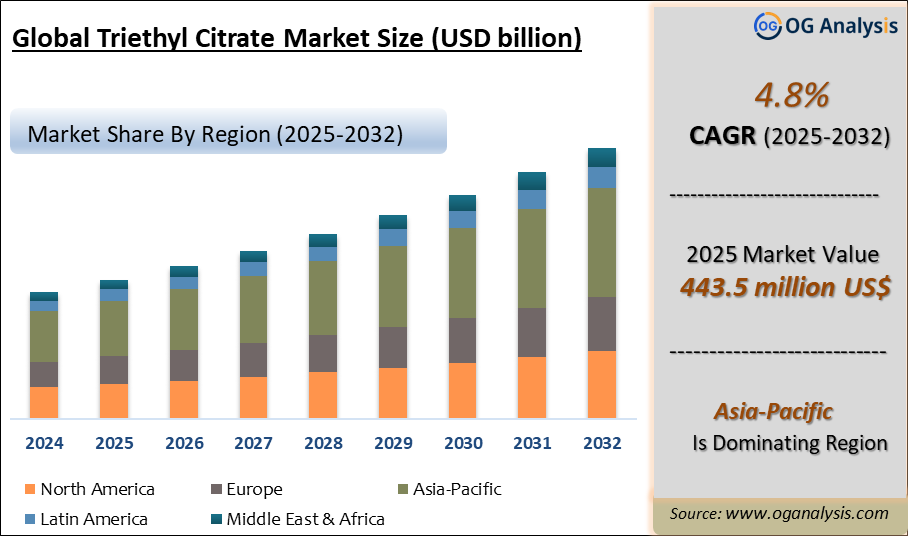

The Triethyl Citrate Market is estimated at USD 406.7 million in 2023. Further, the market is expected to grow from USD 423.2 million in 2024 to USD 589.9 million in 2031 at a CAGR of 4.8%.

Triethyl Citrate Market Overview

Triethyl Citrate also known as Ethyl Citrate, a chemical compound represented by the formula C12H20O7, plays an important role as a flavour enhancer, plasticizer, solubilizer, and emollient in different applications. Triethyl Citrate is a colourless oily liquid with a fruity odor. It is a highly pure and versatile ingredient, well known for its exceptional properties. It is prepared by the esterification of citric acid and ethanol in the presence of a catalyst. It's a versatile lightweight emollient that is non-blocking, non-greasy, has low viscosity, quickly absorbs, and leaves minimal stickiness on the skin.

The applications of triethyl citrate are found in different industries including the food industry, pharmaceutical industry, cosmetics industry, personal care industry, and plastic and polymer industry. Triethyl citrate meets the highest standards of quality and is compliant with FG (USP-NF) and Food Chemicals Codex regulations, ensuring its suitability in different applications. Triethyl Citrate is used as a flavouring agent in foods, as a plasticizer in the pharmaceutical industry for coating, as a food additive for stabilizing foams, and as a pseudo-emulsifier in e-cigarette juices.

Trade Intelligence for Triethyl Citrate Market

|

Global Salts and esters of citric acid (excl. inorganic or organic compounds of mercury) Trade, Imports, USD million, 2020-24 |

|||||

|

|

2020 |

2021 |

2022 |

2023 |

2024 |

|

World |

660 |

840 |

1,356 |

1,090 |

952 |

|

United States of America |

74.4 |

107 |

186 |

165 |

141 |

|

France |

27.1 |

33.9 |

48.3 |

50.6 |

56.3 |

|

Germany |

42.4 |

62.0 |

101 |

56.7 |

50.5 |

|

Poland |

31.4 |

56.0 |

66.4 |

80.3 |

49.8 |

|

Netherlands |

50.1 |

56.2 |

99.3 |

88.2 |

48.9 |

|

Source: OGAnalysis, International Trade Centre (ITC) |

|||||

- United States of America, France, Germany, Poland and Netherlands are the top five countries importing 36.4% of global Salts and esters of citric acid (excl. inorganic or organic compounds of mercury) in 2024

- Global Salts and esters of citric acid (excl. inorganic or organic compounds of mercury) Imports increased by 44.2% between 2020 and 2024

