"The Global Yeast Probiotic Ingredient for Animal Market was valued at $ 8.37 billion in 2025 and is projected to reach $ 23.38 billion by 2034, growing at a CAGR of 12.1%."

The yeast probiotic ingredient for animal market encompasses feed additives derived from yeast strains such as Saccharomyces cerevisiae, Kluyveromyces fragilis, and other beneficial microorganisms, designed to improve gut health, nutrient absorption, immune response, and overall performance of livestock, poultry, aquaculture, and companion animals. These ingredients include yeast cultures, live yeast cells, yeast-derived beta-glucans, and mannan-oligosaccharides (MOS) that serve as prebiotics and immunomodulators. Demand for yeast probiotic ingredients is driven by evolving regulations limiting antibiotic growth promoters, rising interest in natural and sustainable feed solutions, and heightened awareness of animal welfare. The additive market spans various species and production stages, from piglet rearing and laying hens to shrimp farming and equine health, delivering benefits such as reduced diarrhea, improved feed conversion ratio, enhanced weight gain, and resilience to environmental or transporter stress.

Market dynamics are shaped by technological advances, regulatory trends, and shifting nutrition strategies. Yeast probiotic products are now formulated as encapsulated, spray-dried, or microencapsulated forms to improve stability during pelleting, feed processing, and gut transit. Manufacturers are combining yeast probiotics with enzymes, organic acids, and phytogenics to offer multi-modal gut-health solutions. Forecasts suggest continued growth fueled by intensification of livestock systems, expansion in aquaculture feed demand, and emerging interest in pet nutrition. Recent developments include strain-specific yeast probiotics tailored for antimicrobial-resistant pathogens, yeast fractions enriched for postbiotic metabolites, and precision-fed micro-doses suitable for automated feeding systems. As the drive toward antibiotic-free and eco-conscious protein production accelerates, yeast probiotic ingredients are gaining traction as scalable, science-backed components of the next-generation feed toolbox.

Key Market Insights

- The yeast probiotic ingredient for animal market is expanding rapidly due to increasing restrictions on the use of antibiotic growth promoters in livestock production, prompting producers to adopt natural feed additives that promote animal health and performance.

- Rising consumer demand for antibiotic-free meat, dairy, and aquaculture products is encouraging feed manufacturers to integrate yeast-based probiotics, which are recognized for their ability to improve feed efficiency and support sustainable protein production.

- Yeast probiotics offer multi-functional benefits, including improved gut microflora balance, enhanced nutrient absorption, stimulation of immune responses, and reduction of stress-related performance losses in animals under intensive farming conditions.

- Technological innovations such as encapsulation and microencapsulation are improving the shelf life and stability of yeast probiotics, ensuring effectiveness even during high-temperature feed processing and storage.

- The aquaculture sector is becoming a significant growth driver for yeast probiotics, as fish and shrimp producers seek environmentally safe feed solutions that boost disease resistance and growth rates without the use of harmful chemicals.

- Integration of yeast probiotics with complementary feed additives like enzymes, organic acids, and phytogenics is gaining traction, providing synergistic effects for optimal gut health and feed conversion ratios.

- Regional adoption patterns vary, with developed markets focusing on premium, species-specific probiotic solutions, while emerging markets are driving volume demand due to livestock sector intensification and government support for sustainable agriculture.

- Advancements in strain selection are enabling the development of targeted yeast probiotics designed to combat specific pathogenic challenges such as Salmonella, E. coli, and coccidiosis in different animal species.

- The pet nutrition industry is emerging as a new application area for yeast probiotics, offering health benefits for digestive wellness, immune function, and skin health in dogs and cats.

- Ongoing research into postbiotic yeast fractions and metabolite-rich extracts is creating opportunities for value-added probiotic formulations that can deliver functional benefits without the challenges of live microbial viability.

