Industrial Garnet Market: Is This Mineral Quietly Powering the Future of Precision?

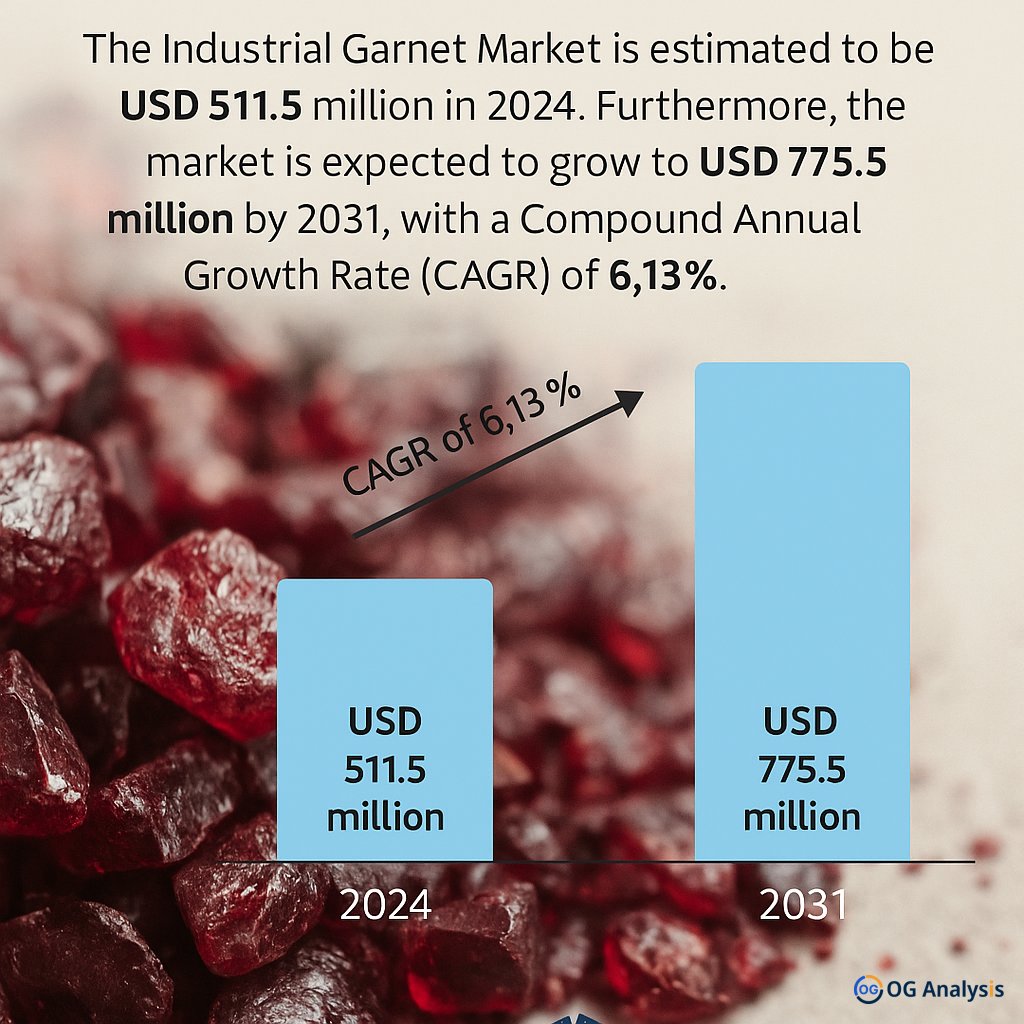

The Industrial Garnet Market may not grab headlines like lithium or cobalt, but its role is quietly expanding across several high-performance industries. Estimated at USD 511.5 million in 2024, the market is expected to reach USD 775.5 million by 2031, growing at a healthy CAGR of 6.13%.

From abrasive blasting to water jet cutting and filtration systems, garnet is prized for its durability, hardness, and chemical inertness. Market leaders like GMA Garnet, BARTON International, and Trimex Sands are pushing technological advancements and global distribution, while rising demand from Asia-Pacific and the Middle East is reshaping the competitive landscape.

Let’s explore seven compelling questions that detail the current momentum, emerging applications, and market opportunities for industrial garnet.