- United States of America accounts for 14.8% of global Salts and esters of citric acid (excl. inorganic or organic compounds of mercury) trade in 2024

- France accounts for 5.9% of global Salts and esters of citric acid (excl. inorganic or organic compounds of mercury) trade in 2024

- Germany accounts for 5.3% of global Salts and esters of citric acid (excl. inorganic or organic compounds of mercury) trade in 2024

|

Global Salts and esters of citric acid (excl. inorganic or organic compounds of mercury) Export Prices, USD/Ton, 2020-24 |

|

|

|

Source: OGAnalysis |

Latest Trends in Triethyl Citrate Market

Emerging Applications of Triethyl Citrate in the Cosmetics & Personal Care Industry:

Triethyl Citrate is used in the formulation for making skincare products such as hand creams, foot balsams, facial creams, sun care creams, hand creams, exfoliation creams, facial moisturizers, anti-aging creams and body lotions. Due to increasing middle-class disposable income and rising aspirations for a fulfilling life and attractive appearance, there is a greater demand for cosmetic products. Triethyl citrate is a common ingredient in numerous cosmetic and beauty products. Triethyl citrate is used by perfumers as a fixative, diluent, and solvent.

Triethyl citrate is an effective solvent for lacquers, varnish, and deodorants because it mixes easily with water and a variety of organic substances. In personal care, Triethyl Citrate is used in infant care products, bath products, creams and lotions, cosmetic sprays and many other types of personal care products. It is also an active ingredient in many chemical skin peels. Triethyl citrate effectively mitigates the accumulation of undesirable body odor by impeding the activity of sweat-producing bacteria enzymes. Its skin tolerance, along with deodorizing attributes, make triethyl citrate highly suitable for deodorant formulations.

Driving Factors

Superior Properties of Triethyl Citrate:

The triethyl citrate market is estimated to experience growth during the forecast period, driven by its excellent properties. Triethyl citrate is generally considered a safe and non-toxic compound, as it improves the flexibility and softness of materials. Triethyl citrate is compatible with a variety of polymers which enhances its utility in different industrial applications. Triethyl citrate is biodegradable and has a low boiling point ensuring easy vaporization. It is a colourless, odourless liquid exhibiting notable solvency and minimal toxicity.

Triethyl citrate possesses excellent flavour and fragrance enhancement properties, natural origin, and exceptional purity. Triethyl citrate is commonly included for its ability to control oil, promoting the well-being of skin and hair. Moreover, it enhances the viscosity of specific formulations, yielding a luxurious texture that is more user-friendly. Also, triethyl citrate serves as an effective solvent and perfuming agent, effectively masking the odors of other ingredients within a formulation. Triethyl citrate is a vital choice for companies focusing on green, natural, and organic mixture

Market Challenges

Strict Environmental Regulations Regarding Triethyl Citrate:

Triethyl citrate is regulated differently across the globe, like in the U.S., it is regulated as a dietary supplement by the Food and Drug Administration (FDA). In the European Union, triethyl citrate is regulated as a food additive by the European Food Safety Authority (EFSA). In Canada, it is regulated as a food additive by Health Canada. In Australia, it is regulated as a food additive by Food Standards Australia New Zealand (FSANZ).

In India, it is regulated as a food additive by the Food Safety and Standards Authority of India (FSSAI). An accidental release of triethyl citrate to the environment may pose a danger to fish, invertebrates and other aquatic organisms before degradation. Triethyl citrate is not expected to adsorb to suspended solids and sediment or accumulate in the tissues of aquatic organisms. The compound gets absorbed in the body by ingestion and inhalation causing irritation in the eyes, lung irritation with coughing and nausea, central nervous depression, and slowing of reflexes. This becomes the biggest limitation to the market growth.

Companies Mentioned

- BASF SE

- Fuso Chemical Co., Ltd.

- Merck KGaA

- Jiangsu Lemon Chemical & Technology Co., Ltd

- Debye Scientific Co., Ltd

- A&J Pharmtech Co., LTD

- RennoTech Co., Ltd

- Finetech Industry Limited

- Sigma-Aldrich

- Tokyo Chemical Industry Co., Ltd.

- MORIMURA BROS. Inc.

- Viachem Ltd.