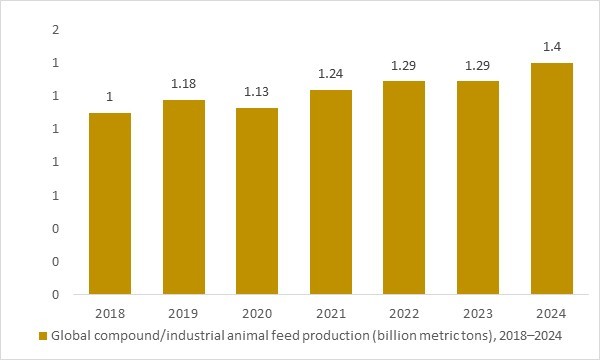

Global compound/industrial animal feed production (billion metric tons), 2018–2024

Figure: Global compound animal feed production has expanded steadily between 2018 and 2024, reflecting the growth of intensive poultry, swine, ruminant and aquaculture systems. As more livestock and fish are fed commercial compound diets, feed formulators are increasing the use of yeast-based probiotic ingredients to improve gut health, feed conversion efficiency and disease resilience, directly supporting long-term demand in the yeast probiotic ingredients for animal market.Global compound animal feed production, 2018–2024 (billion tonnes)

- Global compound animal feed production has increased steadily from 2018 to 2024, reflecting the expanding base of intensive livestock and aquaculture systems worldwide. As more poultry, swine, ruminants and fish are fed commercial diets, adoption of yeast-based probiotic ingredients is rising to improve gut health, feed efficiency and disease resilience, strengthening long-term growth prospects for the yeast probiotic ingredients for animal market.

Regional Insights

North America Yeast Probiotic Ingredient for Animal Market

North America’s market is shaped by consolidation in poultry, dairy, and beef, retailer pressure for antibiotic-free labels, and strong companion-animal spending. Lucrative opportunities exist in rumen-specific live yeast for fiber digestion and acidosis control, MOS/beta-glucan blends for broiler gut integrity, and palatable postbiotic formats for canine and feline digestive health. Latest trends include precision-delivery encapsulation that survives pelleting, on-farm microbiome testing to tailor inclusion rates, and carbon-smart nutrition programs where yeast ingredients support feed efficiency. The forecast points to steady expansion across integrated poultry and large dairies, plus premiumization in pet supplements. Recent developments feature co-formulations with enzymes and organic acids, subscription logistics for cold-chain stability, and field data platforms that link yeast inclusion to health, performance, and sustainability metrics.

Asia Pacific Yeast Probiotic Ingredient for Animal Market

Asia Pacific combines rapid growth in poultry and swine with world-leading aquaculture output, creating multi-species demand for robust, cost-effective yeast solutions. Companies can capture value with heat-stable live yeast for mash/pellet feeds, MOS fractions that curb enteric pathogens in chicks and weaners, and aquaculture-specific strains that bolster shrimp and finfish resilience under variable water quality. Latest trends include hatchery-stage applications, micro-dosing via automated feeders, and local fermentation/ spray-dry capacity to shorten lead times. The forecast indicates strong uptake as producers pivot from antibiotic growth promoters toward multi-modal gut health programs. Recent developments highlight strain libraries selected for regional pathogens, partnerships with integrators for farm-scale trials, and bundled offerings that pair yeast probiotics with water conditioners and immune-priming botanicals.

Europe Yeast Probiotic Ingredient for Animal Market

Europe’s dynamics are anchored by stringent feed additive rules, mature dairy and specialty livestock segments, and accelerating shifts to antibiotic-reduced production. Lucrative opportunities center on EFSA-compliant live yeast for rumen stabilization in high-yield dairies, targeted yeast fractions for necrotic enteritis risk in poultry, and postbiotic formats suited to medicated-feed restrictions. Latest trends include validated mode-of-action dossiers, sustainability claims tied to feed conversion and manure emissions, and integration of yeast data into precision-livestock platforms. The forecast suggests stable growth through replacement of in-feed antibiotics and zinc-based strategies, alongside premium niches in organic and welfare-certified supply chains. Recent developments include co-innovation with premix mills to create species-stage matrices, recyclable packaging for large-format totes, and QA programs linking batch analytics to farm assurance requirements.

