Methodology

15.4. Research Process

15.5. Research Execution

15.6. Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!