- Vertellus

Report Scope

|

Parameter |

Triethyl Citrate Market scope Detail |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Market Size-Units |

USD million |

|

Market Splits Covered |

By Grade, By End-User, By Sales Channel |

|

Countries Covered |

North America (USA, Canada, Mexico) |

|

Analysis Covered |

Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

|

Customization |

10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

|

Post-Sale Support |

4 analyst hours, available up to 4 weeks |

|

Delivery Format |

The Latest Updated PDF and Excel Data file |

Market Segmentation

By Grade

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

By End-Use Industry

- Specialty Chemicals

- Food & Beverages

- Pharmaceutical

- Cosmetics & Personal care

- Other

By Sales Channel

- Direct B2B

- Offline Retail

- Online

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Malaysia, Vietnam, Rest of APAC)

- The Middle East and Africa (Saudi Arabia, South Africa, UAE, Iran, Egypt, Rest of MEA)

- South and Central America (Brazil, Argentina, Chile, Rest of SCA)

Recent Developments

- September 2025: Jungbunzlauer announced the acquisition of a multipurpose production site in Thomson, Illinois, from International Flavors & Fragrances Inc., marking its first U.S. manufacturing footprint to expand local production of citric acid derivatives including triethyl citrate.

- August 2025: Jungbunzlauer received the EcoVadis Platinum Medal for sustainability excellence, ranking among the top 1% of companies globally for ethical, social, and environmental performance in chemical manufacturing.

- July 2025: BASF revised its 2025 financial outlook downward due to weaker global demand for specialty and base chemicals, affecting product categories such as plasticizers and citrates used in coatings and personal care formulations.

- July 2025: Jungbunzlauer introduced TayaGel LA, a new low-acyl gellan gum designed for clean-label formulations, strengthening its biobased ingredient portfolio alongside its citrate product range.

- April 2025: BASF reported lower quarterly sales and margins driven by ongoing chemical market headwinds, signaling continued cost and demand pressures across its performance materials and plasticizer value chains.