Report Scope

| Parameter | Yeast probiotic ingredient for animal Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Yeast Probiotic Ingredient for Animal Market

By Type

- Animal Feed

- Pet Food

- Aquaculture

By Functionality

- Nutritional Supplement

- Digestive Health

- Immune Support

By Formulation

- Dry Powder

- Liquid

- Granules

By Application

- Animal Feed

- Pet Food

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Companies Covered

Lesaffre, Angel Yeast, Chr. Hansen, Alltech, Lallemand, ADM Animal Nutrition, Novus International, Nutreco, Cargill, Calpis Co., Provimi, Phileo by Lesaffre, Biorigin, Diamond V, Evonik Animal Nutrition

Recent Industry Developments

-

July 2025 — Phileo by Lesaffre made a strategic investment in CanBiocin, combining its leadership in yeast probiotics with CanBiocin’s novel microbial strains to accelerate innovation in companion animal and livestock probiotic products.

-

March 2025 — Actisaf® Sc 47 yeast probiotic demonstrated improved nutrient utilization and reduced undigested feed in dairy cows, supporting sustainable milk production through better digestion efficiency.

-

May 2025 — Royal Canin launched Clinically Proven Probiotics probiotic powders featuring Saccharomyces boulardii for digestive and immune health in cats and dogs, aligning with the new "National Pet Wellness Day" initiative.

-

April 2025 — IFF (International Flavors & Fragrances) introduced Enviva PRO, a three-strain Bacillus probiotic for swine, designed to enhance gut health during weaning while reducing diarrhea and improving weight gain performance.

What You Receive

• Global Yeast Probiotic Ingredient for Animal market size and growth projections (CAGR), 2024- 2034

• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Yeast Probiotic Ingredient for Animal.

• Yeast Probiotic Ingredient for Animal market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Yeast Probiotic Ingredient for Animal market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Yeast Probiotic Ingredient for Animal market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Yeast Probiotic Ingredient for Animal market, Yeast Probiotic Ingredient for Animal supply chain analysis.

• Yeast Probiotic Ingredient for Animal trade analysis, Yeast Probiotic Ingredient for Animal market price analysis, Yeast Probiotic Ingredient for Animal Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Yeast Probiotic Ingredient for Animal market news and developments.

The Yeast Probiotic Ingredient for Animal Market international scenario is well established in the report with separate chapters on North America Yeast Probiotic Ingredient for Animal Market, Europe Yeast Probiotic Ingredient for Animal Market, Asia-Pacific Yeast Probiotic Ingredient for Animal Market, Middle East and Africa Yeast Probiotic Ingredient for Animal Market, and South and Central America Yeast Probiotic Ingredient for Animal Markets. These sections further fragment the regional Yeast Probiotic Ingredient for Animal market by type, application, end-user, and country.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Yeast Probiotic Ingredient for Animal Market Latest Trends, Drivers and Challenges, 2024 - 2034

2.1 Yeast Probiotic Ingredient for Animal Market Overview

2.2 Market Strategies of Leading Yeast Probiotic Ingredient for Animal Companies

2.3 Yeast Probiotic Ingredient for Animal Market Insights, 2024 - 2034

2.3.1 Leading Yeast Probiotic Ingredient for Animal Types, 2024 - 2034

2.3.2 Leading Yeast Probiotic Ingredient for Animal End-User industries, 2024 - 2034

2.3.3 Fast-Growing countries for Yeast Probiotic Ingredient for Animal sales, 2024 - 2034

2.4 Yeast Probiotic Ingredient for Animal Market Drivers and Restraints

2.4.1 Yeast Probiotic Ingredient for Animal Demand Drivers to 2034

2.4.2 Yeast Probiotic Ingredient for Animal Challenges to 2034

2.5 Yeast Probiotic Ingredient for Animal Market- Five Forces Analysis

2.5.1 Yeast Probiotic Ingredient for Animal Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Yeast Probiotic Ingredient for Animal Market Value, Market Share, and Forecast to 2034

3.1 Global Yeast Probiotic Ingredient for Animal Market Overview, 2024

3.2 Global Yeast Probiotic Ingredient for Animal Market Revenue and Forecast, 2024 - 2034 (US$ billion)

3.3 Global Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Type, 2024 - 2034

3.4 Global Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Functionality, 2024 - 2034

3.5 Global Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Formulation, 2024 – 2034

3.6 Global Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Application, 2024 - 2034

3.7 Global Yeast Probiotic Ingredient for Animal Market Size and Share Outlook by Region, 2024 - 2034

4. Asia Pacific Yeast Probiotic Ingredient for Animal Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Yeast Probiotic Ingredient for Animal Market Overview, 2024

