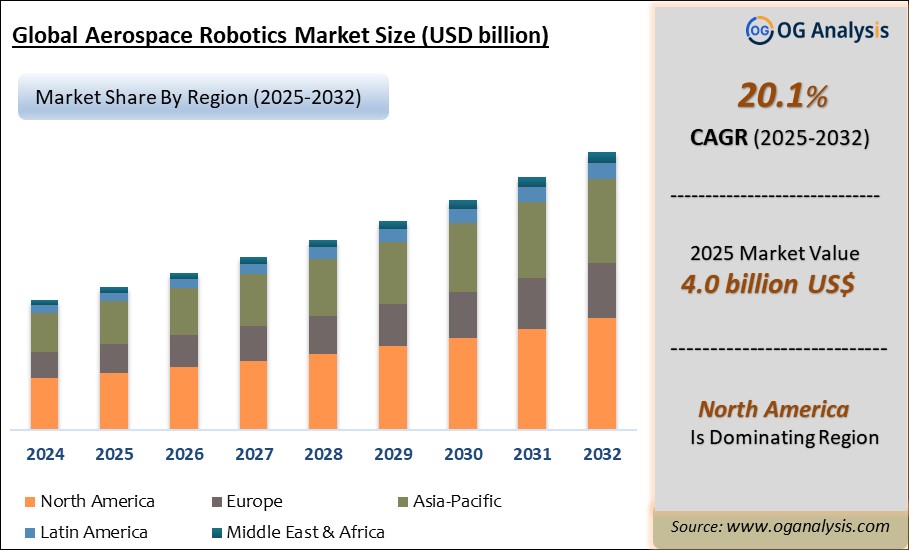

"The Global Aerospace Robotics Market Size was valued at USD 3.4 billion in 2024 and is projected to reach USD 4.0 billion in 2025. Worldwide sales of Aerospace Robotics are expected to grow at a significant CAGR of 20.1%, reaching USD 21.7 billion by the end of the forecast period in 2034."

The global aerospace robotics market is experiencing robust growth driven by increasing automation in aircraft manufacturing, rising demand for precision and efficiency, and the need to reduce operational costs and human error in production processes. Aerospace robotics involves the deployment of industrial robots, collaborative robots, and specialised automated systems across applications such as drilling, fastening, welding, composite fabrication, assembly, painting, and inspection in aircraft production lines. The market is witnessing strong adoption as aerospace OEMs and suppliers integrate advanced robotic solutions to enhance production rates, ensure consistent quality, and meet strict tolerances required in modern aircraft structures. The growing backlog of commercial aircraft orders, coupled with a shortage of skilled labour in aerospace manufacturing hubs, further fuels the demand for robotics to optimise workflows and increase output efficiency.

The market expansion is also supported by technological advancements such as AI-powered vision systems, lightweight robotic arms for composite material handling, and mobile robots for flexible manufacturing and maintenance operations. North America holds the largest market share, led by major aerospace manufacturers in the United States and Canada investing heavily in smart factory initiatives to remain competitive globally. Meanwhile, Europe, particularly Germany, France, and the UK, is also witnessing strong growth driven by automation programs in Airbus and other Tier-1 suppliers. Asia Pacific is emerging as a high-potential market with investments in domestic aircraft production programs in China, India, and Japan, along with the establishment of new aerospace manufacturing facilities adopting robotics to achieve global standards. However, the market faces challenges such as high initial capital costs, complex integration processes, and safety concerns in human-robot collaboration environments. Overall, the aerospace robotics market is poised for steady expansion as the industry embraces Industry 4.0, advanced automation, and robotics to meet future aircraft production demands efficiently and sustainably.

Articulated robots are the largest segment by type in the aerospace robotics market due to their flexibility, multi-axis movement, and ability to perform complex tasks such as drilling, fastening, welding, and composite fabrication. Their high payload capacity and adaptability make them essential in aircraft assembly lines for both structural and precision operations, driving their dominant market share globally.

Manufacturing is the largest application segment as robotics are extensively used in production processes including assembly, drilling, material handling, and surface treatment of aircraft components. The need for precision, repeatability, and efficiency in manufacturing large and complex aircraft structures supports the widespread adoption of robotics in this segment across major aerospace manufacturing hubs.

Key Insights

-

The aerospace robotics market is expanding steadily as OEMs and Tier-1 suppliers adopt automation to increase production efficiency, reduce labour dependency, and maintain precision in complex aircraft manufacturing processes. Robotics are used in drilling, fastening, welding, assembly, and composite fabrication, enabling consistent quality and reduced cycle times in production lines.

