Inside the Rapid Rise of the Global Metal Additive Manufacturing Market

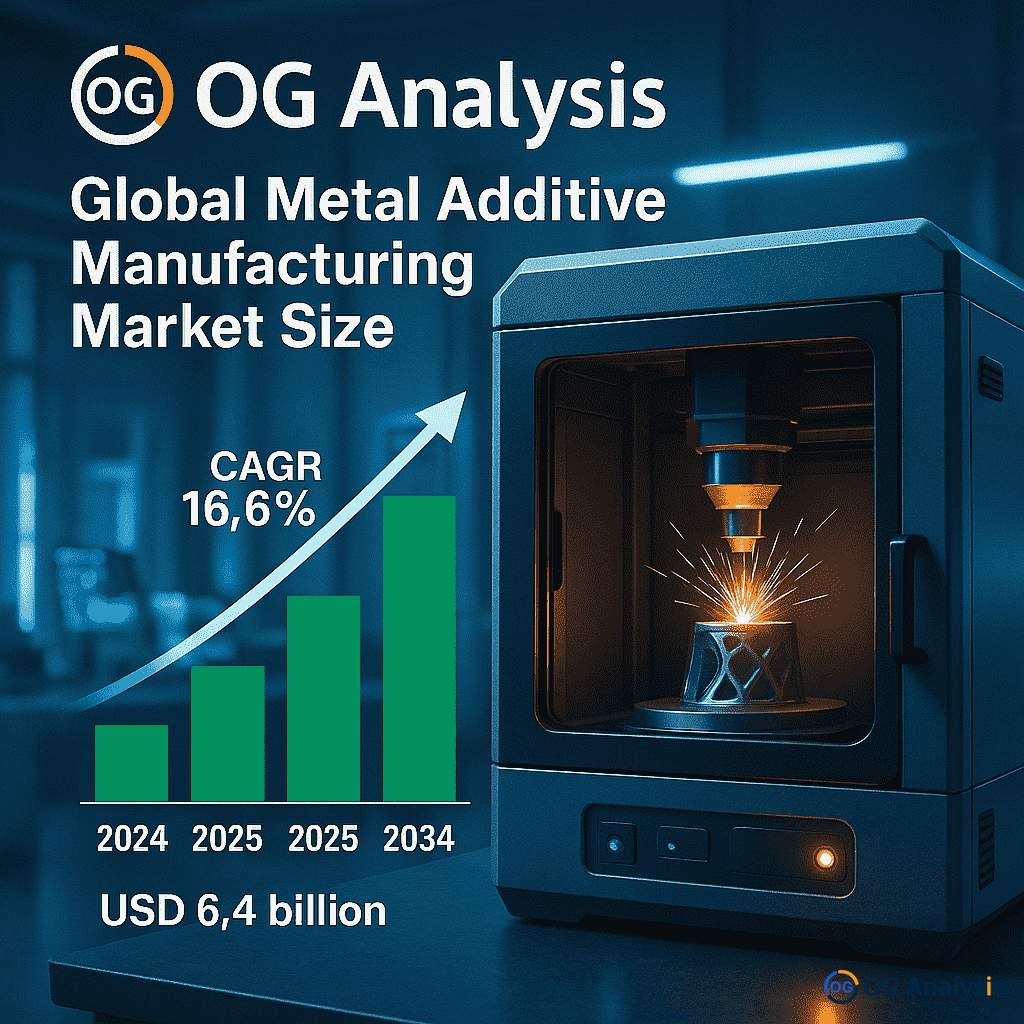

Valued at USD 5.6 billion in 2024 and projected to reach USD 6.4 billion in 2025, the Global Metal Additive Manufacturing (AM) Market is charging ahead at an impressive CAGR of 16.6 %, on course to hit USD 26.3 billion by 2034. Advances in powder-based processes, demand for lightweight yet high-performance parts, and the steady maturation of standards are reshaping how industries—from aerospace to healthcare—design and build metal components. Below are seven thought-provoking questions that unpack the present landscape, hottest trends, emerging opportunities, and regional dynamics shaping this fast-evolving market.

