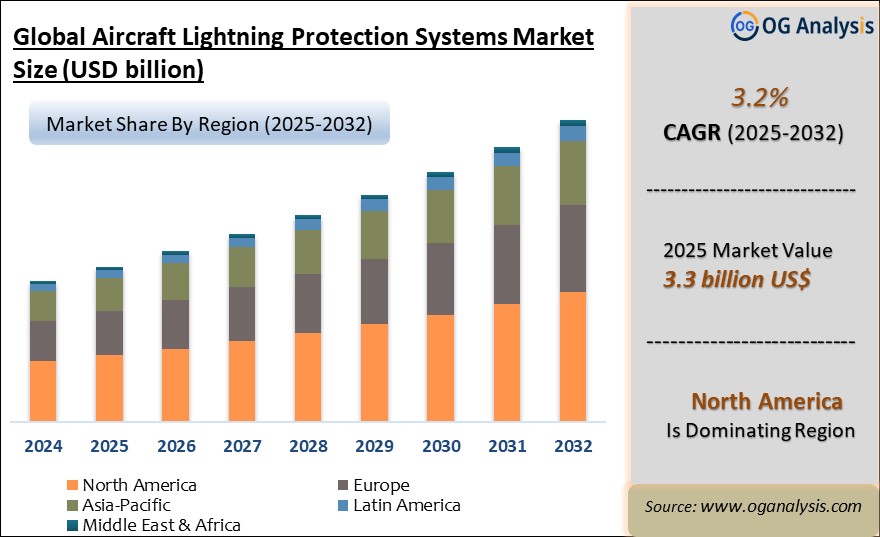

"The Global Aircraft Lightning Protection Systems Market Size was valued at USD 3.2 billion in 2024 and is projected to reach USD 3.3 billion in 2025. Worldwide sales of Aircraft Lightning Protection Systems are expected to grow at a significant CAGR of 3.2%, reaching USD 4.4 billion by the end of the forecast period in 2034."

Introduction and Market Overview

The Aircraft Lightning Protection Systems Market plays a critical role in ensuring the safety and operational efficiency of modern aviation. With increasing air traffic and advancements in aircraft design, the need for reliable protection against lightning strikes has become paramount. Lightning can cause significant damage to aircraft structures and systems, which may lead to service interruptions or, in severe cases, catastrophic failure. As a result, the adoption of advanced lightning protection systems, which are designed to safeguard both the external and internal components of aircraft, is a vital consideration for aerospace manufacturers and operators alike. These systems are integrated into various parts of an aircraft, including fuselage, wings, and electronics, to ensure minimal impact in the event of a strike.

Market growth for aircraft lightning protection systems is largely driven by the expanding global aviation industry, with demand coming from both commercial and military sectors. Aircraft manufacturers are increasingly adopting innovative materials and designs that require enhanced lightning protection, particularly in next-generation planes that feature composite materials. Regulatory bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) have also tightened safety guidelines, encouraging further investment in lightning protection technologies. As the aviation industry continues to evolve, the Aircraft Lightning Protection Systems Market is set to witness significant expansion in the coming years.

Latest Trends

One of the most significant trends in the Aircraft Lightning Protection Systems Market is the shift toward the use of composite materials in aircraft manufacturing. Composite materials, while lighter and more fuel-efficient, are less conductive than traditional metal components, making them more vulnerable to lightning strikes. To address this, manufacturers are investing in advanced lightning protection technologies, such as expanded metal foil and lightning diverters, to safeguard these new designs. The growing adoption of electric and hybrid-electric aircraft is also creating opportunities for specialized lightning protection systems tailored to these aircraft types, which have unique vulnerabilities due to their electrical architecture.

Another emerging trend is the integration of predictive maintenance and monitoring solutions in lightning protection systems. These systems now come equipped with sensors that track the impact of lightning strikes in real-time, enabling airlines and maintenance teams to proactively address any potential damage before it affects the aircraft's operation. This trend aligns with the broader digital transformation of the aerospace industry, where data-driven insights are becoming integral to improving aircraft performance, safety, and cost efficiency. Additionally, developments in simulation technologies are allowing engineers to better predict how lightning will interact with various aircraft components, leading to more effective protection strategies.

Market Drivers

The growth of the Aircraft Lightning Protection Systems Market is fueled by several key drivers. First, the increasing number of aircraft in service worldwide has led to greater demand for safety systems, including lightning protection. With air traffic steadily rising, airlines are investing in robust protection systems to minimize downtime and ensure passenger safety. Additionally, the growing focus on composite materials in aircraft construction, particularly for commercial and military jets, has made lightning protection systems a mandatory component, as these materials require specialized solutions.

Regulatory mandates are another major driver for this market. Aviation safety agencies such as the FAA and EASA have established stringent standards for lightning protection in aircraft, which manufacturers must comply with to gain certification. These regulations not only ensure safety but also encourage ongoing innovation in the field. Furthermore, the rise of new aircraft programs and the push for more fuel-efficient planes are contributing to the demand for advanced protection systems. Airlines and aircraft manufacturers are seeking ways to enhance performance while meeting safety requirements, creating a strong market for innovative lightning protection technologies.

