The Global Nanocomposites Market: Shaping the Future at the Nanoscale

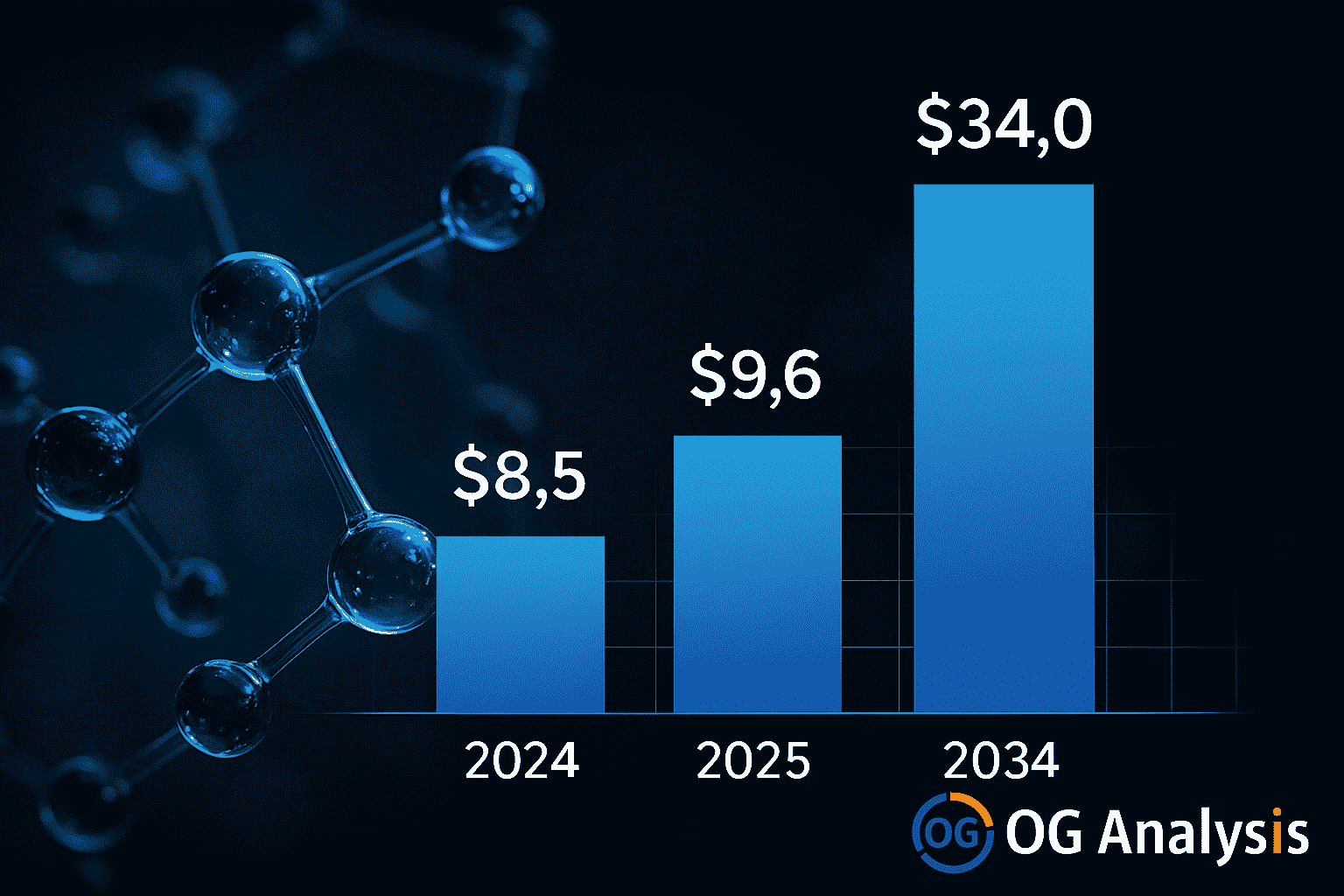

The global nanocomposites market is witnessing explosive growth as advanced materials redefine performance standards across multiple industries. In 2024, the market was valued at USD 8.5 billion and is projected to reach USD 9.6 billion in 2025. With a robust compound annual growth rate (CAGR) of 14.7%, global sales are expected to reach an impressive USD 34.0 billion by 2034. This acceleration is driven by the unique benefits of nanocomposites—superior strength-to-weight ratio, barrier properties, thermal stability, and electrical conductivity—which are transforming applications in automotive, aerospace, packaging, electronics, and more.

