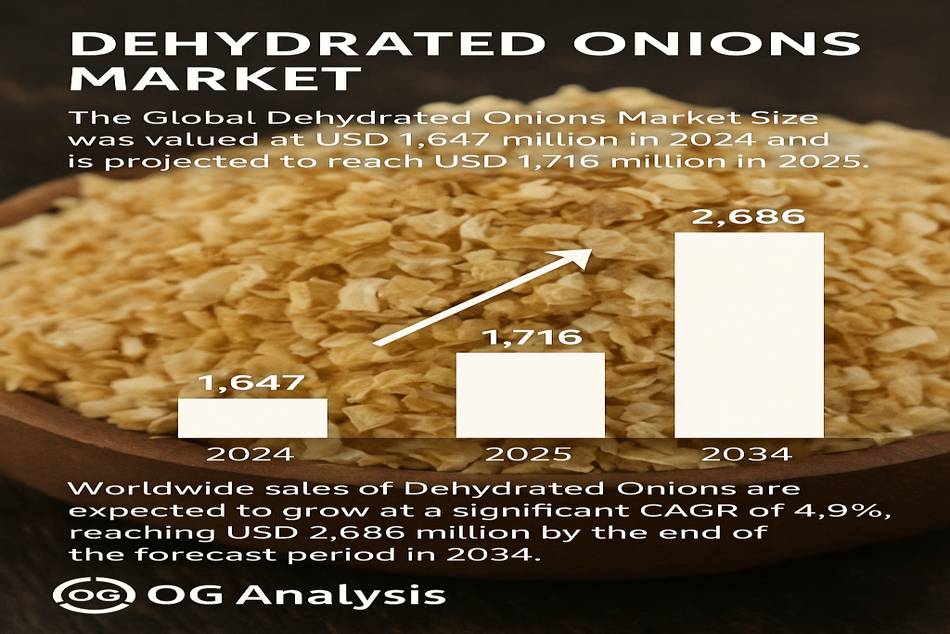

Dehydrated Onions Market: What’s Driving the Growth from USD 1.6 Billion to Over USD 2.6 Billion by 2034?

The global Dehydrated Onions Market is spicing up the food industry. Valued at USD 1,647 million in 2024, the market is projected to reach USD 1,716 million by 2025, and USD 2,686 million by 2034, growing at a CAGR of 4.9%. As consumer lifestyles shift towards convenient, long-lasting, and pantry-friendly ingredients, dehydrated onions are becoming a staple across foodservice, retail, and industrial processing applications. Driven by cost-efficiency, extended shelf life, and ease of storage and transport, the demand for dehydrated onions is growing globally—particularly in Asia-Pacific and North America. Leading players such as Olam International, Jain Farm Fresh, Van Drunen Farms, and Sensient Technologies are innovating across drying techniques and sustainable sourcing to stay ahead of rising global demand.

1. Why are dehydrated onions outpacing fresh ones in commercial kitchens and packaged foods?

The biggest advantage of dehydrated onions is their long shelf life and reduced weight, which makes them easier to store, ship, and use—especially in ready-to-eat meals, spice mixes, and soups. In regions where the fresh onion supply is unpredictable or climate-sensitive, dehydrated alternatives serve as a logistical lifesaver. Moreover, they offer consistent flavor and quality, eliminating variability in food production—a key factor for quick-service restaurants and bulk manufacturers.

2. Which drying technology is shaping the future of dehydrated onion production?

Technology is making a big impact in this segment. While air drying remains dominant due to its affordability and scalability, techniques like freeze drying and vacuum drying are gaining ground. These methods preserve more natural aroma, color, and nutrition, which are important for premium food products and organic brands. As consumer demand tilts towards clean-label, minimally processed foods, companies are investing in advanced drying methods to elevate both product quality and market appeal.