Market Challenges

Despite the promising growth outlook, the Aircraft Lightning Protection Systems Market faces several challenges. One of the primary hurdles is the high cost associated with the development and implementation of advanced lightning protection systems. The need for specialized materials and cutting-edge technologies can drive up costs, making it a significant investment for aircraft manufacturers and operators. This issue is particularly pressing for smaller airlines and aerospace companies that may have limited budgets for safety upgrades. Additionally, the long certification processes required for these systems to meet regulatory standards can delay the adoption of newer technologies, hindering market growth.

Another challenge is the evolving design of next-generation aircraft. As manufacturers continue to innovate with lightweight composite materials and electric propulsion systems, developing lightning protection solutions that are both effective and adaptable can be complex. These new designs present unique vulnerabilities that may require custom solutions, increasing the time and cost associated with protection system development. Moreover, ensuring compatibility between lightning protection systems and other safety or performance-enhancing technologies is an ongoing challenge for industry players.

North America is the largest region in the Aircraft Lightning Protection Systems market, propelled by advanced aerospace manufacturing capabilities, stringent safety regulations, and a high concentration of commercial and military aircraft operators. The commercial aviation segment dominates the market, fueled by the increasing demand for new aircraft and modernization of existing fleets to enhance lightning protection and ensure passenger safety.

Market Players

Honeywell International Inc.

Parker Hannifin Corporation

The Boeing Company

L3Harris Technologies, Inc.

Cobham Limited

Ametek, Inc.

Raytheon Technologies Corporation

BAE Systems plc

Safran S.A.

Thales Group

Lockheed Martin Corporation

Carlisle Interconnect Technologies

LORD Corporation (a Parker Hannifin company)

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By protection Type, By Aircraft Type, By End-user and By Fit |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Protection Type

- Expanded metal foils

- Interwoven wire

- Conductive paints and coatings

- Plated carbon fiber

- Other

By Aircraft Type

- Fixed-wing Aircraft

- Rotorcraft

- Unmanned Aerial Vehicles

By End User

- Civil

- Military

By Fit

- Line-Fit

- Retrofit

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Aircraft Lightning Protection Systems Latest Trends, Drivers and Challenges, 2024- 2032

2.1 Aircraft Lightning Protection Systems Overview

2.2 Key Strategies of Leading Aircraft Lightning Protection Systems Companies

2.3 Aircraft Lightning Protection Systems Insights, 2024- 2032

2.3.1 Leading Aircraft Lightning Protection Systems Types, 2024- 2032

2.3.2 Leading Aircraft Lightning Protection Systems End-User industries, 2024- 2032

2.3.3 Fast-Growing countries for Aircraft Lightning Protection Systems sales, 2024- 2032

2.4 Aircraft Lightning Protection Systems Drivers and Restraints

2.4.1 Aircraft Lightning Protection Systems Demand Drivers to 2032

2.4.2 Aircraft Lightning Protection Systems Challenges to 2032

2.5 Aircraft Lightning Protection Systems- Five Forces Analysis

2.5.1 Aircraft Lightning Protection Systems Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Aircraft Lightning Protection Systems Value, Market Share, and Forecast to 2032