Nanocomposites aren't a one-size-fits-all solution. The market is diverse, segmented by type—ranging from clay-based nanocomposites to carbon nanotubes, metal oxides, nanofibers, and graphene. Dimensionally, they vary from 01-10 nm to 41-50 nm, catering to specialized applications. Key industries benefiting include building and construction, medical and healthcare, military, and plastics and packaging. Geographically, Asia-Pacific leads due to booming manufacturing hubs in China and India, while North America and Europe remain critical for R&D-driven innovation.

With top players like Sigma-Aldrich Co. LLC., InMat Inc., and Industrial Nanotech, Inc. pushing boundaries, the nanocomposites market is evolving rapidly. As the technology matures and adoption broadens, cross-industry opportunities—including in wood packaging—are beginning to emerge. Here's where it gets exciting.

Can nanocomposites be the eco-reinforcement the wood packaging industry needs?

As sustainability becomes non-negotiable, wood packaging faces pressure to boost durability and resistance. Could integrating nanocomposites—such as nanoclay coatings or nano-cellulose films—offer a path to longer-lasting, more protective wooden crates and pallets.

What’s driving the surge in nanocomposites for sustainable packaging—and how does that relate to wood?

With plastics facing bans and sustainability regulations tightening, nanocomposites in bio-based packaging are on the rise. Could engineered wood packaging enhanced with nano-additives become the next zero-waste frontier.

Could nanofiber-reinforced coatings reduce moisture damage in wood packaging

Wood’s susceptibility to water absorption is a known issue in logistics. Applying nanofiber or metal oxide coatings could create invisible protective barriers. Are companies already experimenting with this in high-humidity export zones.

Click Here for the Full Market Report

How is the demand from the electronics and semiconductor industry influencing innovations in protective wood packaging

High-value electronics require secure, anti-static, and shock-absorbing transport. Can the intersection of nanocomposites and engineered wood help design smarter crates that adapt to the needs of precision cargo.

What role does graphene play in reshaping the structural integrity of wood-based materials

Graphene’s legendary strength and conductivity offer wild possibilities. Could we see a future where wood packaging integrates graphene layers for tamper detection, energy storage, or real-time tracking.

Are cross-industry collaborations the secret sauce to unlocking nano-enabled wood packaging

As hybrid products emerge, will future innovation come from unexpected partnerships—say, between nanotech startups and traditional pallet manufacturers.

How will regional demand in Asia-Pacific shape the future of nanocomposites in packaging?

With Asia-Pacific leading in both nanotech manufacturing and wood exports, will the region pioneer the fusion of nanocomposites and renewable packaging at scale.

Click Here for the Full Market Report

Segmentation Overview: Understanding Market Structure:

By Type:

-

Clay-based Nanocomposites

-

Carbon Nanotube

-

Metal Oxide

-

Nanofiber

-

Graphene

-

Others

By Dimension:

-

01-10 nm

-

11-20 nm

-

21-30 nm

-

31-40 nm

-

41-50 nm

By Application:

-

Building and Construction

-

Electronics and Semiconductor

-

Automotive

-

Aviation

-

Medical and Healthcare

-

Plastics and Packaging

-

Energy

-

Military and Defense

-

Others (such as consumer goods)

By Geography:

-

North America (USA, Canada, Mexico)

-

Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

-

Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

-

The Middle East and Africa (Middle East, Africa)

-

South and Central America (Brazil, Argentina, Rest of SCA)

Key Players of the Market:

-

Sigma-Aldrich Co. LLC.

-

InMat Inc.

-

Inframat Corporation

-

Hybrid Plastics Inc.

-

Nanocor Incorporated

-

Foster Corporation

-

BYK-Gardner GmbH

-

Industrial Nanotech, Inc.

Click Here for the Full Market Report

Explore More Industry Insights:

| Global Coated Abrasives Market Outlook Report |

Connect with us on:

Phone: +91 888 64 99099

Email: mailto:sales@oganalysis.com

Learn More about OG Analysis

OG Analysis, established in 2009 has 14+ years of experience and served 1800+ clients from 980+ companies operating in 54+ countries. OG Analysis is a leading provider of market research reports in Chemicals, Energy, Oil & Gas, Food & Beverage, Electronics & Semiconductors, Automotive, Telecommunication, Healthcare and Other industries.