The Global Friction Materials Market: Shifting Gears Toward Sustainable Performance

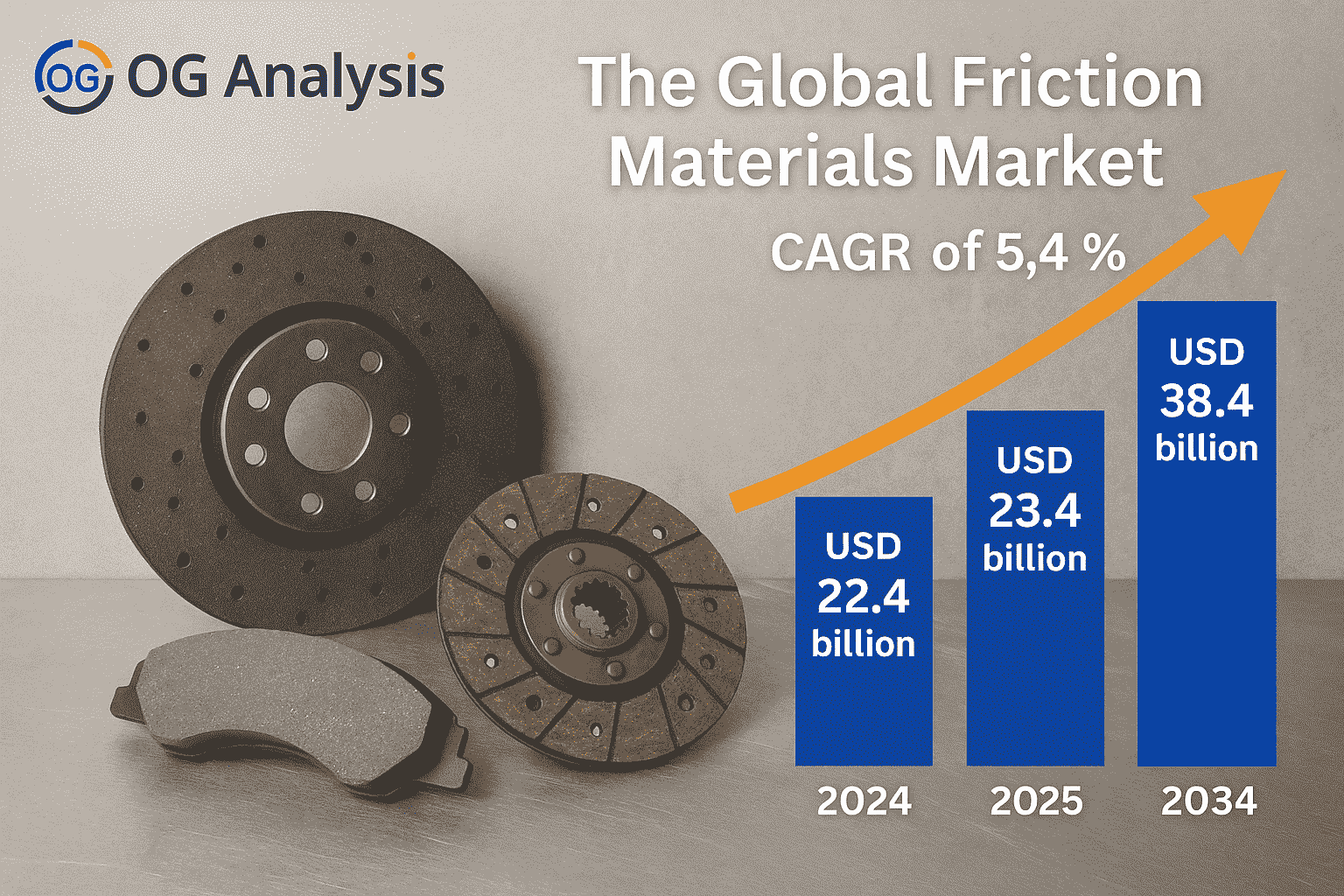

The Global Friction Materials Market is accelerating with purpose. Valued at USD 22.4 billion in 2024, the market is projected to reach USD 23.4 billion in 2025 — and it's not slowing down. With a projected CAGR of 5.4%, the market is expected to reach an impressive USD 38.4 billion by 2034. These materials, vital for clutch and brake systems, gear tooth systems, and more, are seeing heightened demand as industries pursue better safety, durability, and environmental performance.