1. Why is water jet cutting driving a resurgence in industrial garnet demand?

Water jet cutting is revolutionizing modern manufacturing. Unlike traditional tools, it cuts materials without heat, preserving structural integrity. Industrial garnet serves as the ideal abrasive medium, especially almandine garnet, due to its hardness and recycling capability. Industries from automotive to aerospace are rapidly adopting this method, creating robust demand for high-purity garnet grades.

2. Are new garnet applications redefining its industrial value?

Yes—beyond its core uses, garnet is expanding into abrasive powders for electronics, water filtration systems, and even renewable energy maintenance (like cleaning solar panels). As sustainability and performance become industrial imperatives, garnet’s non-toxic, reusable properties are making it the go-to mineral for next-gen applications. This evolution is driving market expansion into new sectors and technologies.

3. What role does Asia-Pacific play in global garnet dynamics?

Asia-Pacific is not just a growth region—it’s a dominant force in both supply and consumption. Countries like India, China, and Australia are major producers and exporters, while regional demand is rising in sectors like construction, oil & gas, and industrial fabrication. The APAC region's rapid urbanization and infrastructure projects are heavily reliant on garnet-based abrasive technologies.

Click Here for the Full Market Report:

4. How is the shift from offline to online sales channels reshaping garnet distribution?

While offline distribution still leads, the rise of online procurement platforms is transforming garnet accessibility—particularly for small and mid-size manufacturers across emerging markets. E-commerce integration allows direct sourcing, better price transparency, and inventory management, allowing companies to bypass complex intermediaries. Expect digital distribution to be a key competitive edge going forward.

5. Which garnet type is gaining traction for industrial precision—and

Almandine garnet remains the industry standard due to its optimal hardness, density, and availability. However, niche types like pyrope and andradite are gaining traction in specialty applications. These variants offer unique characteristics like higher thermal resistance and enhanced polishability, which are valued in optics, ceramics, and advanced abrasive powders.

6. How are environmental concerns shaping mining and usage practices?

With increased scrutiny on mineral sourcing and environmental impact, garnet mining companies are pivoting toward sustainable extraction, water recycling, and closed-loop systems. Leading firms like V.V Mineral and Indian Ocean Garnet Sands Company are embracing ESG standards to ensure responsible production. Eco-conscious sourcing is fast becoming a buyer’s decision-making factor in this market.

7. What does the future hold for garnet in filtration and infrastructure?

Water filtration is one of garnet’s most promising yet underappreciated use cases. It’s being adopted in municipal water treatment plants, industrial wastewater systems, and even desalination units across the Middle East and Africa. Its durability, chemical stability, and low maintenance cost make garnet a preferred medium over sand or silica, especially in regions facing water scarcity and infrastructural stress.

Click Here for the Full Market Report:

Market Segmentation Summary

By Product Type:

-

Almandine

-

Andradite

-

Grossular

-

Pyrope

-

Other Product Types

By Application:

-

Abrasive Blasting

-

Water Jet Cutting

-

Water Filtration

-

Abrasive Powders

-

Other Applications

By Sales Channel:

-

Offline

-

Online

By Region:

-

North America: USA, Canada, Mexico

-

Europe: Germany, UK, France, Spain, Italy, Russia

-

Asia-Pacific: China, India, Japan, Australia, South Korea, Indonesia, Malaysia, Vietnam

-

Middle East & Africa: Saudi Arabia, South Africa, UAE, Iran, Egypt

-

South & Central America: Brazil, Argentina, Chile

Key Players to Watch

-

Mineral Commodities Ltd

-

GMA Garnet Pty Ltd

-

Trimex Sands Pvt Ltd

-

BARTON International

-

RZG Garnet LTD

-

V.V Mineral

-

Indian Ocean Garnet Sands Co.

-

Zircon Mineral Co.

-

Mohawk Garnet Inc.

-

Opta Minerals Inc.

-

Beach Minerals Company

Explore More Industry Insights

| Nanodiamonds Market Outlook report |

| Silicon Metal Market Outlook Report |

Connect with us on:

Phone: +91 888 64 99099

Email: mailto:sales@oganalysis.com

Learn More about OG Analysis

OG Analysis, established in 2009 has 14+ years of experience and served 1800+ clients from 980+ companies operating in 54+ countries. OG Analysis is a leading provider of market research reports in Chemicals, Energy, Oil & Gas, Food & Beverage, Electronics & Semiconductors, Automotive, Telecommunication, Healthcare and Other industries.