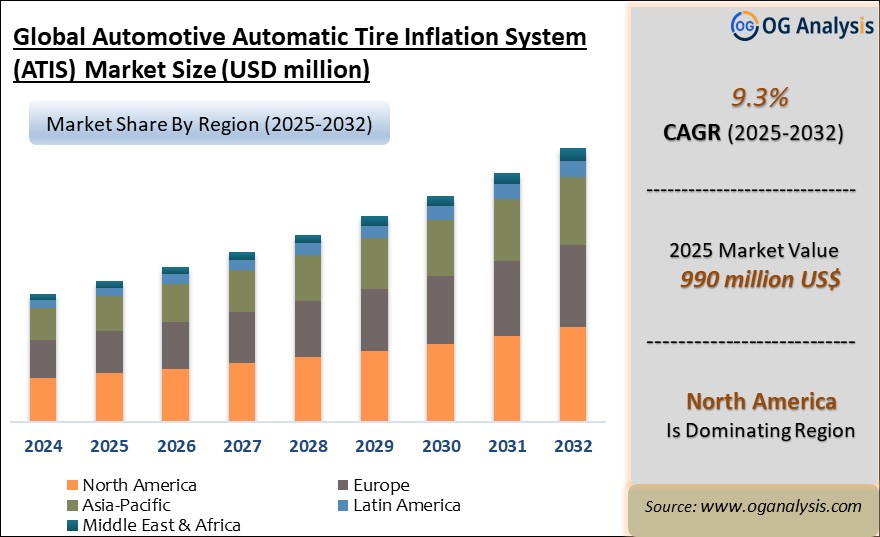

"The Global Automotive Automatic Tire Inflation System Market Size was valued at USD 917 million in 2024 and is projected to reach USD 990 million in 2025. Worldwide sales of Automotive Automatic Tire Inflation System are expected to grow at a significant CAGR of 9.3%, reaching USD 2,255 million by the end of the forecast period in 2034."

Introduction and Overview of the Automotive Automatic Tire Inflation System Market

The Automotive Automatic Tire Inflation System (ATIS) market is rapidly gaining prominence due to the increasing demand for safety, fuel efficiency, and vehicle performance optimization in the automotive industry. ATIS technology allows vehicles to automatically maintain the correct tire pressure, which directly impacts fuel economy, tire lifespan, and vehicle handling. With the growing awareness of the benefits of well-maintained tire pressure, including reducing carbon emissions and improving road safety, ATIS has become a sought-after feature in both commercial and passenger vehicles. Moreover, the rise in long-haul transportation, coupled with stringent government regulations on vehicle safety and fuel efficiency, is driving the adoption of ATIS solutions globally.

The market has witnessed significant growth as manufacturers incorporate ATIS into their vehicle portfolios, particularly in trucks, buses, and heavy-duty vehicles. The increasing focus on reducing vehicular downtime, improving fleet management efficiency, and enhancing tire life expectancy further bolsters the demand for ATIS systems. In addition, the push towards smart vehicles and the integration of advanced technologies such as the Internet of Things (IoT) in automotive systems are contributing to the expansion of the ATIS market. Key players in the market are continuously innovating to improve product reliability and cost-effectiveness, making ATIS solutions more accessible to a broader range of vehicles.

North America is the leading region in the automotive automatic tire inflation system market, powered by stringent vehicle safety regulations, high adoption of advanced commercial vehicle technologies, and the presence of key industry players focused on fleet efficiency and tire performance optimization.

Latest Trends in the Automotive Automatic Tire Inflation System Market

The Automotive ATIS market is evolving with several notable trends that are reshaping the industry landscape. One of the key trends is the integration of IoT and telematics in ATIS, enabling real-time monitoring and data analytics to improve tire management. This innovation allows fleet managers to track tire performance remotely and receive notifications for maintenance, leading to increased efficiency and reduced operational costs. Furthermore, the shift towards electric vehicles (EVs) and hybrid vehicles is creating new opportunities for ATIS manufacturers as these vehicles benefit from improved energy efficiency through optimal tire pressure.