3.1 Global Aircraft Lightning Protection Systems Overview, 2024

3.2 Global Aircraft Lightning Protection Systems Revenue and Forecast, 2024- 2032 (US$ Million)

3.3 Global Aircraft Lightning Protection Systems Size and Share Outlook By Protection Type, 2024- 2032

3.3.1 Expanded metal foils

3.3.2 Interwoven wire

3.3.3 Conductive paints and coatings

3.3.4 Plated carbon fiber

3.3.5 Other

3.4 Global Aircraft Lightning Protection Systems Size and Share Outlook By Aircraft Type, 2024- 2032

3.4.1 Fixed-wing Aircraft

3.4.2 Rotorcraft

3.4.3 Unmanned Aerial Vehicles

3.5 Global Aircraft Lightning Protection Systems Size and Share Outlook By End User, 2024- 2032

3.5.1 Civil

3.5.2 Military

3.6 Global Aircraft Lightning Protection Systems Size and Share Outlook By Fit, 2024- 2032

3.6.1 Line-Fit

3.6.2 Retrofit

3.7 Global Aircraft Lightning Protection Systems Size and Share Outlook by Region, 2024- 2032

4. Asia Pacific Aircraft Lightning Protection Systems Value, Market Share and Forecast to 2032

4.1 Asia Pacific Aircraft Lightning Protection Systems Overview, 2024

4.2 Asia Pacific Aircraft Lightning Protection Systems Revenue and Forecast, 2024- 2032 (US$ Million)

4.3 Asia Pacific Aircraft Lightning Protection Systems Size and Share Outlook By Protection Type, 2024- 2032

4.4 Asia Pacific Aircraft Lightning Protection Systems Size and Share Outlook By Aircraft Type, 2024- 2032

4.5 Asia Pacific Aircraft Lightning Protection Systems Size and Share Outlook By End User, 2024- 2032

4.6 Asia Pacific Aircraft Lightning Protection Systems Size and Share Outlook By Fit, 2024- 2032

4.7 Asia Pacific Aircraft Lightning Protection Systems Size and Share Outlook by Country, 2024- 2032

4.8 Key Companies in Asia Pacific Aircraft Lightning Protection Systems

5. Europe Aircraft Lightning Protection Systems Value, Market Share, and Forecast to 2032

5.1 Europe Aircraft Lightning Protection Systems Overview, 2024

5.2 Europe Aircraft Lightning Protection Systems Revenue and Forecast, 2024- 2032 (US$ Million)

5.3 Europe Aircraft Lightning Protection Systems Size and Share Outlook By Protection Type, 2024- 2032

5.4 Europe Aircraft Lightning Protection Systems Size and Share Outlook By Aircraft Type, 2024- 2032

5.5 Europe Aircraft Lightning Protection Systems Size and Share Outlook By End User, 2024- 2032

5.6 Europe Aircraft Lightning Protection Systems Size and Share Outlook By Fit, 2024- 2032

5.7 Europe Aircraft Lightning Protection Systems Size and Share Outlook by Country, 2024- 2032

5.8 Key Companies in Europe Aircraft Lightning Protection Systems

6. North America Aircraft Lightning Protection Systems Value, Market Share and Forecast to 2032

6.1 North America Aircraft Lightning Protection Systems Overview, 2024

6.2 North America Aircraft Lightning Protection Systems Revenue and Forecast, 2024- 2032 (US$ Million)

6.3 North America Aircraft Lightning Protection Systems Size and Share Outlook By Protection Type, 2024- 2032

6.4 North America Aircraft Lightning Protection Systems Size and Share Outlook By Aircraft Type, 2024- 2032

6.5 North America Aircraft Lightning Protection Systems Size and Share Outlook By End User, 2024- 2032

6.6 North America Aircraft Lightning Protection Systems Size and Share Outlook By Fit, 2024- 2032

6.7 North America Aircraft Lightning Protection Systems Size and Share Outlook by Country, 2024- 2032

6.8 Key Companies in North America Aircraft Lightning Protection Systems

7. South and Central America Aircraft Lightning Protection Systems Value, Market Share and Forecast to 2032

7.1 South and Central America Aircraft Lightning Protection Systems Overview, 2024

7.2 South and Central America Aircraft Lightning Protection Systems Revenue and Forecast, 2024- 2032 (US$ Million)

7.3 South and Central America Aircraft Lightning Protection Systems Size and Share Outlook By Protection Type, 2024- 2032

7.4 South and Central America Aircraft Lightning Protection Systems Size and Share Outlook By Aircraft Type, 2024- 2032

7.5 South and Central America Aircraft Lightning Protection Systems Size and Share Outlook By End User, 2024- 2032

7.6 South and Central America Aircraft Lightning Protection Systems Size and Share Outlook By Fit, 2024- 2032

7.7 South and Central America Aircraft Lightning Protection Systems Size and Share Outlook by Country, 2024- 2032

7.8 Key Companies in South and Central America Aircraft Lightning Protection Systems

8. Middle East Africa Aircraft Lightning Protection Systems Value, Market Share and Forecast to 2032

8.1 Middle East Africa Aircraft Lightning Protection Systems Overview, 2024

8.2 Middle East and Africa Aircraft Lightning Protection Systems Revenue and Forecast, 2024- 2032 (US$ Million)

8.3 Middle East Africa Aircraft Lightning Protection Systems Size and Share Outlook By Protection Type, 2024- 2032

8.4 Middle East Africa Aircraft Lightning Protection Systems Size and Share Outlook By Aircraft Type, 2024- 2032

8.5 Middle East Africa Aircraft Lightning Protection Systems Size and Share Outlook By End User, 2024- 2032

8.6 Middle East Africa Aircraft Lightning Protection Systems Size and Share Outlook By Fit, 2024- 2032

8.7 Middle East Africa Aircraft Lightning Protection Systems Size and Share Outlook by Country, 2024- 2032

8.8 Key Companies in Middle East Africa Aircraft Lightning Protection Systems

9. Aircraft Lightning Protection Systems Structure

9.1 Key Players

9.2 Aircraft Lightning Protection Systems Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Aircraft Lightning Protection Systems Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Aircraft Lightning Protection Systems Market is estimated to reach USD 4.1 billion by 2032.

The Global Aircraft Lightning Protection Systems Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 3.2% during the forecast period from 2025 to 2032.

The Global Aircraft Lightning Protection Systems Market is estimated to generate USD 3.2 billion in revenue in 2024.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!