TABLE OF CONTENTS

1. GLOBAL TRIETHYL CITRATEINDUSTRY

1.1. Market Scope and Definition

1.2. Study Assumptions

2. TRIETHYL CITRATE MARKET LATEST TRENDS, DRIVERS AND CHALLENGES, 2023-2031

2.1. Triethyl Citrate Market Latest Trends

2.1.1. Emerging Applications of Triethyl Citrate in the Cosmetics & Personal Care Industry:

2.1.2. Emphasis on Sustainable and Biodegradable Compounds:

2.1.3. Demand for Natural and Clean-Label Products:

2.1.4. Innovation in Plasticizer Technology:

2.2. Triethyl Citrate Market Insights, 2023-2031

2.2.1. Leading Triethyl Citrate by Grade, 2023-2031

2.2.2. Dominant Triethyl Citrate by End-Use Industry, 2023-2031

2.2.3. Leading Triethyl Citrate Sales Channel, 2023-2031

2.2.4. Fast-Growing Geographies for Triethyl Citrate, 2023-2031

2.3. Triethyl Citrate Demand Drivers to 2031

2.3.1. Superior Properties of Triethyl Citrate:

2.3.2. Growing Usage of Triethyl Citrate in Different End-User Industries:

2.3.3. Growing Demand for Polymer Modifiers and Lubricants:

2.3.4. Rising Automotive and Construction Industry in Emerging Regions:

2.4. Triethyl Citrate Challenges to 2031

2.4.1. Strict Environmental Regulations Regarding Triethyl Citrate:

2.4.2. Fluctuations in Raw Material Prices & Competition with Other Plasticizers:

2.5. Triethyl Citrate Market-Five Forces Analysis

3. GLOBAL TRIETHYL CITRATE MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

3.1. Global Triethyl Citrate Market Overview, 2023

3.2. Global Triethyl Citrate Market Size and Share Outlook, By Grade, 2023-2031

3.2.1. Industrial Grade

3.2.2. Food Grade

3.2.3. Pharmaceutical Grade

3.3. Global Triethyl Citrate Market Size and Share Outlook, By End-Use Industry, 2023-2031

3.3.1. Specialty Chemicals

3.3.2. Food & Beverages

3.3.3. Pharmaceutical

3.3.4. Cosmetics & Personal care

3.3.5. Others

3.4. Global Triethyl Citrate Market Size and Share Outlook, By Sales Channel, 2023-2031

3.4.1. Direct B2B

3.4.2. Offline Retail

3.4.3. Online

3.5. Global Triethyl Citrate Market Size and Share Outlook by Region, 2023-2031

4. NORTH AMERICA TRIETHYL CITRATE MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

4.1. North America Triethyl Citrate Market Overview, 2023

4.2. North America Triethyl Citrate Market Size and Share Outlook By Grade, 2023-2031

4.3. North America Triethyl Citrate Market Size and Share Outlook, By End-Use Industry, 2023-2031

4.4. North America Triethyl Citrate Market Size and Share Outlook By Sales Channel, 2023-2031

4.5. North America Triethyl Citrate Market Size and Share Outlook by Country, 2023-2031

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. EUROPE TRIETHYL CITRATE MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

5.1. Europe Triethyl Citrate Market Overview, 2023

5.2. Europe Triethyl Citrate Market Size and Share Outlook By Grade, 2023-2031

5.3. Europe Triethyl Citrate Market Size and Share Outlook, By End-Use Industry, 2023-2031

5.4. Europe Triethyl Citrate Market Size and Share Outlook By Sales Channel, 2023-2031

5.5. Europe Triethyl Citrate Market Size and Share Outlook by Country, 2023-2031

5.5.1. Germany

5.5.2. France

5.5.3. United Kingdom

5.5.4. Italy

5.5.5. Spain

5.5.6. Rest of Europe

6. ASIA PACIFIC TRIETHYL CITRATE MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

6.1. Asia Pacific Triethyl Citrate Market Overview, 2023

6.2. Asia Pacific Triethyl Citrate Market Size and Share Outlook By Grade, 2023-2031

6.3. Asia Pacific Triethyl Citrate Market Size and Share Outlook, By End-Use Industry, 2023-2031

6.4. Asia Pacific Triethyl Citrate Market Size and Share Outlook By Sales Channel, 2023-2031

6.5. Asia Pacific Triethyl Citrate Market Size and Share Outlook by Country, 2023-2031

6.5.1. China

6.5.2. Japan

6.5.3. India

6.5.4. Rest of Asia Pacific

7. SOUTH AND CENTRAL AMERICA TRIETHYL CITRATE MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

7.1. South and Central America Triethyl Citrate Market Overview, 2023

7.2. South and Central America Triethyl Citrate Market Size and Share Outlook By Grade, 2023-2031

7.3. South and Central America Triethyl Citrate Market Size and Share Outlook, By End-Use Industry, 2023-2031

7.4. South and Central America Triethyl Citrate Market Size and Share Outlook By Sales Channel, 2023-2031

7.5. South and Central America Triethyl Citrate Market Size and Share Outlook by Country, 2023-2031

7.5.1. Brazil

7.5.2. Argentina

7.5.3. Rest of South and Central America

8. MIDDLE EAST AFRICA TRIETHYL CITRATE MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

8.1. Middle East Africa Triethyl Citrate Market Overview, 2023

8.2. Middle East Africa Triethyl Citrate Market Size and Share Outlook By Grade, 2023-2031

8.3. Middle East Africa Triethyl Citrate Market Size and Share Outlook, By End-Use Industry, 2023-2031

8.4. Middle East Africa Triethyl Citrate Market Size and Share Outlook By Sales Channel, 2023-2031

8.5. Middle East Africa Triethyl Citrate Market Size and Share Outlook by Country, 2023-2031

8.5.1. Middle East

8.5.2. Africa

9. TRIETHYL CITRATE MARKET STRUCTURE

9.1. BASF SE

9.2. Fuso Chemical Co.,Ltd.

9.3. Merck KGaA

9.4. Jiangsu Lemon Chemical & Technology Co., Ltd

9.5. Finetech Industry Limited

10. TRIETHYL CITRATE RELATED TRADE DATA

11. APPENDIX

11.1. About Us

11.2. Sources

11.3. Research Methodology

11.4. Research Process

11.5. Research Execution

11.6. Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!