Another significant trend is the growing adoption of ATIS in passenger vehicles. Initially prevalent in commercial trucks and heavy-duty vehicles, ATIS is now being incorporated into passenger cars, especially in premium and luxury models. This shift is driven by the increasing consumer demand for advanced safety features and improved driving comfort. Additionally, regulatory bodies in various regions are mandating stricter vehicle safety standards, further encouraging the use of ATIS in both commercial and passenger vehicles. The rise of autonomous vehicles and smart mobility solutions is also contributing to the increased demand for ATIS systems as part of a larger suite of advanced driver assistance systems (ADAS).

The trend of sustainability is also influencing the ATIS market. With a growing focus on reducing environmental impact, ATIS systems are being positioned as a key solution for minimizing fuel consumption and lowering carbon emissions. This aligns with global initiatives aimed at achieving greener transportation. As a result, manufacturers are investing in research and development to create more energy-efficient and eco-friendly ATIS systems that align with the automotive industry's sustainability goals.

Key Drivers of the Automotive Automatic Tire Inflation System Market

Several factors are driving the growth of the Automotive ATIS market, with safety and fuel efficiency being the primary motivators. Maintaining optimal tire pressure improves vehicle handling and reduces the risk of tire blowouts, which enhances overall road safety. This is particularly important in long-haul trucking, where vehicle downtime due to tire-related issues can lead to significant financial losses. ATIS technology helps prevent such problems by ensuring that tires are always at the correct pressure, thus reducing maintenance costs and prolonging tire life.

Fuel efficiency is another crucial driver, as proper tire inflation can lead to substantial fuel savings. Under-inflated tires cause increased rolling resistance, which reduces fuel economy. By automatically adjusting tire pressure to the ideal level, ATIS systems help optimize fuel consumption, which is especially valuable for commercial fleets. In a market where fuel costs represent a significant portion of operating expenses, the adoption of ATIS can provide a competitive advantage by lowering overall fuel consumption.

Moreover, government regulations aimed at improving vehicle safety and environmental performance are promoting the adoption of ATIS systems. In many regions, such as North America and Europe, there are mandates requiring tire pressure monitoring systems (TPMS) in vehicles, and ATIS represents an advanced solution to meet these regulatory requirements. As regulatory frameworks become more stringent, especially concerning emissions and fuel efficiency, the demand for ATIS technology is expected to rise, driving market growth.

Market Challenges in the Automotive Automatic Tire Inflation System Market

Despite the promising growth trajectory, the Automotive ATIS market faces several challenges. One of the primary challenges is the high cost of installation and maintenance. While ATIS provides long-term benefits in terms of fuel efficiency and tire longevity, the initial investment is often seen as a barrier, particularly for small fleet operators and cost-sensitive consumers. Additionally, integrating ATIS into vehicles requires significant technical expertise, which can drive up the cost of both installation and repairs, limiting the adoption of these systems in budget-friendly vehicle segments.

Another challenge lies in the varying compatibility of ATIS with different vehicle models and tire types. Not all vehicles are equipped with the necessary infrastructure to support automatic inflation systems, and this limits the potential for widespread adoption across all vehicle categories. Furthermore, in regions with harsh weather conditions, the reliability of ATIS systems can be compromised, requiring additional technological advancements to ensure consistent performance.

Market Players

Michelin

Goodyear

Bridgestone

Continental AG

Dana Incorporated

Hendrickson

Pressure Systems International (PSI)

Nexter Group

Meritor, Inc.

Aperia Technologies, Inc.

STEMCO (EnPro Industries)

Haldex AB

WABCO (ZF Group)

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD million |

| Market Splits Covered | By Type, By Technology Node, By Component, By Foundry Type, By Vehicle Type, By Application, By Sales Channel |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Type

- Central Tire Inflation

- Continuous Tire Inflation

- Others

By Technology Node

- 10/7/5 nm

- 16/14 nm

- 20 nm

- 28 nm

- 45/40 nm

- Others

By Component

- Rotary Union

- Compressor

- Pressure Sensor

- Air Delivery System

- Other

By Foundry Type

- Pure Play Foundry

- IDMs

By Vehicle Type

- On-Highway Vehicle(Light Duty and Heavy Duty Vehicle)