3. Which regions are cooking up the highest demand for dehydrated onions—and why?

Asia-Pacific, led by India and China, is the manufacturing engine of dehydrated onions, thanks to abundant raw material availability and lower processing costs. Meanwhile, North America and Europe are key consumers, driven by high demand in food processing and retail segments. The Middle East and Africa, with rising fast-food chains and urban food habits, are emerging as promising markets. Market expansion is also being supported by regulatory approvals, export subsidies, and cold chain logistics advancements.

Click Here for the Full Market Report:

4. Are organic and clean-label trends creating a new submarket for dehydrated onions?

Absolutely. Consumers are now actively reading labels and looking for ingredients that are organic, allergen-free, and sustainably sourced. This has fueled the rise of organic dehydrated onion variants, prompting players like Harmony House Foods and Natural Dehydrated Vegetables Pvt. Ltd. to focus on certified organic production. As this niche grows, product differentiation through traceability, farming practices, and eco-packaging will become central to brand strategy.

5. What’s driving household demand for dehydrated onions beyond the B2B space?

While food processing and service providers dominate in volume, retail and household consumption is witnessing a spike, especially post-pandemic. Consumers are now stocking up on non-perishable pantry essentials, and dehydrated onions—available as granules, minced, powder, and chopped—fit perfectly into this demand pattern. Brands that offer versatile packaging sizes, recipe-ready formats, and even reusable jars or zip-lock pouches are seeing increased traction in supermarkets and online grocery platforms.

The Dehydrated Onions Market is no longer a niche within food ingredients—it's a critical component of the global processed foods supply chain. With its scalability, versatility, and alignment with convenience-driven lifestyles, this market is set for a steady climb over the next decade. For players ready to innovate across drying processes, sustainable sourcing, and packaging formats, the opportunity is ripe and ready to harvest.

6. How are food service providers transforming the way dehydrated onions are used in 2025?

Quick-service restaurants, meal kit companies, and institutional caterers are driving customized formats of dehydrated onions—like pre-seasoned, pre-cooked, or blended spice mixtures. These innovations are enabling faster preparation, reduced kitchen waste, and standardized flavor profiles across global franchise outlets. With labor shortages and rising costs in the food service sector, dehydrated onions are proving invaluable for maintaining consistency while keeping operations lean. Expect more partnerships between bulk dehydrated onion producers and commercial kitchens aiming to scale menus with minimal back-end effort.

7. Could innovation in shelf-stable packaging give dehydrated onions an edge in the export market?

Yes—and it’s already happening. Brands are now launching vacuum-sealed pouches, oxygen-absorbing sachets, and moisture-resistant jars to maintain freshness during international shipping. This is opening up lucrative markets in Africa, Southeast Asia, and Latin America, where supply chains are often challenged by temperature swings and infrastructure gaps. Exporters are also aligning with regulatory packaging mandates and incorporating QR-code traceability to enhance trust and compliance. As demand for globally shipped pantry goods rises, smart packaging will be a powerful differentiator for dehydrated onion brands.

Click Here for the Full Market Report:

Market Segmentation Snapshot: Key Categories and Regional Insights:

By form

Chopped

Minced

Powder

Granules

Others

By Nature

Organic

Conventional

By Drying Process

Air Drying

Vacuum Drying

Freeze Drying

Microwave Drying

Other

By End Use

Food Processing

Food Service Providers

Retail/Household

By Geography

North America (USA, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

The Middle East and Africa (Middle East, Africa)

South and Central America (Brazil, Argentina, Rest of SCA)

Explore More Industry Insights:

salad container market Analysis and Outlook Report:

Ready-To-Drink (RTD) Packaging market Analysis and Outlook Report:

Connect with us on:

Phone: +91 888 64 99099

Email: mailto:sales@oganalysis.com

Learn More about OG Analysis

OG Analysis, established in 2009 has 14+ years of experience and served 1800+ clients from 980+ companies operating in 54+ countries. OG Analysis is a leading provider of market research reports in Chemicals, Energy, Oil & Gas, Food & Beverage, Electronics & Semiconductors, Automotive, Telecommunication, Healthcare and Other industries.