4.2 Asia Pacific Yeast Probiotic Ingredient for Animal Market Revenue and Forecast, 2024 - 2034 (US$ billion)

4.3 Asia Pacific Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Type, 2024 - 2034

4.4 Asia Pacific Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Functionality, 2024 - 2034

4.5 Asia Pacific Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Formulation, 2024 – 2034

4.6 Asia Pacific Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Application, 2024 - 2034

4.7 Asia Pacific Yeast Probiotic Ingredient for Animal Market Size and Share Outlook by Country, 2024 - 2034

5. Europe Yeast Probiotic Ingredient for Animal Market Value, Market Share, and Forecast to 2034

5.1 Europe Yeast Probiotic Ingredient for Animal Market Overview, 2024

5.2 Europe Yeast Probiotic Ingredient for Animal Market Revenue and Forecast, 2024 - 2034 (US$ billion)

5.3 Europe Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Type, 2024 - 2034

5.4 Europe Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Functionality, 2024 - 2034

5.5 Europe Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Formulation, 2024 – 2034

5.6 Europe Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Application, 2024 - 2034

5.7 Europe Yeast Probiotic Ingredient for Animal Market Size and Share Outlook by Country, 2024 - 2034

6. North America Yeast Probiotic Ingredient for Animal Market Value, Market Share and Forecast to 2034

6.1 North America Yeast Probiotic Ingredient for Animal Market Overview, 2024

6.2 North America Yeast Probiotic Ingredient for Animal Market Revenue and Forecast, 2024 - 2034 (US$ billion)

6.3 North America Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Type, 2024 - 2034

6.4 North America Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Functionality, 2024 - 2034

6.5 North America Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Formulation, 2024 – 2034

6.6 North America Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Application, 2024 - 2034

6.7 North America Yeast Probiotic Ingredient for Animal Market Size and Share Outlook by Country, 2024 - 2034

7. South and Central America Yeast Probiotic Ingredient for Animal Market Value, Market Share and Forecast to 2034

7.1 South and Central America Yeast Probiotic Ingredient for Animal Market Overview, 2024

7.2 South and Central America Yeast Probiotic Ingredient for Animal Market Revenue and Forecast, 2024 - 2034 (US$ billion)

7.3 South and Central America Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Type, 2024 - 2034

7.4 South and Central America Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Functionality, 2024 - 2034

7.5 South and Central America Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Formulation, 2024 – 2034

7.6 South and Central America Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Application, 2024 - 2034

7.7 South and Central America Yeast Probiotic Ingredient for Animal Market Size and Share Outlook by Country, 2024 - 2034

8. Middle East Africa Yeast Probiotic Ingredient for Animal Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Yeast Probiotic Ingredient for Animal Market Overview, 2024

8.2 Middle East and Africa Yeast Probiotic Ingredient for Animal Market Revenue and Forecast, 2024 - 2034 (US$ billion)

8.3 Middle East Africa Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Type, 2024 - 2034

8.4 Middle East Africa Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Functionality, 2024 - 2034

8.5 Middle East Africa Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Formulation, 2024 – 2034

8.6 Middle East Africa Yeast Probiotic Ingredient for Animal Market Size and Share Outlook By Application, 2024 - 2034

8.7 Middle East Africa Yeast Probiotic Ingredient for Animal Market Size and Share Outlook by Country, 2024 - 2034

9. Yeast Probiotic Ingredient for Animal Market Structure

9.1 Key Players

9.2 Yeast Probiotic Ingredient for Animal Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Yeast Probiotic Ingredient for Animal Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Yeast Probiotic Ingredient for Animal Market is estimated to generate USD 8.37 billion in revenue in 2025.

The Global Yeast Probiotic Ingredient for Animal Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 12.1% during the forecast period from 2025 to 2034.

The Yeast Probiotic Ingredient for Animal Market is estimated to reach USD 23.38 billion by 2034.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!