From automotive to aerospace, friction materials are an essential component for industries that rely on controlled motion and precision stopping power. As electric vehicles, high-speed rail, and next-gen aviation platforms evolve, the need for reliable and high-performance friction solutions is growing. Advanced ceramics, aramid fibers, and semi-metallic composites are replacing traditional asbestos-based materials, driving innovation across sectors.

1. How is the transition to electric vehicles impacting the demand for friction materials?

While EVs have fewer moving parts than traditional vehicles, they still rely heavily on braking systems. Regenerative braking adds complexity, pushing manufacturers to develop quieter, longer-lasting friction materials specifically tailored to electric drivetrains.

2. Are friction materials moving away from asbestos — and what’s replacing it?

Yes, the industry is steering away from asbestos due to health and regulatory concerns. Modern alternatives like ceramic, aramid fiber, and sintered metal compositions offer enhanced performance while maintaining safety and compliance with global standards.

3. Which end-use industries are driving the highest demand for friction materials?

The automotive sector remains dominant, but demand is revving up in aerospace, marine, and construction, where high-pressure systems and braking precision are essential. Railway is also a key growth vertical, particularly in developing regions.

Click Here for the Full Market Report

4. What innovation trends are reshaping the friction materials landscape in 2024 and beyond?

Nano-coatings, thermal-resistant fibers, and eco-friendly binders are just a few of the innovations making headlines. These advancements aim to reduce noise, improve lifespan, and deliver consistent friction across extreme temperatures and pressures.

5. How are sustainability goals influencing the friction materials market?

Sustainability is now a strategic focus. Manufacturers are investing in recyclable, non-toxic materials and greener production processes. The shift not only meets environmental mandates but also aligns with automakers’ and aviation firms’ ESG commitments.

6. Which regions are leading in production and consumption of friction materials?

Asia-Pacific especially China and India is a powerhouse in both manufacturing and consumption. Europe and North America, meanwhile, remain leaders in innovation and regulatory compliance, driving demand for premium, eco-conscious solutions.

7. Who are the major players shaping the global friction materials industry?

Market leaders include ABS Friction Corp., ANAND Group, Carlisle Brake & Friction, ITT Inc., MIBA AG, Nisshinbo Holdings Inc., and Hindustan Composites Ltd. These companies are investing heavily in R&D, automation, and expansion into high-growth regions.

Click Here for the Full Market Report

Segmentation Overview: Understanding Market Structure:

-

By Type: Discs, Pads, Blocks, Linings, Other Types

-

By Material: Ceramic, Asbestos, Semi-metallic, Sintered Metals, Aramid Fibers, Other Materials

-

By Application: Clutch and Brake Systems, Gear Tooth Systems, Other Applications

-

By End Use: Automotive, Railway, Construction, Aerospace and Marine, Others

-

By Geography:

-

North America (USA, Canada, Mexico)

-

Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

-

Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

-

The Middle East and Africa

-

South and Central America (Brazil, Argentina, Rest of SCA)

-

Key Players of the Market:

-

ABS FRICTION CORP.

-

ANAND Group

-

Carlisle Brake & Friction (CBF)

-

European Friction Industries Ltd

-

GMP Friction Products

-

Hindustan Composites Ltd.

-

ITT INC.

-

MIBA AG

-

Nisshinbo Holdings Inc.

Click Here for the Full Market Report

Explore More Industry Insights:

|

Global Electric Vehicle Telematics Market Outlook Report

|

|

| Global Micro Electric Vehicle Market Outlook Report |

Connect with us on:

Phone: +91 888 64 99099

Email: mailto:sales@oganalysis.com

Learn More about OG Analysis

OG Analysis, established in 2009 has 14+ years of experience and served 1800+ clients from 980+ companies operating in 54+ countries. OG Analysis is a leading provider of market research reports in Chemicals, Energy, Oil & Gas, Food & Beverage, Electronics & Semiconductors, Automotive, Telecommunication, Healthcare and Other industries.