- Off-Highway Vehicle(Agriculture tractors and Construction Vehicle)

- Electric heavy-duty vehicles(Battery Electric Vehicle,Plug-In Hybrid Electric Vehicle and Fuel Cell Electric Vehicle)

By Application

- Communication

- Consumer Electronics

- Computer

- Automotive

- Others

By Sales Channel

- OEM

- Aftermarket

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Automotive Automatic Tire Inflation System Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Automotive Automatic Tire Inflation System Market Overview

2.2 Key Strategies of Leading Automotive Automatic Tire Inflation System Companies

2.3 Automotive Automatic Tire Inflation System Market Insights, 2024- 2034

2.3.1 Leading Automotive Automatic Tire Inflation System Types, 2024- 2034

2.3.2 Leading Automotive Automatic Tire Inflation System End-User industries, 2024- 2034

2.3.3 Fast-Growing countries for Automotive Automatic Tire Inflation System sales, 2024- 2034

2.4 Automotive Automatic Tire Inflation System Market Drivers and Restraints

2.4.1 Automotive Automatic Tire Inflation System Demand Drivers to 2034

2.4.2 Automotive Automatic Tire Inflation System Challenges to 2034

2.5 Automotive Automatic Tire Inflation System Market- Five Forces Analysis

2.5.1 Automotive Automatic Tire Inflation System Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Automotive Automatic Tire Inflation System Market Value, Market Share, and Forecast to 2034

3.1 Global Automotive Automatic Tire Inflation System Market Overview, 2024

3.2 Global Automotive Automatic Tire Inflation System Market Revenue and Forecast, 2024- 2034 (US$ Million)

3.3 Global Automotive Automatic Tire Inflation System Market Size and Share Outlook By Type, 2024- 2034

3.3.1 Central Tire Inflation

3.3.2 Continuous Tire Inflation

3.3.3 Others

3.4 Global Automotive Automatic Tire Inflation System Market Size and Share Outlook By Technology Node, 2024- 2034

3.4.1 10/7/5 nm

3.4.2 16/14 nm

3.4.3 20 nm

3.4.4 28 nm

3.4.5 45/40 nm

3.4.6 Others

3.5 Global Automotive Automatic Tire Inflation System Market Size and Share Outlook By Component, 2024- 2034

3.5.1 Rotary Union

3.5.2 Compressor

3.5.3 Pressure Sensor

3.5.4 Air Delivery System

3.5.5 Other

3.6 Global Automotive Automatic Tire Inflation System Market Size and Share Outlook By Application, 2024- 2034

3.6.1 Communication

3.6.2 Consumer Electronics

3.6.3 Computer

3.6.4 Automotive

3.6.5 Others

3.7 Global Automotive Automatic Tire Inflation System Market Size and Share Outlook by Region, 2024- 2034

4. Asia Pacific Automotive Automatic Tire Inflation System Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Automotive Automatic Tire Inflation System Market Overview, 2024