-

North America holds the largest market share due to established aerospace manufacturing hubs, major investments by companies like Boeing and Lockheed Martin in smart factory automation, and strong technological capabilities. The region leads in deploying robotics for composite material handling, automated drilling, and inspection applications in aircraft production.

-

Asia Pacific is the fastest-growing regional market driven by rising aircraft production programs in China, Japan, and India, supported by government initiatives to build indigenous aerospace capabilities. Companies in the region are investing in robotics to achieve global manufacturing standards and expand their presence in commercial aircraft supply chains.

-

Collaborative robots (cobots) are gaining traction in aerospace manufacturing due to their ability to work safely alongside human operators in assembly, material handling, and inspection tasks. Cobots enhance flexibility, reduce ergonomic risks, and improve productivity, especially in small to medium-sized component manufacturing and sub-assembly lines.

-

Advancements in robotic vision systems, AI-based path planning, and sensor integration are enabling precise and adaptive operations such as automated drilling of composite materials and accurate placement of fasteners. These technologies improve quality control and minimise rework, supporting cost reduction in aircraft manufacturing projects.

-

High initial capital investment remains a key challenge, as integrating robotics in aerospace production requires significant upfront costs, customised programming, and system integration with existing manufacturing setups. However, long-term operational savings, reduced wastage, and improved throughput are driving ROI-focused investments by major players.

-

Painting and coating robots are witnessing increased adoption to ensure uniform application, reduce material wastage, and comply with stringent environmental regulations on VOC emissions. Robotic systems provide consistent finishes while enhancing worker safety by minimising exposure to hazardous chemicals in aerospace paint shops.

-

Major companies such as KUKA, FANUC, ABB, Kawasaki Heavy Industries, and Yaskawa Electric are expanding their aerospace robotics offerings by developing lightweight, high-payload robotic arms and turnkey automation solutions tailored for aircraft fuselage, wing, and engine component manufacturing applications.

-

Automated guided vehicles (AGVs) and mobile robots are being integrated into aerospace production facilities for efficient intra-logistics, material transport, and parts movement across assembly lines, enabling lean manufacturing practices and improved factory floor utilisation.

-

The market outlook remains positive as aerospace OEMs increasingly adopt Industry 4.0 strategies, integrating robotics, IoT, AI, and digital twins to build smart manufacturing ecosystems that enhance operational agility, product quality, and competitiveness in a dynamic global aerospace sector.

Reort Scope

| Parameter | Detail |

|---|---|

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Type, By Application, By Component, By End-User, |

| Countries Covered | North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10 % free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

Market Segmentation

By Type:

- Articulated Robots

- Cartesian Robots

- SCARA Robots

- Cylindrical Robots

- Collaborative Robots

By Application:

- Manufacturing

- Maintenance & Inspection

- Quality Control

- Surface Treatment

- Welding

By Component:

- Controllers

- Sensors

- Drives

- End Effectors

- Others

By End-User:

- Commercial Aerospace

- Defense

- Space

By Region:

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

What You Receive

• Global Aerospace Robotics market size and growth projections (CAGR), 2024- 2034• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Aerospace Robotics.

• Aerospace Robotics market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Aerospace Robotics market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Aerospace Robotics market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Aerospace Robotics market, Aerospace Robotics supply chain analysis.

• Aerospace Robotics trade analysis, Aerospace Robotics market price analysis, Aerospace Robotics Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Aerospace Robotics market news and developments.

The Aerospace Robotics Market international scenario is well established in the report with separate chapters on North America Aerospace Robotics Market, Europe Aerospace Robotics Market, Asia-Pacific Aerospace Robotics Market, Middle East and Africa Aerospace Robotics Market, and South and Central America Aerospace Robotics Markets. These sections further fragment the regional Aerospace Robotics market by type, application, end-user, and country.

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways1. The report provides 2024 Aerospace Robotics market sales data at the global, regional, and key country levels with a detailed outlook to 2034, allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Aerospace Robotics market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Aerospace Robotics market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Aerospace Robotics business prospects by region, key countries, and top companies' information to channel their investments.

Available Customizations

The standard syndicate report is designed to serve the common interests of Aerospace Robotics Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below :

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Aerospace Robotics Pricing and Margins Across the Supply Chain, Aerospace Robotics Price Analysis / International Trade Data / Import-Export Analysis

Supply Chain Analysis, Supply–Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Aerospace Robotics market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days.

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Aerospace Robotics Market is estimated to generate USD 3.4 billion in revenue in 2024.

The Global Aerospace Robotics Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 20.1% during the forecast period from 2025 to 2032.

The Aerospace Robotics Market is estimated to reach USD 14.7 billion by 2032.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!