1. What factors are pushing metal additive manufacturing from niche prototyping to full-scale production?

Heightened need for complex, weight-optimized parts, supply-chain resilience, and the falling cost of metal powders are convincing OEMs that AM is no longer just a prototyping tool. Aerospace primes now certify flight-critical parts, while medical device makers leverage patient-specific implants to shorten recovery times and improve outcomes.

2. Which metal AM technologies are stealing the spotlight—and why?

Powder Bed Fusion dominates for its fine feature resolution, yet Binder Jetting and Bound Powder Extrusion are gaining traction for faster throughput and lower part cost. Meanwhile, Direct Energy Deposition is winning fans in repair and large-format applications, especially in oil & gas and heavy equipment.

3. How are advances in materials transforming the economics of metal AM?

The shift from premium aerospace alloys to more cost-effective stainless steels, tool steels, and copper blends is broadening adoption. New parameter sets allow higher build rates, while recycled powder and sustainable feedstocks reduce waste and edge the technology closer to circular-manufacturing mandates.

Click Here for the Full Market Report:

4. What regional dynamics are shaping growth trajectories?

-

North America spearheads R&D funding and defense adoption.

-

Europe leads in industrialization, with Germany and the UK focusing on automotive and medical implants.

-

Asia-Pacific, led by China and Japan, posts the fastest CAGR, driven by aggressive manufacturing digitalization incentives.

-

Middle East & Africa are targeting aerospace MRO hubs, whereas South & Central America see opportunity in localized spare-parts production for mining and energy.

5. Where do the biggest opportunities lie for newcomers and niche providers?

Tool-and-mold shops are embracing AM inserts with conformal cooling, slashing cycle times. In healthcare, patient-matched orthopedic and dental implants deliver premium margins. Emerging service bureaus, especially in India and Brazil, are finding white-space in localized high-mix, low-volume production.

6. How are leading vendors future-proofing their portfolios?

Players such as GE Additive, EOS, and SLM Solutions are integrating real-time process monitoring and AI-based parameter optimization to assure part quality. Hybrid machines from DMG Mori and TRUMPF combine subtractive and additive in a single setup, accelerating post-processing and boosting ROI.

7. Which trends will reshape the market through 2034?

Expect broader qualification of high-temperature alloys for hypersonic vehicles, cloud-based AM-workflow platforms enabling global part libraries, and green initiatives driving closed-loop powder recycling. Strategic partnerships among machine OEMs, powder suppliers, and software firms will define the next wave of turnkey “factory in a box” solutions.

Click Here for the Full Market Report:

Market Segmentation Snapshot: Key Categories and Regional Insights:

By Technology

-

Powder Bed Fusion

-

Binder Jetting

-

Direct Energy Deposition

-

Bound Powder Extrusion

-

Other Technologies

By Component

-

Systems

-

Materials

-

Service and Parts

By Application

-

Aerospace

-

Healthcare

-

Tools and Mold

-

Automobile

-

Others

By Geography

-

North America (USA, Canada, Mexico)

-

Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

-

Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

-

Middle East & Africa

-

South & Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

-

3D Systems Corp.

-

BEAMIT Group

-

DMG Mori

-

EOS GmbH

-

Farsoon Technologies

-

GE Additive

-

Materialise NV

-

Norsk Titanium AS

-

Renishaw Plc

-

SISMA S.p.A.

-

SLM Solutions Group AG

-

Stratasys Ltd.

-

The ExOne Co.

-

TRUMPF GmbH + Co. KG

-

Xi’an Bright Laser Technologies Co. Ltd.

Explore More Industry Insights:

Global Polyvinyl Acetate Market Outlook Report

Global Additive Manufacturing with Metal Powders Market Outlook Report

Connect with us on:

Phone: +91 888 64 99099

Email: mailto:sales@oganalysis.com

Learn More about OG Analysis

OG Analysis, established in 2009 has 14+ years of experience and served 1800+ clients from 980+ companies operating in 54+ countries. OG Analysis is a leading provider of market research reports in Chemicals, Energy, Oil & Gas, Food & Beverage, Electronics & Semiconductors, Automotive, Telecommunication, Healthcare and Other industries.