4.2 Asia Pacific Automotive Automatic Tire Inflation System Market Revenue and Forecast, 2024- 2034 (US$ Million)

4.3 Asia Pacific Automotive Automatic Tire Inflation System Market Size and Share Outlook By Type, 2024- 2034

4.4 Asia Pacific Automotive Automatic Tire Inflation System Market Size and Share Outlook By Technology Node, 2024- 2034

4.5 Asia Pacific Automotive Automatic Tire Inflation System Market Size and Share Outlook By Component, 2024- 2034

4.6 Asia Pacific Automotive Automatic Tire Inflation System Market Size and Share Outlook By Application, 2024- 2034

4.7 Asia Pacific Automotive Automatic Tire Inflation System Market Size and Share Outlook by Country, 2024- 2034

4.8 Key Companies in Asia Pacific Automotive Automatic Tire Inflation System Market

5. Europe Automotive Automatic Tire Inflation System Market Value, Market Share, and Forecast to 2034

5.1 Europe Automotive Automatic Tire Inflation System Market Overview, 2024

5.2 Europe Automotive Automatic Tire Inflation System Market Revenue and Forecast, 2024- 2034 (US$ Million)

5.3 Europe Automotive Automatic Tire Inflation System Market Size and Share Outlook By Type, 2024- 2034

5.4 Europe Automotive Automatic Tire Inflation System Market Size and Share Outlook By Technology Node, 2024- 2034

5.5 Europe Automotive Automatic Tire Inflation System Market Size and Share Outlook By Component, 2024- 2034

5.6 Europe Automotive Automatic Tire Inflation System Market Size and Share Outlook By Application, 2024- 2034

5.7 Europe Automotive Automatic Tire Inflation System Market Size and Share Outlook by Country, 2024- 2034

5.8 Key Companies in Europe Automotive Automatic Tire Inflation System Market

6. North America Automotive Automatic Tire Inflation System Market Value, Market Share and Forecast to 2034

6.1 North America Automotive Automatic Tire Inflation System Market Overview, 2024

6.2 North America Automotive Automatic Tire Inflation System Market Revenue and Forecast, 2024- 2034 (US$ Million)

6.3 North America Automotive Automatic Tire Inflation System Market Size and Share Outlook By Type, 2024- 2034

6.4 North America Automotive Automatic Tire Inflation System Market Size and Share Outlook By Technology Node, 2024- 2034

6.5 North America Automotive Automatic Tire Inflation System Market Size and Share Outlook By Component, 2024- 2034

6.6 North America Automotive Automatic Tire Inflation System Market Size and Share Outlook By Application, 2024- 2034

6.7 North America Automotive Automatic Tire Inflation System Market Size and Share Outlook by Country, 2024- 2034

6.8 Key Companies in North America Automotive Automatic Tire Inflation System Market

7. South and Central America Automotive Automatic Tire Inflation System Market Value, Market Share and Forecast to 2034

7.1 South and Central America Automotive Automatic Tire Inflation System Market Overview, 2024

7.2 South and Central America Automotive Automatic Tire Inflation System Market Revenue and Forecast, 2024- 2034 (US$ Million)

7.3 South and Central America Automotive Automatic Tire Inflation System Market Size and Share Outlook By Type, 2024- 2034

7.4 South and Central America Automotive Automatic Tire Inflation System Market Size and Share Outlook By Technology Node, 2024- 2034

7.5 South and Central America Automotive Automatic Tire Inflation System Market Size and Share Outlook By Component, 2024- 2034

7.6 South and Central America Automotive Automatic Tire Inflation System Market Size and Share Outlook By Application, 2024- 2034

7.7 South and Central America Automotive Automatic Tire Inflation System Market Size and Share Outlook by Country, 2024- 2034

7.8 Key Companies in South and Central America Automotive Automatic Tire Inflation System Market

8. Middle East Africa Automotive Automatic Tire Inflation System Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Automotive Automatic Tire Inflation System Market Overview, 2024

8.2 Middle East and Africa Automotive Automatic Tire Inflation System Market Revenue and Forecast, 2024- 2034 (US$ Million)

8.3 Middle East Africa Automotive Automatic Tire Inflation System Market Size and Share Outlook By Type, 2024- 2034

8.4 Middle East Africa Automotive Automatic Tire Inflation System Market Size and Share Outlook By Technology Node, 2024- 2034

8.5 Middle East Africa Automotive Automatic Tire Inflation System Market Size and Share Outlook By Component, 2024- 2034

8.6 Middle East Africa Automotive Automatic Tire Inflation System Market Size and Share Outlook By Application, 2024- 2034

8.7 Middle East Africa Automotive Automatic Tire Inflation System Market Size and Share Outlook by Country, 2024- 2034

8.8 Key Companies in Middle East Africa Automotive Automatic Tire Inflation System Market

9. Automotive Automatic Tire Inflation System Market Structure

9.1 Key Players

9.2 Automotive Automatic Tire Inflation System Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Automotive Automatic Tire Inflation System Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information"

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Automotive Automatic Tire Inflation System Market is estimated to generate USD 917 million in revenue in 2024.

The Global Automotive Automatic Tire Inflation System Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.3% during the forecast period from 2025 to 2032.

The Automotive Automatic Tire Inflation System Market is estimated to reach USD 1867.8 million by 2032.

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!